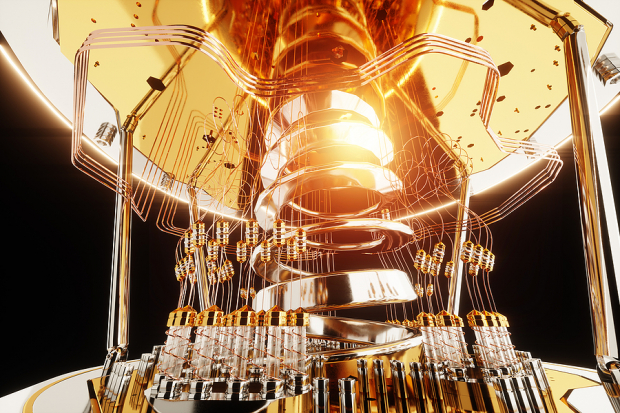

D-Wave Quantum Inc. (QBTS)

Will D-Wave (QBTS) Stock Keep Rallying, or Will the Bubble Burst? Here's What Traders Are Betting On

D-Wave Quantum (NYSE:QBTS ) has been on a rally that exceeded bullish expectations several times over.

QBTS vs. QUBT Ahead of Q3 Earnings: Which Quantum Stock Leads?

D-Wave's record cash, rising revenues and Advantage2 rollout give it the edge over QUBT ahead of Q3 earnings.

QS Stock Or QBTS Stock: Which Future Tech Wins?

Both QuantumScape and D-Wave Quantum have captivated investor interest with their innovative technologies and impressive 2025 returns of approximately 200% year-to-date. But if you were to select just one for the upcoming phase of the tech revolution, which would you choose?

QBTS Stock Ahead of Q3 Earnings: Should Investors Buy or Wait?

D-Wave Quantum witnesses a 66.7% stock surge and major commercial wins, but its lofty valuation raises caution ahead of Q3 earnings.

Will D-Wave's Federal Government Boost Last?

D-Wave Quantum Inc. NYSE: QBTS experienced an unusually volatile week in mid-October 2025, even relative to other turbulent periods in the quantum computing star's recent history. Shares plummeted from close to $40 to under $27 each before partially reversing course late in the week, leaving the firm with a five-day return of -17.6%.

Will D-Wave's European Expansion Keep Fueling the Rally?

Shares have nearly quadrupled in value this year, but as of the middle of October, it appears QBTS could be reversing course. The stock has fallen after reaching nearly $45 each on Oct. 15.

QBTS Investment Check Before Q3 Earnings: Liquidity Solid Amid Risks

D-Wave Quantum's liquidity looks solid ahead of Q3 earnings, but stretched valuation and ongoing losses cloud its near-term appeal.

D-Wave: Reevaluating the Short Seller's Case After the Downgrade

Like much of the quantum computing industry, D-Wave Quantum Inc. NYSE: QBTS has recently been on a high-flying ride. Shares have surged by more than 243% year-to-date (YTD) and nearly doubled in the last month alone.

Rigetti vs D-Wave: Which Quantum Computing Stock Holds More Promise?

RGTI advances superconducting qubits while QBTS pushes annealing, showcasing two distinct quantum computing strategies for investors.

D-Wave Rises on Advantage2 Launch, Solid Roadmap: More Upside Ahead?

D-Wave launches Advantage2, achieves quantum supremacy, and expands quantum AI & hybrid solutions, but analyst targets signal limited short-term upside.

D-WAVE QUANTUM (QBTS) Stock Jumps 11.9%: Will It Continue to Soar?

D-WAVE QUANTUM (QBTS) saw its shares surge in the last session with trading volume being higher than average. The latest trend in earnings estimate revisions may not translate into further price increase in the near term.

QBTS Hits New High Amid Fed Rate Cut, Quantum Growth: Buy Now or Wait?

D-Wave Quantum stock hits $24.85 on global adoption, Advantage2 rollout, and Fed rate cut- but high valuation suggests waiting for a better entry point.