China Yuchai International Ltd (CYD)

China Yuchai International: Share Price Sits At A Good Entry Point

CYD is an intriguing stock in a number of ways and the charts suggest now is a good time to get in on CYD. There are a number of potential flaws to be found in CYD with the biggest arguably being CYD's roots in China. An argument can be made that CYD is undervalued, although some may counter that it deserves to trade that way due to the future of ICE vehicles.

China Yuchai International: Significant R&D Focus And Rising Exposure To ESG Trend, Yet Undervalued

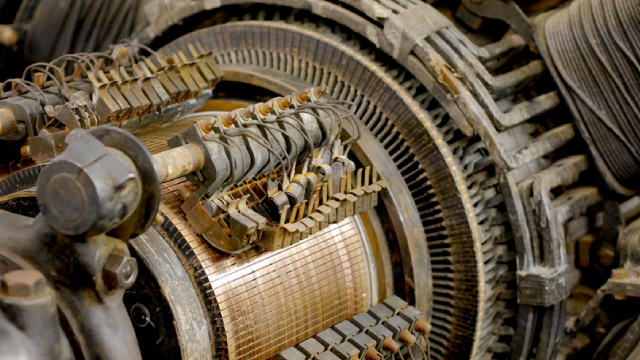

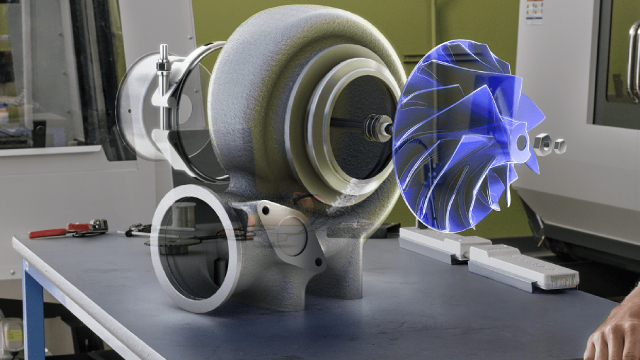

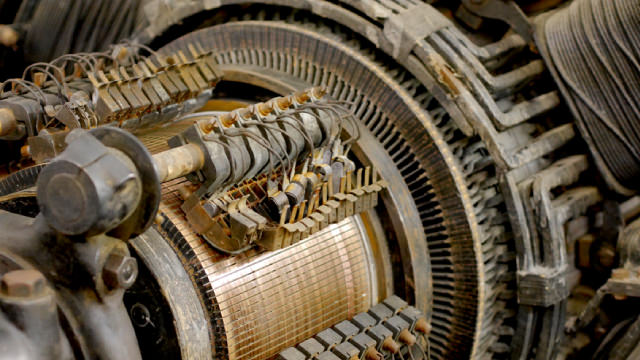

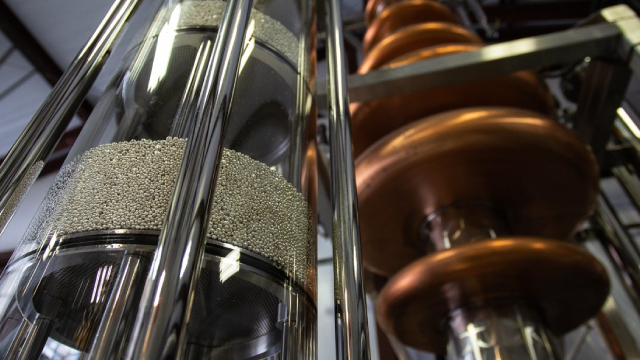

China Yuchai International is investing heavily in R&D, launching innovations like the 350hp IE-Power Hybrid system, and collaborating with the government of Nanning Municipality. CYD's exposure to the rapidly growing ESG investing market in the Asia Pacific, expected to grow at 21.5% CAGR, enhances its investment appeal. Despite strong financials, including positive free cash flow and EBITDA, the Company is trading significantly undervalued, presenting a compelling investment opportunity.

Is China Yuchai International (CYD) Stock Outpacing Its Auto-Tires-Trucks Peers This Year?

Here is how China Yuchai (CYD) and General Motors (GM) have performed compared to their sector so far this year.

Recent Price Trend in China Yuchai (CYD) is Your Friend, Here's Why

If you are looking for stocks that are well positioned to maintain their recent uptrend, China Yuchai (CYD) could be a great choice. It is one of the several stocks that passed through our "Recent Price Strength" screen.

Is China Yuchai International (CYD) Outperforming Other Auto-Tires-Trucks Stocks This Year?

Here is how China Yuchai (CYD) and Hyliion Holdings Corp. (HYLN) have performed compared to their sector so far this year.

China Yuchai (CYD) Is a Great Choice for 'Trend' Investors, Here's Why

China Yuchai (CYD) could be a solid choice for shorter-term investors looking to capitalize on the recent price trend in fundamentally sound stocks. It is one of the many stocks that passed through our shorter-term trading strategy-based screen.

Here's Why Momentum in China Yuchai (CYD) Should Keep going

If you are looking for stocks that are well positioned to maintain their recent uptrend, China Yuchai (CYD) could be a great choice. It is one of the several stocks that passed through our "Recent Price Strength" screen.

Are Auto-Tires-Trucks Stocks Lagging China Yuchai International (CYD) This Year?

Here is how China Yuchai (CYD) and Hyliion Holdings Corp. (HYLN) have performed compared to their sector so far this year.

All You Need to Know About China Yuchai (CYD) Rating Upgrade to Strong Buy

China Yuchai (CYD) has been upgraded to a Zacks Rank #1 (Strong Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

Is China Yuchai International (CYD) Stock Outpacing Its Auto-Tires-Trucks Peers This Year?

Here is how China Yuchai (CYD) and Strattec Security (STRT) have performed compared to their sector so far this year.

China Yuchai: Staying Positive On Policy Tailwinds And Significant Repurchases

China's new government policy offering subsidies for heavy-duty truck replacements could boost the industry's sales volume in the second half of 2024. CYD's potential FY 2024 buyback yield might be as high as 10%, judging by the company's actual share repurchases in recent months. I remain bullish on China Yuchai, taking into consideration tailwinds for the heavy-duty truck sector in China and the company's shareholder capital return prospects.

China Yuchai International Limited (CYD) Q2 2024 Earnings Call Transcript

China Yuchai International Limited (NYSE:CYD ) Q2 2024 Earnings Conference Call August 12, 2024 8:00 AM ET Company Participants Kevin Theiss - Head, Investor Relations Weng Ming Hoh - President Choon Sen Loo - Chief Financial Officer Conference Call Participants Gary Nash - Nash Consulting Operator Good day, and thank you for standing by. Welcome to the China Yuchai International Limited First Half 2024 Financial Results Conference call.