Sensata Technologies Holding plc (ST)

Sensata's Q1 Earnings & Revenues Surpass Estimates, Down Y/Y

ST's first-quarter 2025 performance reflects improvement in Sensing Solutions business, while Performance Sensing witnesses a slowdown.

Sensata Technologies Holding PLC (ST) Q1 2025 Earnings Call Transcript

Sensata Technologies Holding PLC (NYSE:ST ) Q1 2025 Earnings Conference Call May 8, 2025 4:30 PM ET Company Participants James Entwistle - Senior Director of Investor Relations Stephan von Schuckmann - Chief Executive Officer Brian Roberts - Chief Financial Officer Conference Call Participants Wamsi Mohan - Bank of America Mark Delaney - Goldman Sachs Joe Giordano - TD Cowen Joe Spak - UBS Christopher Glynn - Oppenheimer Samik Chatterjee - JPMorgan Shreyas Patil - Wolfe Research Kosta Tasoulis - Wells Fargo Guy Hardwick - Freedom Capital Markets Operator Good afternoon, and welcome to the Sensata Technologies' First Quarter 2025 Earnings Call. All participants will be in a listen-only mode.

Sensata (ST) Q1 Earnings: Taking a Look at Key Metrics Versus Estimates

Although the revenue and EPS for Sensata (ST) give a sense of how its business performed in the quarter ended March 2025, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Sensata (ST) Q1 Earnings and Revenues Beat Estimates

Sensata (ST) came out with quarterly earnings of $0.78 per share, beating the Zacks Consensus Estimate of $0.72 per share. This compares to earnings of $0.89 per share a year ago.

Countdown to Sensata (ST) Q1 Earnings: Wall Street Forecasts for Key Metrics

Beyond analysts' top -and-bottom-line estimates for Sensata (ST), evaluate projections for some of its key metrics to gain a better insight into how the business might have performed for the quarter ended March 2025.

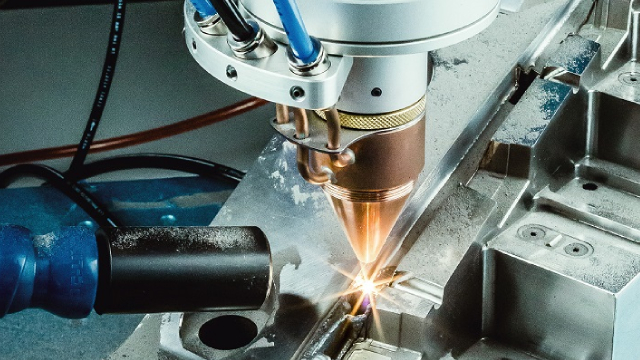

Sensata's HVDUs Power Megawatt Charging in Electric Trucks, Shares Up

ST's High Voltage Distribution Units, enabling megawatt charging, are now in serial production on heavy electric trucks, boosting commercial EV innovation.

Sensata (ST) Soars 18.0%: Is Further Upside Left in the Stock?

Sensata (ST) was a big mover last session on higher-than-average trading volume. The latest trend in earnings estimate revisions might not help the stock continue moving higher in the near term.

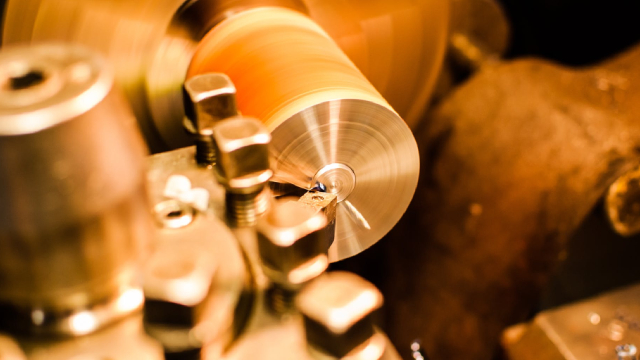

Sensata Unveils SIM200 for Advanced Safety in High Voltage Systems

ST's SIM200 Insulation Monitoring Device is designed for active monitoring of unearthed (Isolated Terra) DC systems, including EVs & charging stations.

With Long Timeline To Full Recovery, Sensata Technologies Continues To Struggle

Sensata Technologies has seen significant end-market challenges, with weak end-markets in autos, off-road machinery, and industrial products driving further share price declines. Fourth quarter results were better than expected, but revenue and margin pressures are expected until at least late 2025, as end-market pressures remain significant. EV adoption, safety regulations, and new product development can all drive future revenue growth, but it will take time for these drivers to activate.

Sensata's Q4 Earnings Match Estimates, Revenues Decrease Y/Y

ST's fourth-quarter 2024 performance reflects a slowdown in the Performance Sensing and Sensing Solutions business units.

Sensata Technologies Holding PLC (ST) Q4 2024 Earnings Call Transcript

Sensata Technologies Holding PLC (NYSE:ST ) Q4 2024 Earnings Conference Call February 11, 2025 4:30 PM ET Company Participants James Entwistle - Senior Director of Investor Relations Stephan von Schuckmann - Chief Executive Officer Brian Roberts - Chief Financial Officer Conference Call Participants Joe Giordano - TD Cowen Amit Daryanani - Evercore Mark Delaney - Goldman Sachs Christopher Glynn - Oppenheimer Luke Junk - Baird Guy Hardwick - Freedom Capital Markets Samik Chatterjee - J.P. Morgan Zach Walljasper - UBS Operator Good afternoon, and welcome to the Sensata Technologies' Fourth Quarter and Full-Year 2024 Earnings Call.

Sensata (ST) Reports Q4 Earnings: What Key Metrics Have to Say

While the top- and bottom-line numbers for Sensata (ST) give a sense of how the business performed in the quarter ended December 2024, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.