Super Micro Computer Inc (SMCI)

Super Micro Computer Rallies After Raising Full-Year Revenue Guidance to $40 Billion From $33 Billion

Yesterday we were watching whether Super Micro Computer (NASDAQ: SMCI) could finally reverse its recent string of earnings disappointments, which included three misses over the past five quarters.

Super Micro: The $12B AI Illusion -- A Record Beat Is A Major Red Flag

Super Micro Computer, Inc. delivered record Q2 '26 revenue of $12.7B, but gross margins collapsed to 6.3%, highlighting severe profitability pressures. SMCI's business is structurally squeezed—Nvidia commands premium pricing, hyperscalers demand low prices, and SMCI is left with little bargaining power or moat. Customer concentration is acute: 63% of Q2 revenue came from a single client, amplifying financial and execution risk.

Super Micro Computer: Blowout Earnings Confirm Bullish Case

Super Micro Computer delivered a blowout FQ2 2026, comfortably beating revenue and EPS estimates and issuing robust guidance. SMCI's Data Center Building Block Solutions segment is driving premium profitability and is expected to reach double-digit profit contribution by FY2026. Despite a 7% post-earnings rally, SMCI remains deeply undervalued with a forward P/S below 0.5 versus a sector median of 3.5.

Super Micro Computer, Inc. (SMCI) Q2 2026 Earnings Call Transcript

Super Micro Computer, Inc. (SMCI) Q2 2026 Earnings Call Transcript

Super Micro Computer (SMCI) Q2 Earnings and Revenues Beat Estimates

Super Micro Computer (SMCI) came out with quarterly earnings of $0.69 per share, beating the Zacks Consensus Estimate of $0.49 per share. This compares to earnings of $0.61 per share a year ago.

Super Micro logs record revenue from AI demand, and the stock surges

Super Micro's revenue exploded to $12.7 billion as delayed orders finally materialized, but aggressive competition and rising costs pushed gross margins to a razor-thin 6.3%

Super Micro Computer Posts Higher Second-Quarter Profit on Two-Fold Sales Boost

The maker of server and computer products logged a quarterly profit of $400.6 million as sales more than doubled to $12.68 billion.

Super Micro Computer Reports After the Close, and Wall Street Expects 82% Revenue Growth

Super Micro Computer (NASDAQ: SMCI) reports Q2 fiscal 2026 earnings today, Feb.

Super Micro Computer earnings expected to reflect strong AI infrastructure momentum

Super Micro Computer (NASDAQ:SMCI) is set to report fiscal second quarter 2026 earnings after the close on Tuesday, with Wedbush analysts saying the report could show meaningful upside or downside depending on margins, supply chain conditions, and guidance. Wall Street analysts expect Super Micro to report revenue of $10.44 billion, more than doubling from $5.6 billion in the year-ago quarter, and earnings per share of $0.49, down about 20% year-over-year.

Traction in AI-GPU Platform and DCBBS to Propel SMCI's Q2 Earnings

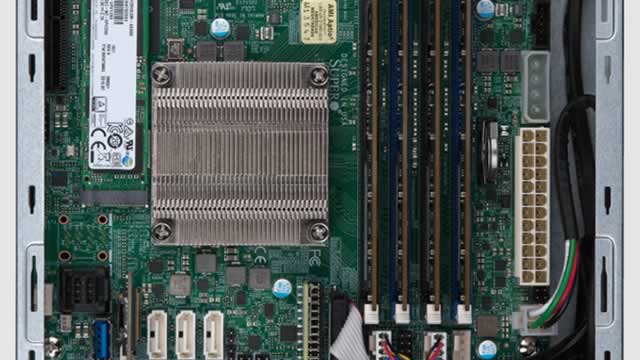

Super Micro Computer heads into Q2 FY26 with AI-server momentum, Blackwell/B300 platforms and DCBBS traction despite inventory and cash flow strains.

Should You Hold or Fold Super Micro Computer Stock Before Q2 Earnings?

SMCI heads into Q2 earnings with 84% revenue growth expected, but EPS seen down, as AI server demand collides with margin and cash-cycle risks.

Super Micro Q2 Preview: What I Need To See To Change My Mind (Rating Downgrade)

Super Micro Computer remains rated Hold due to persistent margin pressures and unresolved accounting concerns, despite strong AI-driven revenue growth. SMCI's Q2 '26 guidance suggests robust demand, with a $13B+ backlog and potential for further expansion, but margin contraction overshadows topline momentum. Gross margin deterioration—now at 10 consecutive quarters—remains a critical risk; recovery hinges on successful adoption of higher-margin DCBBS products.