Ultralife Corporation (ULBI)

Summary

Ultralife Corporation (ULBI) Q3 2025 Earnings Call Transcript

Ultralife Corporation ( ULBI ) Q3 2025 Earnings Call November 18, 2025 8:30 AM EST Company Participants Michael Manna - President, CEO & Director Philip A. Fain - CFO, Treasurer & Corporate Secretary Conference Call Participants Jody Burfening - Lippert/Heilshorn & Associates, Inc. Presentation Operator Good day, and thank you for standing by.

Ultralife Corporation (ULBI) Q2 2025 Earnings Call Transcript

Ultralife Corporation (NASDAQ:ULBI ) Q2 2025 Earnings Conference Call August 7, 2025 12:00 PM ET Company Participants Michael E. Manna - President, CEO & Director Philip A.

Ultralife Loses Place On Index, But Is Rebounding Robustly

Ultralife was removed from the FTSE Russell 3000 Microcap Index due to a share price slump, but fundamentals remain strong, and recovery is underway. Recent earnings show robust revenue and EPS growth, boosted by the Electrochem acquisition and improved productivity, supporting a bullish outlook. The valuation remains attractive, with forecasted EPS growth and a one-year price target of $14.12, representing a significant upside from current levels.

Ultralife Corporation (ULBI) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

What is the earnings per share?

When is the next earnings date?

Has Ultralife Corporation ever had a stock split?

Ultralife Corporation Profile

| Electrical Equipment Industry | Industrials Sector | Michael E. Manna CEO | NASDAQ (NMS) Exchange | 903899102 CUSIP |

| US Country | 671 Employees | - Last Dividend | - Last Split | 23 Dec 1992 IPO Date |

Overview

Ultralife Corporation, along with its subsidiaries, is a global entity focused on the design, manufacture, installation, and maintenance of power, and communication and electronics systems. With operations segmented into Battery & Energy Products and Communications Systems, the company caters to a wide range of requirements worldwide. Serving the government, defense, and commercial sectors, Ultralife Corporation has established itself as a significant player in the provision of advanced technological solutions since its inception in 1990. Headquartered in Newark, New York, Ultralife aims to deliver high-quality products and services that enhance the operational capabilities of its clients across various industries.

Products and Services

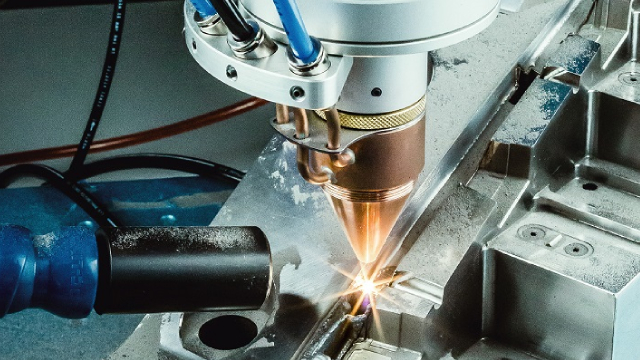

- Battery & Energy Products: This segment includes a vast range of batteries and power solutions such as lithium 9-volt, cylindrical, and thin lithium manganese dioxide batteries, along with rechargeable and non-rechargeable variants. It also offers lithium-ion cells, multi-kilowatt module lithium-ion battery systems, and uninterruptable power supplies. Additionally, rugged military and commercial battery charging systems and accessories, such as smart chargers, multi-bay charging systems, and cables are available.

- Communications Systems: Ultralife provides an array of communications systems and accessories designed to support and enhance military communications. These include radio frequency amplifiers, power supplies and cables, connector assemblies, amplified speakers, equipment mounts, case equipment, man-portable systems, and integrated communication systems for both fixed and vehicle applications. Key offerings are vehicle adapters, vehicle-installed power-enhanced rifleman appliqué systems, and SATCOM systems. The communications systems and accessories are specifically designed to amplify and extend the operation of communications equipment like vehicle-mounted, manpack, and handheld transceivers.

Ultralife Corporation markets its products under various brands including Ultralife, Ultralife Thin Cell, Ultralife HiRate, and several others, through channels such as original equipment manufacturers (OEMs), industrial and defense supply distributors, and directly to the defense departments in the United States and internationally. Furthermore, the company extends its reach to the broader consumer market, offering its 9-volt battery through national and regional retail chains as well as online retailers, ensuring wide accessibility and utility across different sectors.