Intel Corporation (INTC)

Intel Stock Could Explode: Buy Now Or Regret It Forever

Intel Corporation delivered a strong Q3 '25, with revenue and EPS beating expectations, driven by improved product mix and cost-cutting. INTC's turnaround is supported by next-gen 18A process technology, major partnerships like Nvidia, and U.S. government backing via the CHIPS Act. Valuation remains deeply discounted versus peers, reflecting skepticism, but low expectations set the stage for upside if execution improves.

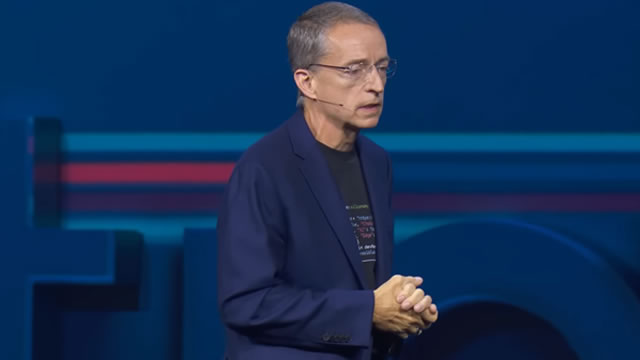

Intel Corporation (INTC) Presents at Global Technology, Internet, Media & Telecommunications Conference 2025 Transcript

Intel Corporation ( INTC ) Global Technology, Internet, Media & Telecommunications Conference 2025 November 18, 2025 3:20 PM EST Company Participants John Pitzer - Corporate Vice President of Corporate Planning & Investor Relations Conference Call Participants Srinivas Pajjuri Presentation Srinivas Pajjuri I am Srini Pajjuri, I'm the semi analyst here. And we're delighted to have Intel today, John Pitzer, who heads the IR team there and also the CVP of Treasury.

Intel Stock To $25?

Our multifactor evaluation indicates that it could be the right moment to sell INTC stock due to the company's weak financial performance and the stock's strong surge this year.

Are Declining Earnings Estimates an Indication to Avoid INTC Stock?

Falling earnings estimates cloud Intel's outlook, even as AI chip launches and major investments aim to revive growth.

Intel AI chief Sachin Katti departs to join OpenAI

Intel Corp (NASDAQ:INTC, ETR:INL)'s chief technology and artificial intelligence officer, Sachin Katti, is leaving the chipmaker to lead compute infrastructure efforts at OpenAI, the company behind ChatGPT. Katti, who had held the top AI role at Intel for seven months, announced the move on social media, saying he was “excited for the opportunity to work with Greg Brockman, Sam Altman and the OpenAI team on building out the compute infrastructure for AGI.

Here is What to Know Beyond Why Intel Corporation (INTC) is a Trending Stock

Intel (INTC) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

TCW Relative Value Large Cap Fund Q3 2025 Sectors And Securities

All sectors in the Russell 1000 Value were in the positive save for Consumer Staples. Portfolio stock selection was a positive (+240 bps) in the quarter led by Intel (INTC), Seagate Technology (STX), and Tapestry (TPR). Fiserv (FI), Intercontinental Exchange (ICE), and IBM (IBM) were the weakest performers in the quarter.

Intel comes under pressure to win foundry customers

CNBC's Deirdre Bosa reports on news regarding Intel.

Musk plans Tesla mega AI chip fab, mulls potential Intel partnership

CEO Elon Musk on Thursday said Tesla probably will have to build "a gigantic chip fab" to make artificial intelligence chips and publicly mused the EV maker could work with Intel.

What Could Spark Intel Stock's Next Big Move

Intel (INTC) has seen well documented struggles in recent years—ranging from manufacturing setbacks to market share losses in the CPU space and struggles with ramping up its foundry business.

Intel Stock: Is The Turnaround Finally Real?

Intel has improved its cash position with investments from the US Government, Nvidia, and SoftBank, but core profitability challenges persist. Q3 2025 results exceeded estimates, with revenue and EPS beats, though foundry losses remain and future profitability hinges on ramping 18A/14A technologies. Guidance for Q4 points to year-over-year declines in sales and margins, reflecting ongoing challenges despite recent operational improvements.

Intel's SambaNova Play Isn't an Acquisition, It's an Ambush

Recent reports that Intel Corporation NASDAQ: INTC is in early discussions to acquire artificial intelligence (AI) chip designer SambaNova Systems have ignited speculation across the market.