Micron Technology Inc. (MU)

Micron Technology: Laggard Shovel Seller?

After a period of unprofitability, Micron Technology has delivered strong margins and growth as it supplies the AI industry. The business has a limited moat, as many competitors exist; past cycles indicate it is a commoditized industry. I argue that MU's valuation seems attractive, despite that.

Micron Technology: If AI Has Legs, The Stock Can Fly

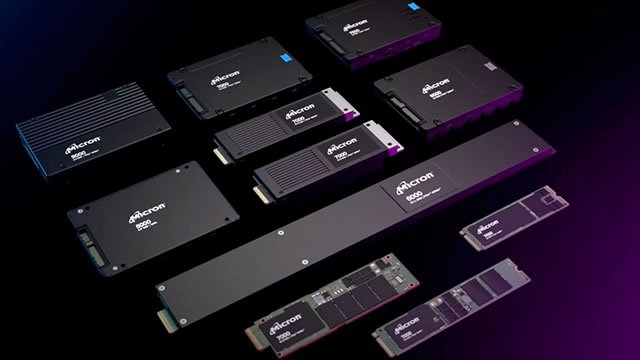

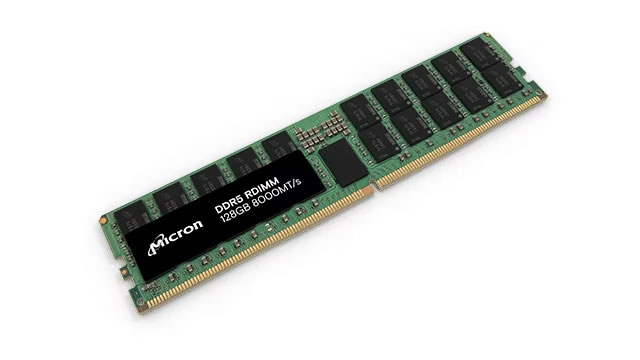

Micron Technology, Inc. is a key player in AI infrastructure, with memory demand poised to break historic business cycles and drive long-term growth. AI-driven demand is boosting DRAM/NAND markets, supporting higher margins and revenue growth, especially in data center/server segments through 2027. Despite strong fundamentals, Micron trades at low valuations, 6.1x P/CE or a 0.4x PEG, offering significant upside if the market recognizes its pivotal AI role.

Micron: Valued Like A Boring Business

Micron Technology, Inc. remains fundamentally strong, benefiting from AI-driven demand and robust financial performance, as highlighted in my previous bullish call. Micron is currently valued as if it lacks both soaring EPS and significant AI exposure, with its forward P/E ratio for FY2026 nearly identical to that of Verizon. The company recently delivered a notable across-the-board upgrade to its FQ4 guidance, reinforcing its fundamental strength and AI-driven momentum.

Is Micron Technology (MU) Stock Outpacing Its Computer and Technology Peers This Year?

Here is how Micron (MU) and Bel Fuse (BELFB) have performed compared to their sector so far this year.

Why Micron (MU) Dipped More Than Broader Market Today

In the most recent trading session, Micron (MU) closed at $116.47, indicating a -1.03% shift from the previous trading day.

Micron: A Completely Different Company From 2 Years Ago (Rating Upgrade)

Micron Technology, Inc.'s turnaround is remarkable, driven by surging demand for DRAM and NAND in AI and data centers, resulting in strong revenue and margin growth. Management expects continued momentum, fueled by AI adoption and massive capex from big tech, positioning Micron as a leader in high-bandwidth memory. Micron's robust financial position, improving profitability, and proactive U.S. expansion mitigate macro and geopolitical risks, enhancing long-term resilience.

Earnings Growth & Price Strength Make Micron (MU) a Stock to Watch

The Zacks Focus List offers investors a way to easily find top-rated stocks and build a winning investment portfolio. Here's why you should take advantage.

Wall Street Analysts Believe Micron (MU) Could Rally 30.04%: Here's is How to Trade

The average of price targets set by Wall Street analysts indicates a potential upside of 30% in Micron (MU). While the effectiveness of this highly sought-after metric is questionable, the positive trend in earnings estimate revisions might translate into an upside in the stock.

Micron Trades Near 52-Week High: Is the Stock Still Worth Buying?

MU trades near its 52-week high and rallies 45% YTD as AI demand, HBM growth and a discounted valuation support a buy strategy.

Micron (MU) Falls More Steeply Than Broader Market: What Investors Need to Know

The latest trading day saw Micron (MU) settling at $122, representing a -1.26% change from its previous close.

Micron Stock Still Cheap Despite 25% Rally, Analysts Say

Most investors are rightfully wary of trading or buying a stock during earnings season, since the implied volatility around the announcement dates can throw off even the shrewdest in the marketplace. However, knowing what to look for helps in a situation like this, and that is where an opportunity for continued rallies has just shown up inside the technology sector of the United States.

Micron Stock At 10x Earnings: AI's Best Bargain?

Micron Technology stock (NASDQ:MU) increased by about 6% in the last month and is up nearly 40% year-to-date. The company has recently raised its Q4 FY'25 forecast, expecting revenue of $11.2 billion at the midpoint, an increase from its previous estimate of $10.7 billion, with adjusted earnings projected to be $2.85 at the midpoint, up from $2.50.