Serve Robotics Inc. (SERV)

SERV vs. UBER: Which Autonomous Delivery Play Offers More Upside Now?

Uber edges past Serve Robotics with platform scale, AV partnerships and profitable delivery growth.

Serve Robotics' Top Line Gains Traction: Can It Sustain the Momentum?

SERV's Q1 revenues are aided by Gen 3 robot rollout, boosting deliveries and merchant growth across new markets.

SERV Stock Slips 9% in a Month: Should Investors Buy the Dip or Wait?

Shares of Serve Robotics Inc. SERV have declined 9.1% over the past month, against the Zacks Computers - IT Services industry's rise of 1.1%. The stock has lagged the Zacks Computer and Technology sector's and the S&P 500's growth of 6.6% and 4.4%, respectively.

Serve Robotics' Fleet Expansion Gains Traction: Is Growth Sustainable?

SERV's Q1 robot rollout, delivery surge and cash-backed expansion lift momentum toward its 2,000-unit 2025 goal.

Serve Robotics May Be The Next Big Thing In The Trillion-Dollar Robotics Market

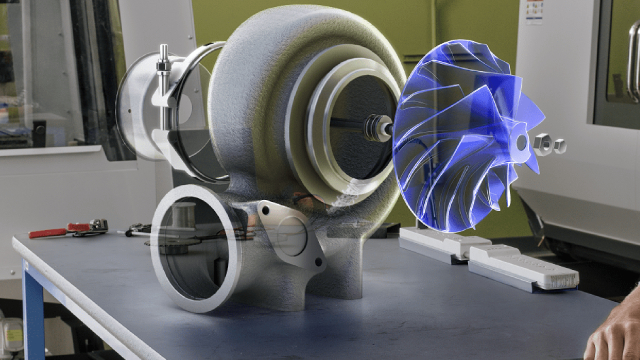

Serve Robotics, an Uber spin-off, is a high-growth robotics play. Its recent Atlanta launch signals strong scalability, suggesting significant upside potential for investors. The delivery robot market is projected to reach $4 billion by 2032. As a leader, Serve Robotics has a clear path to multiply its valuation. Strong Q1 results show impressive execution with 150% revenue growth. The company is on track to deploy 2,000 robots by the end of 2025.

This AI Robotics Stock is About to Surge (SERV)

Few investors have even heard of Serve Robotics Inc. ( SERV ), yet the coming weeks could push this micro-cap onto every AI and robotics watch-list. Spun out of Uber Technologies ( UBER ) in 2021, the company's bright-blue sidewalk robots have already logged tens of thousands of autonomous deliveries, but the real inflection point is just ahead.

Serve Robotics Surges 103% in a Month: What Should Investors Do?

SERV accelerates growth with fleet and new market expansion. Yet, persistent losses and supply-chain headwinds limit near-term growth visibility.

Serve Robotics: An Interesting Play On Artificial Intelligence And Automation

Serve Robotics Inc. is a speculative investment in AI and automation, aiming to revolutionize food delivery with autonomous robots, despite poor current fundamentals. SERV's partnership with Uber Eats and ambitious goal to deploy 2,000 robots by year-end could significantly boost revenue, earnings, and cash flow. High startup costs and reliance on Uber pose significant risks, but successful implementation could lead to a cash-generating, fully automated delivery system.

Serve Robotics: Don't Chase

Serve Robotics Inc. has significant long-term potential, but current revenue growth and robot utilization are lagging behind ambitious scaling plans. The company's Q2 guidance remains modest despite rapid robot fleet expansion and new market entries, raising concerns about near-term revenue acceleration. With a $525M market cap and 2026 revenue targets looking optimistic, the stock is not justified for aggressive buying at current levels.

Serve Robotics Inc. (SERV) Q1 2025 Earnings Conference Call Transcript

Serve Robotics Inc. (NASDAQ:SERV ) Q1 2025 Results Earnings Conference Call May 8, 2025 5:00 PM ET Company Participants Aduke Thelwell - Head of Communications and Investor Relations Ali Kashani - Co-Founder and Chief Executive Officer Brian Read - Chief Financial Officer Conference Call Participants Operator Thank you for standing by and welcome to Serve Robotics First Quarter 2025 Earnings Conference Call. Please be advised that today's conference call is being recorded.

Serve Robotics Inc. (SERV) Reports Q1 Loss, Misses Revenue Estimates

Serve Robotics Inc. (SERV) came out with a quarterly loss of $0.16 per share versus the Zacks Consensus Estimate of a loss of $0.21. This compares to loss of $0.37 per share a year ago.

SERV Set to Report Q1 Earnings: What's in Store for the Stock?

Serve Robotics' first-quarter 2025 results are likely to reflect the improving utilization of its delivery robots.