Entergy Corporation (ETR)

Entergy (ETR) is a Great Momentum Stock: Should You Buy?

Does Entergy (ETR) have what it takes to be a top stock pick for momentum investors? Let's find out.

Entergy: The Earnings Base Continues To Move Higher

Entergy: The Earnings Base Continues To Move Higher

Why Entergy (ETR) is a Great Dividend Stock Right Now

Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does Entergy (ETR) have what it takes?

Entergy Corporation (ETR) Q4 2025 Earnings Call Transcript

Entergy Corporation (ETR) Q4 2025 Earnings Call Transcript

Entergy Gears Up to Report Q4 Earnings: Here's What You Need to Know (Revised)

ETR's Q4 results may highlight solid sales growth and data center demand despite pressure from mild winter weather.

Entergy's Q4 Earnings In Line With Estimates, Revenues Rise Y/Y

ETR's Q4 EPS matches estimates but falls 22.7% year over year, even as revenues climb 8% and 2026 earnings guidance comes in above consensus.

Entergy (ETR) Q4 Earnings Meet Estimates

Entergy (ETR) came out with quarterly earnings of $0.51 per share, in line with the Zacks Consensus Estimate . This compares to earnings of $0.66 per share a year ago.

Entergy Gears Up to Report Q4 Earnings: Here's What You Need to Know

ETR's Q4 results may highlight solid sales growth and data center demand despite pressure from mild winter weather.

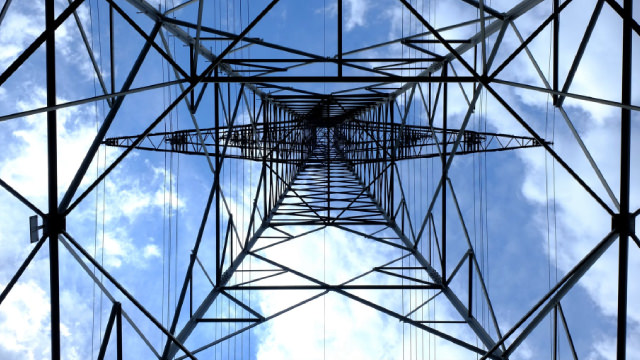

Entergy's Grid and Renewable Investments Strengthen Growth Outlook

ETR plans $41B in grid, transmission and generation upgrades while accelerating solar additions, but nuclear fuel price volatility remains a key risk.

Will Entergy (ETR) Beat Estimates Again in Its Next Earnings Report?

Entergy (ETR) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

Here's Why Entergy (ETR) is a Strong Momentum Stock

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

ETR to Gain From Strategic Nuclear Expansion & Renewable Transition

Entergy ramps up grid hardening and nuclear bets, backing $41B capex and solar growth as shares beat industry gains over the past six months on renewables.