UBS Group AG (UBS)

UBS or NU: Which Is the Better Value Stock Right Now?

Investors looking for stocks in the Banks - Foreign sector might want to consider either UBS (UBS) or Nu Holdings Ltd. (NU). But which of these two stocks offers value investors a better bang for their buck right now?

UBS Group AG Eyes $1B Loan Risk Transfer to Ease Capital Strain

UBS plans a $1B loan risk transfer to free up capital as tougher Swiss rules loom following the Credit Suisse collapse.

Melrose Industries update not likely to move dial, says UBS

Melrose Industries PLC (LSE:MRO, OTC:MLSPF) will post a third-quarter trading statement in mid-November with its shares still recovering from the hit to high expectations delivered at its final results in March. Having risen over 20% to around 700p in the first months of the year, following the results, the shares sank below 400p by April.

Are You Looking for a Top Momentum Pick? Why UBS (UBS) is a Great Choice

Does UBS (UBS) have what it takes to be a top stock pick for momentum investors? Let's find out.

Looking through to 2027, UBS upgrades ‘quality compounder' ASML to buy

Among the largest stocks in Europe, ASML has underperformed its benchmark Euro Stoxx 50 index by around 15% in 2025 so far. That's far enough for UBS which has upgraded the stock to buy on Friday, while bumping up its target price from €660 to €750.

Here's What Makes UBS Stock a Solid Investment Option Now

UBS Group stock remains a strong investment, supported by Credit Suisse integration, strategic partnerships, cost efficiencies, and steady NII growth.

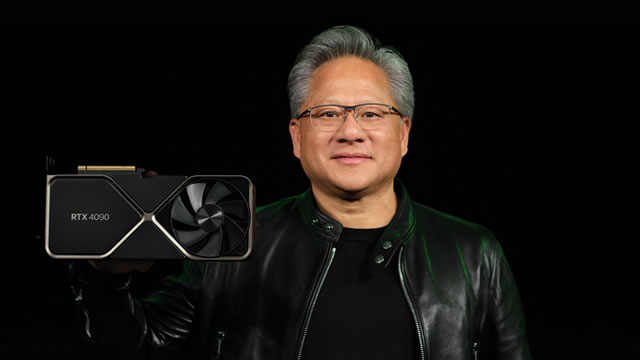

Why Nvidia and Other Chip Stocks' Slump Is an Opportunity for Investors, UBS Says

Semiconductor stocks are taking a chip out of U.S. indexes to start September—a month that's earned a reputation as the worst for American investors—but for some bulls on Wall Street, that could mean it's time to buy.

Why Is UBS (UBS) Up 8.8% Since Last Earnings Report?

UBS (UBS) reported earnings 30 days ago. What's next for the stock?

Homebuilder stocks need stable rates, improved consumer confidence, says UBS' John Lovallo

CNBC's “Closing Bell Overtime” team is joined by John Lovallo, U.S. homebuilders analyst at UBS, to discuss the rally in homebuilder stocks and his market outlook.

Nvidia poised to deliver strong Q2 report on data center growth, UBS analysts say

Nvidia Corp (NASDAQ:NVDA, ETR:NVD) is set to report its second quarter results amid expectations of robust growth across its data center and compute segments, according to analysts at UBS. Ahead of next week's report, the firm raised its price target to $205 from $175 and maintained a ‘Buy' rating.

Chart of the Day: UBS Hikes NVDA Price Target

Nvidia (NVDA) shares have fallen this week, but one analyst has hiked its price target on the chipmaker ahead of next week's earnings. UBS lifted its target to $205 from $175 while reiterating a buy rating on shares.

CVS Health upgraded by UBS on strong execution, margin improvement

CVS Health Corp (NYSE:CVS) has been upgraded by UBS analysts who cited greater confidence in the company's recovery trajectory and multiple levers for earnings growth. The analysts upped their rating to ‘Buy' from ‘Neutral' and raised their price objective to $79 from $67, implying upside from its share price on Monday afternoon of about $70.