Centrus Energy Corp. (LEU)

Centrus Energy: Securing Americas Energy Future In The New Dawn Of Nuclear

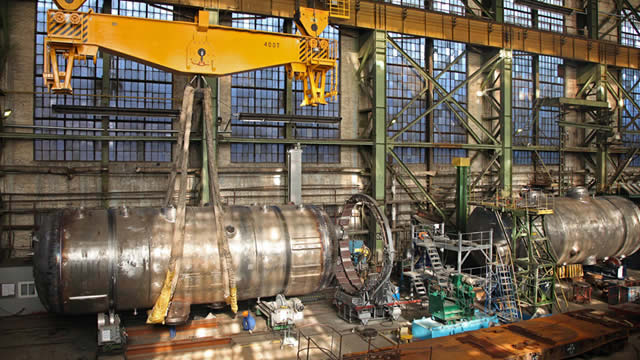

Centrus Energy is uniquely positioned to capitalize on the growing nuclear industry, being the only U.S. company licensed to produce both LEU and HALEU. The U.S. government is heavily investing in rebuilding domestic uranium enrichment capabilities, with Centrus already securing substantial funding and contingent orders worth $900 million. Centrus has a strong balance sheet, experienced workforce, and significant competitive advantages, making it a front-runner in the nuclear fuel market revival.

Centrus Secures $1.8 Billion in Contingent Sales Commitments

LEU signs a long-term supply commitment deal with Korea Hydro & Nuclear Power.

Are Investors Undervaluing Centrus Energy (LEU) Right Now?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

All You Need to Know About Centrus Energy (LEU) Rating Upgrade to Strong Buy

Centrus Energy (LEU) has been upgraded to a Zacks Rank #1 (Strong Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

Is Centrus Energy (LEU) Stock Undervalued Right Now?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

Centrus Energy Corp (LEU) Q2 2024 Earnings Call Transcript

Centrus Energy Corp (NYSE:LEU ) Q2 2024 Results Conference Call August 7, 2024 8:30 AM ET Company Participants Dan Leistikow - Vice President, Corporate Communications Amir Vexler - President and Chief Executive Officer Kevin Harrill - Chief Financial Officer Conference Call Participants Rob Brown - Lake Street Capital Markets, LLC Alex Rygiel - B. Riley Securities, Inc Joseph Reagor - Roth MKM Operator Thank you for standing by.

Centrus Energy (LEU) Q2 Earnings: Taking a Look at Key Metrics Versus Estimates

Although the revenue and EPS for Centrus Energy (LEU) give a sense of how its business performed in the quarter ended June 2024, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Centrus Energy Corp. (LEU) Q2 Earnings and Revenues Top Estimates

Centrus Energy Corp. (LEU) came out with quarterly earnings of $1.89 per share, beating the Zacks Consensus Estimate of $0.77 per share. This compares to earnings of $0.83 per share a year ago.

Centrus Energy Corp.: Riding The Nuclear Renaissance Wave

Centrus Energy Corp.'s present business focuses on providing imported nuclear fuel and services for the U.S. domestic nuclear power industry. The U.S. government has enacted legislation intended to establish U.S. independence from imported nuclear fuel, alongside plans for tripling U.S. nuclear generation capacity by 2050. Centrus Energy Corp. has existing intellectual property, know-how, and the necessary licensing, to produce LEU and HALEU fuel domestically to meet anticipated demand growth arising from the U.S. government's actions.

The Schall Law Firm Is Performing A Scrutiny Into Centrus Energy Corp And Proprietors Of LEU Stocks Are Welcomed To Engage

LOS ANGELES, CA / ACCESSWIRE / July 1, 2024 / The Schall Law Firm, a national shareholder rights litigation firm, announces that it is investigating claims on behalf of investors in Centrus Energy Corp. ("Centrus" or "the Company") (NYSE American:LEU) for potential breaches of fiduciary duty on the part of its directors and management. The investigation focuses on determining if the Centrus board breached its fiduciary duties to shareholders.

The Schall Law Firm Is Carrying Out An Inquiry Into Centrus Energy Corp And Possessors Of LEU Stocks Are Requested To Be Part Of It

LOS ANGELES, CA / ACCESSWIRE / June 30, 2024 / The Schall Law Firm, a national shareholder rights litigation firm, announces that it is investigating claims on behalf of investors in Centrus Energy Corp. ("Centrus" or "the Company") (NYSE American:LEU) for potential breaches of fiduciary duty on the part of its directors and management. The investigation focuses on determining if the Centrus board breached its fiduciary duties to shareholders.

The Schall Law Firm Is Conducting A Probe Into Centrus Energy Corp And Holders Of LEU Stocks Are Invited To Participate

LOS ANGELES, CA / ACCESSWIRE / June 29, 2024 / The Schall Law Firm, a national shareholder rights litigation firm, announces that it is investigating claims on behalf of investors in Centrus Energy Corp. ("Centrus" or "the Company") (NYSE American:LEU) for potential breaches of fiduciary duty on the part of its directors and management. The investigation focuses on determining if the Centrus board breached its fiduciary duties to shareholders.