Sharp Corporation ADR (SHCAY)

Aegon: Sharp Derating Presents Opportunity - Buy Confirmed

Despite disappointing FY results and P&L volatility, Aegon maintains solid capital and cash positions. Aegon's capital return strategy includes significant share repurchases and dividends, making it an attractive investment within the insurance sector. Lowered profit forecasts align with new CFO guidance, yet strategic optionality and valuation discounts offer upside potential.

Sharp drop in U.S. Consumer Confidence provides little safe-haven support for gold

Neils Christensen has a diploma in journalism from Lethbridge College and has more than a decade of reporting experience working for news organizations throughout Canada. His experiences include covering territorial and federal politics in Nunavut, Canada.

Federal Agricultural Mortgage: Sharp Increase In Non-Accruing Loans But Preferred Shares Still Attractive

Federal Agricultural Mortgage (Farmer Mac) maintains a conservative balance sheet with a low LTV ratio, ensuring strong collateral backing for its loans. AGM's 2024 financial results showed a significant increase in net interest income, leading to a dividend hike and improved preferred dividend coverage. Despite a rise in non-accruing loans, AGM's collateralized loan book and low loan loss provisions suggest minimal impact on overall loan quality.

Oil News: Crude at Risk of Sharp Drop as Inventories Surge, Trade Uncertainty Grows

Crude oil faces downside pressure as rising inventories and trade concerns weigh on sentiment. Key technical levels signal potential breakout or pullback.

2 Travel Stocks Seeing Sharp Post-Earnings Moves

Shares of travel industry giants Royal Caribbean Cruises Ltd (NYSE:RCL) and JetBlue Airways Corporation (NASDAQ:JBLU) are experiencing notable price swings following their recent earnings announcements.

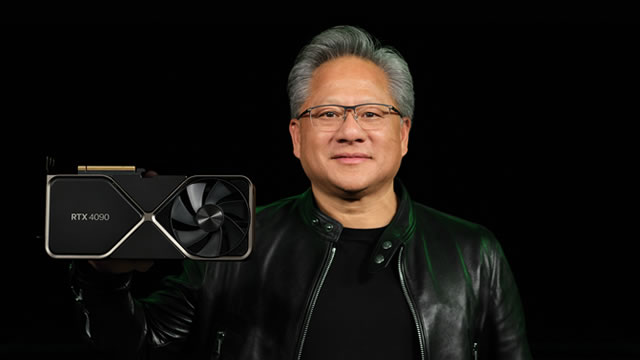

Nvidia Stock Faces Sharp Decline as AI Rival Emerges

Shares of artificial intelligence (AI) darling Nvidia Corp (NASDAQ:NVDA) are experiencing an 11.8% drop in pre-market trading, putting the chip darling on track for its worst performance since March 2020.

Sharp Sentiment Shift Could Be 2025's First Opportunity

Subscribers to Chart of the Week received this commentary on Sunday, January 19.

Sharp Corporation Is Showing Signs Of Growth

Sharp Corporation is rated a buy with a $2.00 price target, offering a 28% upside due to restructuring and market trends. The company is transitioning from high-investment, competitive segments to faster-growing, less competitive ones, improving profitability despite lower revenue. New management's focus on smart devices and collaboration with Foxconn is driving growth, especially in smart home and office markets.

Oil News: API Data Reveals Sharp Draw in U.S. Crude Stocks, Boosting Futures

Crude oil prices edge higher on API inventory draw, with traders eyeing Fed rate cut signals and $71 resistance. Read the latest oil outlook and analysis.

Super Micro Stock Recovering From Sharp Falls

Shares appear to be stabilizing after a significant decline since the beginning of last week.

Sprout Social: This Sharp Deceleration Is Startling

Shares of Sprout Social sputtered after reporting weak Q3 results that featured a sharp deceleration in revenue growth rates. Year to date, the stock has lost half of its value. The company insists that it's facing macro-related headwinds, but its failure to maintain its growth pace suggests its product may not be suitable for the enterprise market. Guidance for Q4 calls for an even sharper pace of deceleration to just 14% y/y growth.

BMW Posts Sharp Fall in Automotive Profitability

BMW reported a sharp drop in profitability for its key automotive unit, hit by costs of a recall and weak demand in China, even as it forecast stronger earnings in the fourth quarter.