Texas Instruments Inc. (TXN)

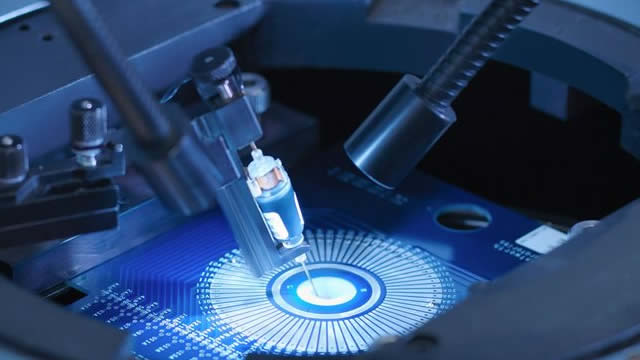

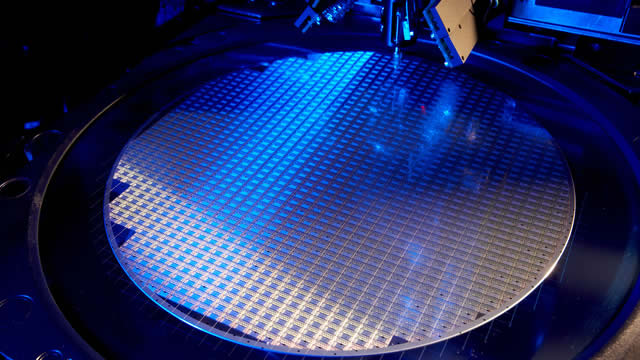

Texas Instruments to receive up to $1.6 bln under CHIPS and Science Act

Texas Instruments has signed a preliminary agreement with the U.S. Department of Commerce to receive up to $1.6 billion in proposed direct funding under the CHIPS and Science Act, it said on Friday.

Investors Heavily Search Texas Instruments Incorporated (TXN): Here is What You Need to Know

Recently, Zacks.com users have been paying close attention to Texas Instruments (TXN). This makes it worthwhile to examine what the stock has in store.

Here is What to Know Beyond Why Texas Instruments Incorporated (TXN) is a Trending Stock

Recently, Zacks.com users have been paying close attention to Texas Instruments (TXN). This makes it worthwhile to examine what the stock has in store.

Deciphering Texas Instruments (TXN) International Revenue Trends

Evaluate Texas Instruments' (TXN) reliance on international revenue to better understand the company's financial stability, growth prospects and potential stock price performance.

3 Stocks With Clear Upside Potential for the Future

“The person that turns over the most rocks wins the game,” prominent investor Peter Lynch famously said regarding investing. This basically means that investors need to do a lot of digging and research in order to find quality stocks in which to invest their capital.

Texas Instruments (TXN) Q2 Earnings Beat, Revenues Fall Y/Y

Texas Instruments' (TXN) second-quarter 2024 results reflect weakness across Analog, Embedded Processing and Other segments.

Texas Instruments Incorporated (TXN) Q2 2024 Earnings Call Transcript

Texas Instruments Incorporated (NASDAQ:TXN ) Q2 2024 Earnings Conference Call July 23, 2024 4:30 PM ET Company Participants Dave Pahl - Head of IR Haviv Ilan - CEO Rafael Lizardi - CFO Conference Call Participants Timothy Arcuri - UBS Stacy Rasgon - Bernstein Research Vivek Arya - Bank of America Securities Ross Seymore - Deutsche Bank Chris Danely - Citibank Toshiya Hari - Goldman Sachs Harlan Sur - JP Morgan Joe Moore - Morgan Stanley Dave Pahl Welcome to the Texas Instruments Second Quarter 2024 Earnings Conference Call. I'm Dave Pahl, Head of Investor Relations, and I'm joined by our Chief Executive Officer, Haviv Ilan; and our Chief Financial Officer, Rafael Lizardi.

Compared to Estimates, Texas Instruments (TXN) Q2 Earnings: A Look at Key Metrics

While the top- and bottom-line numbers for Texas Instruments (TXN) give a sense of how the business performed in the quarter ended June 2024, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Texas Instruments (TXN) Q2 Earnings and Revenues Beat Estimates

Texas Instruments (TXN) came out with quarterly earnings of $1.22 per share, beating the Zacks Consensus Estimate of $1.16 per share. This compares to earnings of $1.87 per share a year ago.

Texas Instruments faces investor scrutiny amid high capex spending: What to expect in Q2 earnings

Texas Instruments will announce its earnings later today. All eyes will be on the company's Capex plans which have gone out of control in the last 3 years.

7 Investments To Buy And Hold For Next 10 Years

We present a diversified yet simple portfolio of 6 stocks and one ETF with nearly 4% dividend yield. The portfolio has been designed for retirees and income investors whose needs are generally met with a 4% income yield. This portfolio is not meant for high-income investors. We believe the portfolio presented will likely provide market-matching total returns and at least 6% dividend growth over the long term, handily beating inflation.

What's in Store for Texas Instruments (TXN) in Q2 Earnings?

Texas Instruments' (TXN) second-quarter 2024 results are likely to reflect the adverse impacts of a weak demand environment and increasing manufacturing costs.