Super Micro Computer, Inc. (SMCI)

Can't Buy Super Micro Computer, Can't Trust SMCY: A Cautious Investor's Dilemma

I maintain a Hold on Super Micro Computer: bullish on fundamentals, but valuation and volatility concerns keep me cautious despite recent price corrections. SMCI's AI hardware leverage is compelling, but risks include customer concentration, execution challenges, and high competition with no clear moat. Option-writing ETF YieldMax SMCI Option Income Strategy ETF fails to mitigate SMCI's volatility or capture meaningful upside, making it an unattractive alternative for risk-averse investors.

Options Bulls Love Super Micro Computer Stock

Super Micro Computer Inc (NASDAQ:SMCI) stock was last seen 5.4% higher to trade at $49.14, brushing off Keybanc's new "sector weight" rating, with the analyst in question highlighting competitive pressure in the artificial intelligence (AI) space.

Super Micro's $2 Billion Offering Provided A Generational Buying Opportunity

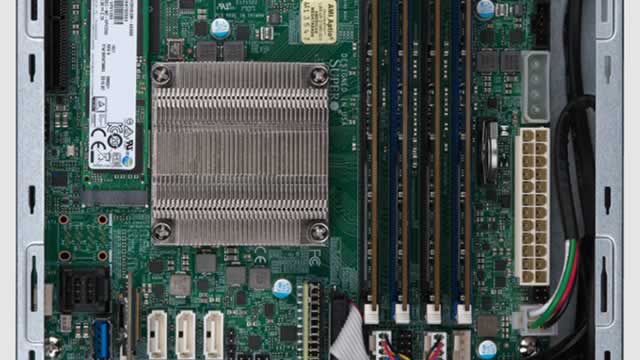

I reiterate my 'Buy' rating on SMCI, highlighting the recent $2B convertible notes offering as a bullish catalyst for future growth. The capital raise positions SMCI to aggressively capture AI infrastructure demand, especially with NVIDIA's Blackwell architecture ramping up. The offering structure, including capped calls and share repurchases, should minimize dilution risk and signal management's confidence in undervalued shares.

Super Micro Computer Is Poised For A Monster Move

SMCI has surged 46% from its $30 base, confirming a structural setup ahead of Nvidia's Blackwell-driven H2 supercycle. Whale activity shows $2.5M in call buying near $47, while $400M in dark pool volume clusters between $43–$48. Call open interest rebounded to 1.45M contracts from 1.25M, outpacing puts at 949K, signaling renewed institutional upside positioning.

SMCI Bets on DCBBS to Redefine Data Centers: Will it Deliver Growth?

SMCI's new DCBBS aims to transform data centers with liquid-cooled, rack-scale AI systems.

Super Micro shares fall on planned $2 billion convertible debt offering

Super Micro Computer shares fell on Monday after the server maker announced plans to offer $2 billion in convertible notes. A company's stock often falls on announced convertible note offerings because the conversion to equity could dilute existing shareholders' stakes.

Super Micro Computer (SMCI) Increases Despite Market Slip: Here's What You Need to Know

In the latest trading session, Super Micro Computer (SMCI) closed at $45.32, marking a +1.91% move from the previous day.

SMCI vs. DELL: Which Server Stock is the Better Buy Now?

Super Micro Computer and Dell Technologies are both riding the AI-driven server demand. However, DELL's lower valuation makes it a better pick at present.

Super Micro Computer Stock's Rally Backed by Strong Financials

Shares of Super Micro Computer Inc. NASDAQ: SMCI have been subject to significant volatility in recent months, largely due to negative headlines and other developments within the technology sector. However, most (if not all) of these negative outlooks have already been proven to be fixed and overcome, leaving an opportunity for current and prospective shareholders to take advantage of the upside.

Super Micro Computer, Inc. (SMCI) is Attracting Investor Attention: Here is What You Should Know

Zacks.com users have recently been watching Super Micro (SMCI) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

The Growth Around Super Micro Computer Has Just Begun.

Super Micro Computer remains a Buy as AI adoption accelerates, with the company well-positioned to benefit from surging data center and AI server demand. Despite past overhype and recent challenges, SMCI's strong valuation and growth grades justify optimism for continued upside. SMCI's core business—designing and assembling AI servers—places it at the heart of the expanding AI infrastructure market.

SMCI's Server Demand Rising: Will Innovation Keep the Momentum?

Super Micro Computer sees soaring demand for its AI-focused server solutions, fueled by innovation and global expansion efforts.