Arm Holdings plc American Depositary Receipt (ARM)

ARM Stock Declines 10% in a Month: Buy or Wait for Further Fall?

Given the recent fall in Arm Holdings shares, we evaluate the stock's current position to determine whether it presents a good investment opportunity.

Every Arm Holdings Investor Should Keep an Eye on This Number

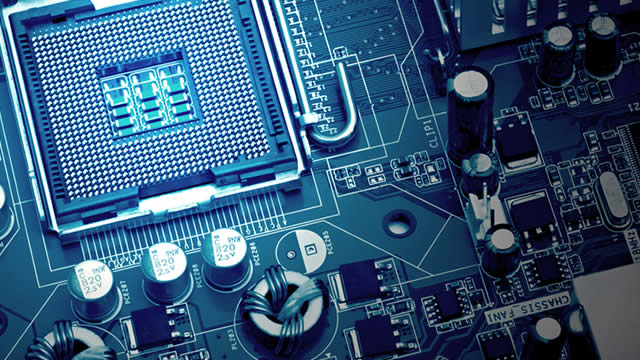

Arm Holdings (ARM -0.08%) might not get as much attention as chip designer stocks like Nvidia, but it's one of the most important companies in the semiconductor industry. Its designs are found in more than 99% of smartphones.

Should Investors Buy Arm Holdings Stock?

Arm Holdings (ARM 0.67%) is considering a major strategic shift that could have enormous implications for stock market investors.

Arm Holdings' Selloff Is Here, Warranting An Upgrade To Opportunistic Buy

The bursting AI bubble and market wide correction has already triggered ARM's deep selloff and much more compelling entry points. The same has been observed in its cheaper valuations and double digits upside potential over the next few years, thanks to its high growth/ profitable growth cadence. Combined with its robust multi-year RPOs, expanding hyperscalers partnerships, and growing demand for custom silicon, we believe that ARM's investment thesis is a lot more interesting here.

Why Semiconductor Stocks Micron Technology, Lam Research, and Arm Holdings Rallied Today

Shares of semiconductor and technology names were mostly bouncing back today, with chip leaders Micron Technology (MU 7.33%), Lam Research (LRCX 4.35%), and Arm Holdings (ARM 1.26%) rallying 7.6%, 3.7%, and 3.6%, respectively as of 12:10 p.m. ET.

Does Nvidia Know Something Wall Street Doesn't? It Sold 2 AI Stocks Analysts Say Can Soar 65% and 110%.

Companies that own more than $100 million in publicly traded stock must disclose that information in Form 13F. Those reports must be filed no later than 45 days after the end of each quarter, and they can provide clues as to how large institutions are navigating the stock market.

Better Artificial Intelligence Stock: Strategy vs. Arm Holdings

Artificial intelligence (AI) is a great sector to invest in as a rapidly expanding industry with years of growth ahead. And you have a wide selection of AI companies to choose from when making an investment decision.

Arm Holdings Makes a Massive Strategy Change. It Could Be Brilliant, or Blow Up in Investors' Faces.

Arm Holdings (ARM 0.49%) has been a strong stock to own since it went public in September 2023. After hitting the market at $51 per share, Arm's stock has since tripled in price to $159 as of this writing.

ARM Stock Surges 12% in a Month: Buy or Wait for a Pullback?

Given the recent surge in Arm Holdings shares, we evaluate the stock's current position to determine whether it presents a good investment opportunity.

Report: Arm to make its own chips

CNBC's Kristina Partsinevelos joins 'Squawk on the Street' to discuss the latest news in the chips space.

Arm Stock Falls and SoundHound Crumbles After Nvidia Cuts Stakes

Nvidia cut its stakes in chip designer Arm and exited its position in SoundHound AI. Both stocks were falling on the news.

Nvidia cuts stake in Arm Holdings, invests in China's WeRide

Nvidia reduced its stake in British chip firm Arm Holdings by about 44% and exited its holdings in Serve Robotics and SoundHound AI in the fourth quarter, a regulatory filing showed on Friday.