Super Micro Computer Inc (SMCI)

Super Micro Computer (SMCI) Week in Review: 11% Stock Drop Despite 123% Growth

Super Micro Computer (NASDAQ:SMCI | SMCI Price Prediction) dropped 11.2% this week, closing at $30.54 on Friday.

Super Micro: Market Still Showing No Love For A Big AI Boost

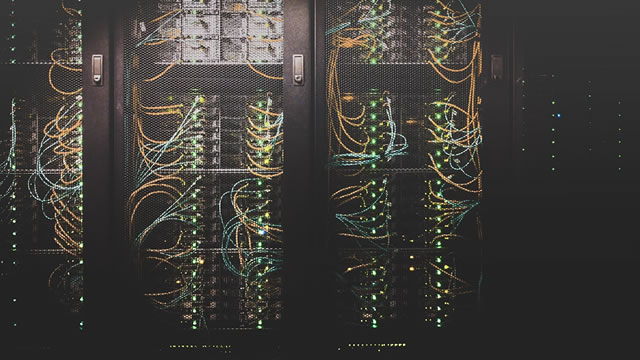

Super Micro Computer delivered a record quarter, posting $12.7B in sales and 123% YoY growth, yet the stock barely rallied. The AI server company guided to $12.3B in FQ3 sales and raised FY26 revenue targets to $40B, but these appear conservative given current run rates. Gross margins remain pressured at 6.4% due to discounted contracts, but management expects DCBBS solutions to drive some gross margins above 20%.

Super Micro Computer: This Stock Is Still Dead Money

Super Micro Computer, Inc. reported solid Q2 2026 earnings. Revenue grew significantly, and SMCI raised its FY2026 outlook. Despite these results, operating leverage continues to deteriorate.

Super Micro Computer: Strong Growth Setup As Industry CapEx Soars

Super Micro Computer (SMCI) delivered record Q2'26 results, with 123% revenue growth and robust AI server demand driving a 14% share price gain after earnings. Despite intense competition and non-GAAP gross margin contraction to 6.4%, SMCI remains highly profitable and benefits from accelerating hyperscaler CapEx trends. Super Micro is set to benefit from demand for the new Vera Rubin NVL72 rack-scale system later this year.

Investors Heavily Search Super Micro Computer, Inc. (SMCI): Here is What You Need to Know

Super Micro (SMCI) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Why Super Micro Computer (SMCI) is a Top Value Stock for the Long-Term

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

Super Micro Computer Tumbles on AI Boom Backlash

Super Micro Computer ( NASDAQ:SMCI ) reported robust artificial intelligence (AI) growth in its fiscal second-quarter results on Tuesday after the markets closed, with revenue surging 123% year-over-year to $12.7 billion, exceeding estimates around $10.4 billion.

Super Micro Computer: Still Plenty Of Issues But Upgrading On Valuation - Hold

Super Micro Computer reported better-than-expected Q2/FY2026 results, with both the company's top- and bottom lines coming in handily above consensus estimates. However, non-GAAP gross margin of just 6.4% hit a new all-time low, due to a combination of customer concentration, unfavorable product mix, component shortages, and expedite costs. While management expects margins to increase slightly in Q3, competitive pressures make a return to double-digit gross margins unlikely in the near term.

SMCI Soars Post-Earnings: Head Fake, Or Sign of True Recovery?

After a precipitous slide, artificial intelligence (AI) server giant Super Micro Computer NASDAQ: SMCI just got some much-needed good news. Since hitting its 52-week closing high near $61 back in July of 2025, Super Micro shares had fallen around 50% through the close on Feb. 3, 2026.

Super Micro Computer: The Most Misunderstood AI Stock Today

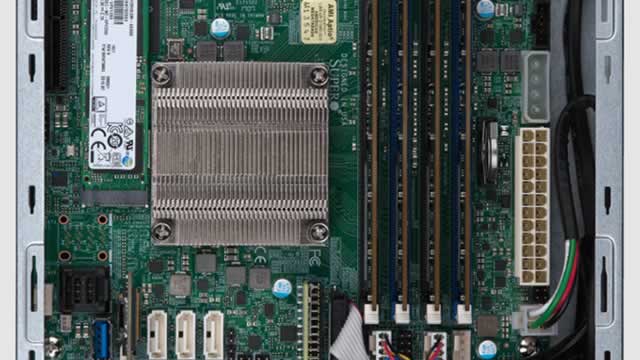

Super Micro Computer, Inc. delivered record Q2 revenue and raised guidance, confirming its successful repositioning as a full-stack AI infrastructure provider. Over 90% of SMCI revenue now comes from AI GPU platforms, but customer concentration remains high, with one hyperscale customer accounting for 63% of sales. Non-GAAP gross margin fell to 6.4%, but management expects sequential improvement and sees DCBBS solutions driving higher-margin growth into 2026.

Super Micro Computer Q2 Earnings Beat Estimates, Revenues Rise Y/Y

SMCI tops Q2 EPS and revenue estimates as sales surge 123% Y/Y, fueled by hyperscale AI demand and strong U.S. data center deployments.

Super Micro Computer shares jump on Q2 results, upbeat outlook

Super Micro Computer Inc (NASDAQ:SMCI) shares surged more than 13% after the company reported fiscal second quarter earnings that exceeded analyst expectations and issued forward guidance above Wall Street estimates, reflecting continued demand for AI-focused infrastructure hardware. The San Jose, California–based company reported non-GAAP diluted EPS of $0.69 for fiscal Q2 ended December 31, 2025, surpassing the $0.49 Wall Street consensus.