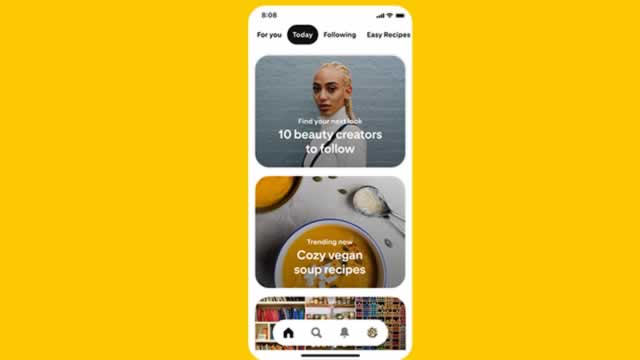

Pinterest, Inc. Class A (PINS)

2 Tech Stock Bargains Offering Buy the Dip Opportunities

Every earnings season has its share of sell-the-news reactions that punish good stocks despite reporting solid earnings reports. The market is known to overreact as selling begets more selling, just as buying begets more buying.

Is Trending Stock Pinterest, Inc. (PINS) a Buy Now?

Pinterest (PINS) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Pinterest Plunges on Soft Guidance. Is This a Golden Opportunity to Buy the Dip?

Pinterest disappoints investors for the second quarter in a row.

Should Investors Buy Pinterest Stock on the Dip?

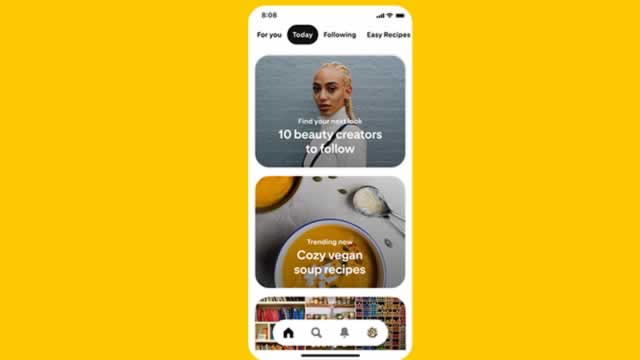

The social media company delivered revenue growth that matched industry leaders in the most recently completed quarter.

Should Investors Buy the Post-Earnings Dip in Pinterest (PINS) Stock?

Weaker revenue guidance caused Pinterest (PINS) stock to fall over -15% last Friday but investors may wonder if the post-earnings selloff is overdone.

Pinterest Stock Up As Analyst Turns Bullish. Earnings Sell-Off 'Overdone.

Pinterest has a very strong EPS Rating of 97 out of a best-possible 99. The post Pinterest Stock Up As Analyst Turns Bullish.

Pinterest (PINS) Reliance on International Sales: What Investors Need to Know

Examine Pinterest's (PINS) international revenue patterns and their implications on Wall Street's forecasts and the prospective trajectory of the stock.

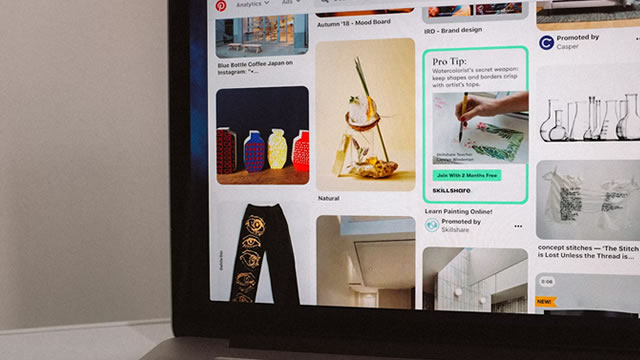

Pinterest has ‘considerable monetization potential ahead', reckon analysts

Wedbush has upgraded Pinterest Inc (NYSE:PINS) to an ‘outperform' rating from ‘neutral' with a 12-month share price target of $38. “We think the company is executing well against its user engagement and monetization strategies and remains on pace to deliver growth and profits in line with its multi-year guidance framework,” said analysts.

This Analyst With 86% Accuracy Rate Sees More Than 58% Upside In Pinterest - Here Are 5 Stock Picks For Last Week From Wall Street's Most Accurate Analysts

U.S. stocks settled higher on Friday, with the Dow Jones and S&P 500 recording their best week in the year following the election of Donald Trump as the 47th U.S. president.

Pinterest: Why I'm Aggressively Buying The Q3 Dip

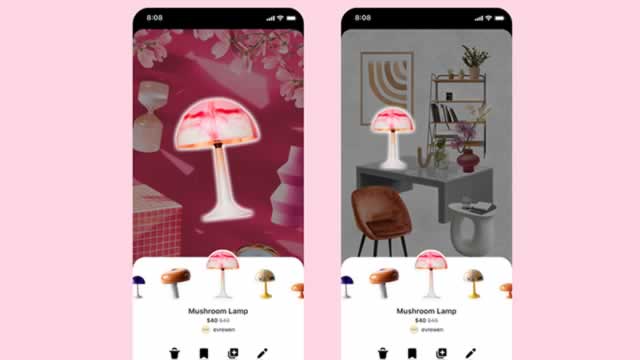

Pinterest's Q3 FY24 earnings showed 18% YoY revenue growth and 31% YoY Adjusted EBITDA growth, driven by increasing MAUs and advertiser spend. However, investor confidence dropped due to declining ad pricing in international markets and concerns over AI investments impacting profitability, but I see these as temporary issues. I believe its long-term growth story is alive from growing Gen Z user base and AI-driven user engagement improvements, which should result in higher advertiser spend, supporting a price target.

Pinterest: Q3 Report Demonstrates $17B Enterprise Value Is Getting Ridiculous

Pinterest's Q3 update showed strong fundamentals with 11% user growth and 18% revenue growth, yet the stock fell 16%, presenting a buying opportunity. CEO Bill Ready's focus on AI and platform enhancements has driven significant engagement and monetization improvements, especially among Gen Z users. Due to the price drop and earnings growth, Pinterest's Owner's Yield has increased to 11.7%, indicating strong potential returns with continued revenue growth and efficient R&D spending.

Pinterest profit is soaring, but the stock price is sinking anyway. What's happening with PINS?

Investors clearly had their hopes pinned on a better forecast for Pinterest when the company announced its Q3 2024 results and Q4 forecast yesterday.