Quantum Corporation (QMCO)

Prediction: Quantum Computing Will Be the Biggest AI Trend in 2025, and This Stock Will Lead the Charge

By now, I'm sure you realize that artificial intelligence (AI) is by far the biggest opportunity fueling the technology sector. Underneath the AI umbrella, semiconductor stocks have been some of the largest beneficiaries.

Better Quantum Computing Stock: Alphabet at $2.4T or Rigetti at $2.8B?

Alphabet is a stronger quantum computing stock compared to Rigetti due to its funding and fundamentals.

Is Quantum Computing Leader IonQ Still a Buy After Falling 20%?

Quantum computing stocks landed on investors' radars late last year when Alphabet announced a huge breakthrough with one of its quantum computing chips. This caused a marketwide rally in quantum computing stocks, sending top picks like IonQ (IONQ -6.40%) and Rigetti Computing through the roof.

2 Quantum Computing Stocks That Could Be a Once-in-a-Lifetime Opportunity

The quantum computing revolution is changing technology as we know it. Quantum computers leverage the principles of quantum mechanics to perform calculations far beyond the capabilities of traditional computers.

Here's Some Reassuring News for Anyone Invested in Quantum Computing Stocks

Last year, investors poured into artificial intelligence (AI) stocks, and the biggest players -- from Nvidia (NVDA 3.10%) to Amazon -- helped the general market soar. The S&P 500, the Dow Jones Industrial Average, and the Nasdaq each climbed in the double digits.

Quantum Computing vs. Traditional AI: Which Tech Stocks Are Must-Haves in 2025?

Quantum computing has suddenly become a buzzword on Wall Street.

Prediction: This Stock Will Be the Biggest Quantum Computing Winner of 2025

In recent months, investors have taken a renewed interest in quantum computing. Traditional computer bits can only hold zeros or ones.

Quantum computing comes into focus

CNBC's Kate Rooney reports on the latest regarding quantum computing stocks.

Why Quantum Computing Stock IonQ Surged Higher This Week

Shares of quantum computing company IonQ (IONQ 5.48%) raced higher this week. The stock was up by 28.5% as of Friday morning, according to data provided by S&P Global Market Intelligence.

Should You Buy Quantum Computing Stock While It's Below $15?

For the last few months, a technology known as quantum computing has started receiving a lot of attention. As is often the case when new subject matter enters the spotlight, people try to figure out how to invest in this technology, which will eventually support the artificial intelligence (AI) market.

Bond Rally Drives Stock Market, Taiwan Semi Results Show AI Demand, Manipulators Having A Heyday With Quantum Computing

To gain an edge, this is what you need to know today.

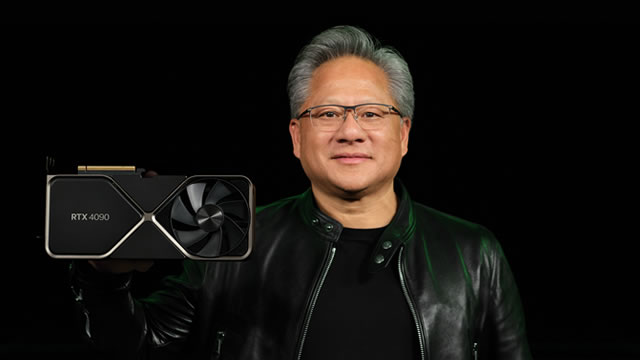

Interested in Quantum Computing? You Might Want to Hear What Nvidia's CEO Just Said About It

Recently, Nvidia (NVDA 3.40%) CEO Jensen Huang made a head-turning, market-moving comment regarding his thoughts on quantum computing. Stocks in this space sold off in response.