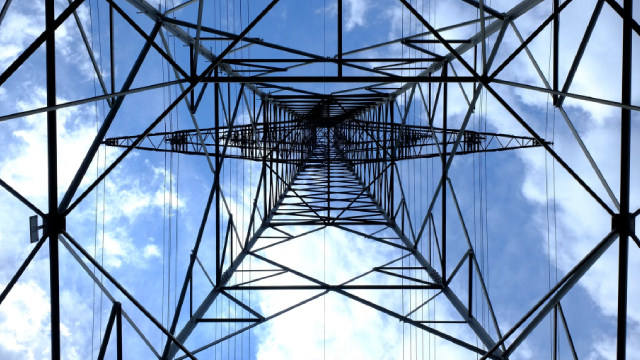

Fortis Inc. (FTS)

3 Stocks I think Should Be Included In Every Million Dollar Portfolio

Given the inflationary forces at play in recent decades, achieving a seven-digit portfolio isn't what it once used to be.

Fortis: A New Capital Plan Extends Decades Of Dividend Growth

Fortis Inc. (FTS:CA) unveils a $28.8B, 5-year capital plan targeting 7% annualized rate base growth and continued low-risk project execution. FTS maintains its 52-year dividend growth streak, announcing a 4% increase and targeting 4-6% annual dividend growth through 2030. Recent results highlight stable earnings, strong U.S. operations, and a resilient regulatory profile, supporting Fortis' premium valuation among peers.

Fortis (FTS) Misses Q3 Earnings Estimates

Fortis (FTS) came out with quarterly earnings of $0.59 per share, missing the Zacks Consensus Estimate of $0.61 per share. This compares to earnings of $0.62 per share a year ago.

3 Dividend Aristocrats to Buy that Continued to Beat the Market

Finding top dividend stocks to invest in is one thing. Finding companies that can pay that dividend for years, and potentially decades, to come is a whole other story.

3 Ultra-Safe Dividend Stocks to Buy Now, If You're Concerned About Volatility Ahead

Investors who find themselves awake at night thinking about their portfolios, fear not.

Fortis (FTS) Hits Fresh High: Is There Still Room to Run?

Fortis (FTS) is at a 52-week high, but can investors hope for more gains in the future? We take a look at the company's fundamentals for clues.

Fortis Inc. (FTS) Q2 2025 Earnings Call Transcript

Fortis Inc. (NYSE:FTS ) Q2 2025 Earnings Conference Call August 1, 2025 8:30 AM ET Company Participants David Gerard Hutchens - President, CEO & Director Jocelyn H. Perry - Executive VP & CFO Roger A.

Fortis (FTS) Q2 Earnings and Revenues Beat Estimates

Fortis (FTS) came out with quarterly earnings of $0.55 per share, beating the Zacks Consensus Estimate of $0.51 per share. This compares to earnings of $0.49 per share a year ago.

4 Low-Beta Utility Stocks to Buy as Fed Keeps Interest Rates Steady

As rate cuts stall and market volatility returns, low-beta utility stocks like OGS, FTS, NWN and IDA offer steady upside.

Fortis (FTS) Reports Next Week: Wall Street Expects Earnings Growth

Fortis (FTS) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Will Fortis (FTS) Beat Estimates Again in Its Next Earnings Report?

Fortis (FTS) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

Build An Ultra-Low-Cost Dividend Portfolio with Just $25,000 and These 3 Stocks

For dividend investors looking to create a meaningful passive income stream either for today or in retirement, the stark reality is that there are probably too many options to consider.