Merck & Co., Inc. (MRK)

Merck creates separate oncology arm ahead of Keytruda patent loss

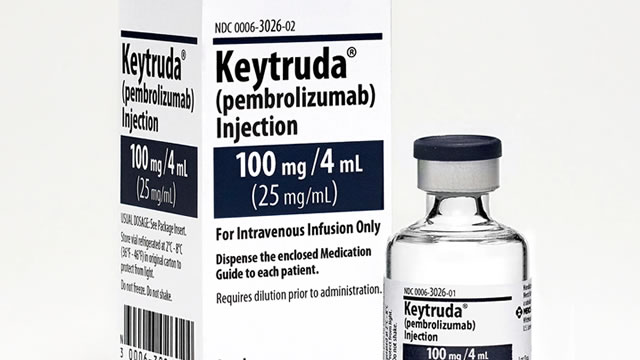

Merck said on Monday that it will split its human-health operations into two separate divisions, a move designed to sharpen focus across its portfolio and ensure smoother launches of new medicines. The move comes as the drugmaker seeks to prepare for mounting sales pressure later this decade, driven by the looming loss of exclusivity for its top-selling cancer drug Keytruda, which will also expose it to lower-cost copycat competition.

Merck reportedly ready to the splits as Keytruda patent cliff looms. Market shrugs

Investors gave a collective meh to news that Merck & Co Inc (NYSE:MRK, XETRA:6MK) is reportedly restructuring its human-health division, with shares marking time in premarket trading despite a reorganisation that signals the US drugmaker is bracing for the biggest revenue hit in its recent history. The Wall Street Journal reported on Monday that Merck plans to separate its human-health operations into two distinct divisions.

Merck to create separate cancer business to offset Keytruda patent loss, WSJ reports

Drugmaker Merck is separating its human-health business into two divisions to offset pressures related to the patent loss of its top-selling drug Keytruda, the Wall Street Journal reported on Monday.

Merck is establishing a separate cancer unit. The reorganization of its pharmaceutical business is aimed at bolstering product launches ahead of a key patent loss.

The drugmaker is splitting its pharmaceuticals unit to bolster product launches before a crucial patent loss.

Merck: Why Investors Should Remain Bullish Despite Patent Risks

Merck started 2026 on a high note. On February 13, its stock reached a 52-week high of $123.3. One of the key reasons Merck is once again becoming a Wall Street favorite is the 6.8% year-over-year increase in sales of pembrolizumab franchise to $8.37 billion in Q4.

Merck Indicates Better Growth Visibility in Post-Keytruda LOE Period

MRK outlines solid long-term outlook with more than $70B opportunity beyond Keytruda LOE, backed by pipeline progress, new product launches and M&A deals.

MRK Up More Than 7% on Improved Long-Term Prospects: Still a Sell?

Merck stock has risen more than 7% in a month on a stronger long-term outlook, but 2026 headwinds, Keytruda patent risk and Gardasil slump keep it a Sell.

Is Merck (MRK) a Buy as Wall Street Analysts Look Optimistic?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock's price.

Merck & Co., Inc. (MRK) is Attracting Investor Attention: Here is What You Should Know

Recently, Zacks.com users have been paying close attention to Merck (MRK). This makes it worthwhile to examine what the stock has in store.

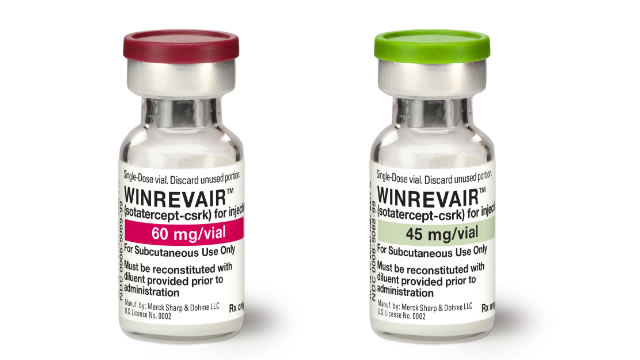

Merck: Keytruda Remains Resilient Despite LOE Risks - Buy Upon Correction

New KEYTRUDA indications are expected to preserve Merck's top line, significantly aided by the high single-digit Animal Health/Livestock and the triple-digit Winrevair revenue growth in FY2025. KEYTRUDA QLEX, with the expected ~20Y monopoly on injection delivery and the projected ~40% user transition by 2027, is positioned to bridge revenue risks after the original KEYTRUDA's 2028 LOE. MRK's healthier balance sheet, secure dividends, and disciplined capital allocation support resilience, despite the lumpy intermediate-term adjusted EPS prospects.

Merck: The Spike Doesn't Make It Overvalued

Merck has surged more than 50% in six months, underpinned by a robust asset portfolio and strong shareholder return strategy. Keytruda, MRK's top-selling drug, faces a 2028 patent cliff, but ongoing innovation and new approvals like Qlex aim to mitigate revenue risk. Despite Gardasil's recent sales decline, MRK's vaccine portfolio remains resilient, with Capvaxive sales up 460% to more than $1 billion annualized.

Merck: A Buy For 2026, But The Clock Is Still Ticking

Merck is rated Buy after extending Keytruda's patent protection to late-2029, delaying the anticipated patent cliff, and unlocking significant near-term value. The extended exclusivity creates a one-time cash windfall and enables deeper penetration of Keytruda QLEX, potentially adding $10/share in 'hidden alpha.' MRK's 40:30:30 strategy—QLEX migration, pipeline execution, and business development—offers a realistic path to offset Keytruda's eventual decline.