Amprius Technologies Inc. (AMPX)

3 Micro-Caps Set for Major Moves: Balancing Risk and Opportunity

Micro-cap stocks can come in many shapes and sizes. Some might be once successful firms that lost their way and are looking to recover their prior glory.

Amprius Technologies, Inc. (AMPX) Q2 2024 Earnings Call Transcript

Amprius Technologies, Inc. (NYSE:AMPX ) Q2 2024 Earnings Conference Call August 8, 2024 5:00 PM ET Company Participants Kang Sun - Chief Executive Officer Sandra Wallach - Chief Financial Officer Conference Call Participants Colin Rusch - Oppenheimer Chip Moore - Roth Jeff Grampp - Alliance Global Partners Donovan Schafer - Northland Capital Markets Ryan Pfingst - B. Riley Amit Dayal - H.C.

Amprius Technologies (AMPX) Reports Q2 Loss, Tops Revenue Estimates

Amprius Technologies (AMPX) came out with a quarterly loss of $0.13 per share versus the Zacks Consensus Estimate of a loss of $0.11. This compares to loss of $0.11 per share a year ago.

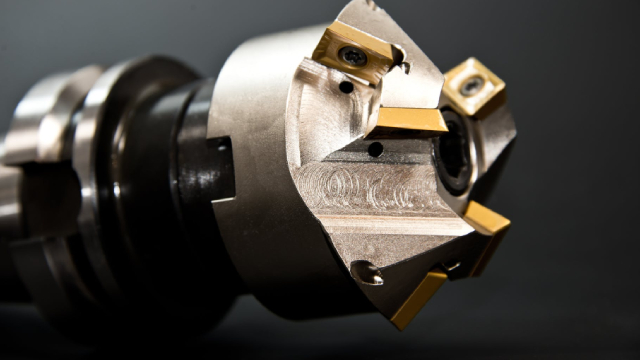

Amprius Technologies: Undervalued Stock With Promising Technology And Growing Pipeline

Amprius Technologies' silicon anode battery technology offers superior energy density and charging speed, positioning the company as an innovator in the competitive battery market. Despite a 90% stock selloff, Amprius shows strong revenue growth and customer base expansion, indicating potential for market recovery and future success. The company faces challenges in scaling production and achieving profitability, but strategic partnerships and growing demand in key sectors offer promising opportunities.