Super Micro Computer, Inc. (SMCI)

Super Micro Computer, Inc. (SMCI) is Attracting Investor Attention: Here is What You Should Know

Super Micro (SMCI) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

SMCI Plunges 25.6% Post Q4 Earnings: Should You Hold or Fold the Stock?

Super Micro Computer slides 25.6% after a Q4 earnings miss, but its AI-driven server strength suggests long-term growth potential despite near-term challenges.

Super Micro Computer: Low Valuation But Margins Have To Improve

Revenue and EPS in the recent quarter missed estimates, as EPS guidance also dissapointed, but revenue was above consensus. With DCBBS and increased number of major customers, margin expansion alongside its already high revenue growth could lead to a stock turnaround. With a lower P/E and P/S valuation compared to its relative sector, alongside high revenue growth, I believe SMCI presents a great opportunity.

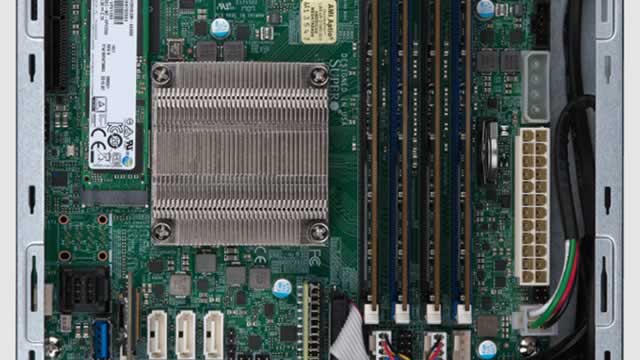

Super Micro Computer: The Hidden Winner In The AI Factory Race

SMCI's recent sell-off overlooks its strong AI infrastructure positioning, robust balance sheet, and leadership in liquid-cooled, rack-scale systems for Blackwell-class AI factories. Despite near-term margin concerns, SMCI's speed, thermal innovation, and global scale make it the right choice for rapid AI data center buildouts. The company is undervalued, trading at less than 1.0x forward EV/sales, with significant upside potential as AI infrastructure spending accelerates.

Hyperscaler Spending Could Supercharge Super Micro Computer Stock

One thing's for sure: the tech industry is booming, with five major players—Amazon, Microsoft, Alphabet, Meta, and Oracle—investing heavily to make their ambitious plans a reality. The US has seen over $600 billion invested in new AI infrastructure development, earning these companies the nickname "hyperscalers.

Super Micro Computer: Guidance Implies A Major Growth Inflection In 2H FY2026 (Rating Upgrade)

SMCI missed both revenue and EPS estimates in 4Q FY2025, and issued very weak 1Q FY2026 guidance, sending a 20% pullback. Management slashed FY2026 revenue outlook from $40B to "at least" $33B, but implied a major near-term growth inflection in 2H FY2026. Key growth catalysts include large shipments of GB200 systems for NVIDIA's Blackwell and DCBBS, expected to reach 30% of total revenue by next summer.

Super Micro Computer Sees Modular Infrastructure As The Solution For Its Margin Decline

I'm upgrading Super Micro Computer to a "Buy" with a $74.89 price target, driven by the launch of its Data Center Building Block Solutions (DCBBS). DCBBS is expected to boost margins and diversify SMCI's customer mix toward higher-margin enterprise AI infrastructure solutions. Despite revenue growth headwinds and inventory build, SMCI's strong balance sheet and capital raise position it well for future growth.

Super Micro Computer: Wait For The GB300 Ramp

I'm neutral on Super Micro Computer due to recent revenue shortfalls, cautious guidance, and deteriorating sentiment reflected in the stock's price action. Gross margins have been sliding since late 2022, and Q1 FY26 is only expected to match Q4 FY25. The situation may improve in the back half of FY2026. I believe customers are waiting for Nvidia's GB300. In fact, the Street is projecting a recovery in growth and EPS (again, backweighted to the second half of FY2026).

SMCI vs. CSCO: Which Server Stock is the Better Buy Now?

Cisco's AI-driven server momentum, billion-dollar orders, and lower valuation make it a stronger buy than Super Micro Computer right now.

Super Micro Computer: AI Champion, Priced For Distress

Super Micro Computer, Inc.'s recent earnings miss was minor; FY2026 revenue guidance is robust, highlighting strong AI tailwinds and continued growth potential. AI demand remains powerful, supported by cloud giants' growth and chip industry trends, positioning SMCI to benefit from ongoing sector momentum. SMCI stock valuation is extremely attractive: forward P/E and P/S ratios are low, technicals suggest a rebound, and fair value per share is estimated at $75.

Super Micro Stock Falls 23%: Falling Knife Or Buying Opportunity?

Super Micro Computer stock (NASDAQ:SMCI) has declined by close to 23% over the last five trading sessions, falling to about $45 per share. The sell-off follows the company's tough Q4 2025 earnings report, which missed estimates and saw margins contract.

Super Micro Computer, Inc. (SMCI) Is a Trending Stock: Facts to Know Before Betting on It

Super Micro (SMCI) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.