Applied Industrial Technologies Inc. (AIT)

5 stocks Congress is buying in 2025

The stock trading activities of US Congress members continue to draw attention, with disclosures under the STOCK Act providing insight into their investment strategies. So, in this piece, we bring you the top 5 stocks Congress is buying in 2025.

Applied Industrial Technologies (AIT) International Revenue Performance Explored

Explore how Applied Industrial Technologies' (AIT) revenue from international markets is changing and the resulting impact on Wall Street's predictions and the stock's prospects.

23 Upcoming Dividend Increases, Including 2 Kings

Excited to announce dividend hikes for 23 companies, including dividend kings SJW Group and California Water Service Group, with 5% and 7.1% increases. Companies with consistent dividend growth indicate financial health, attracting investors and boosting stock prices, leading to long-term wealth accumulation. Investment strategy focuses on stocks with rising dividends and outperforming benchmarks, using data from U.S. Dividend Champions and NASDAQ.

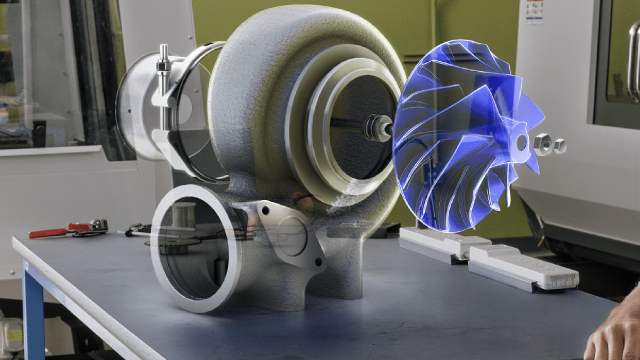

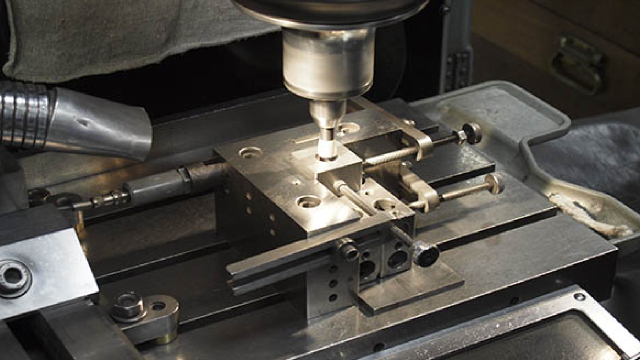

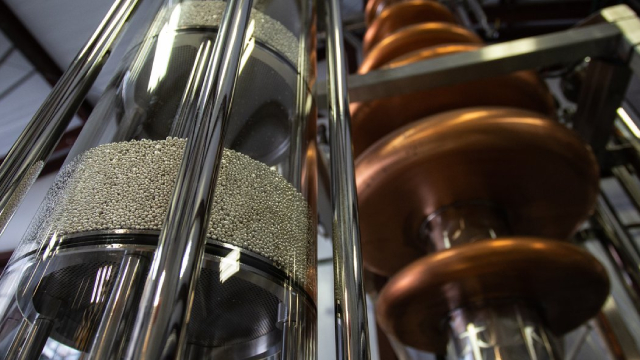

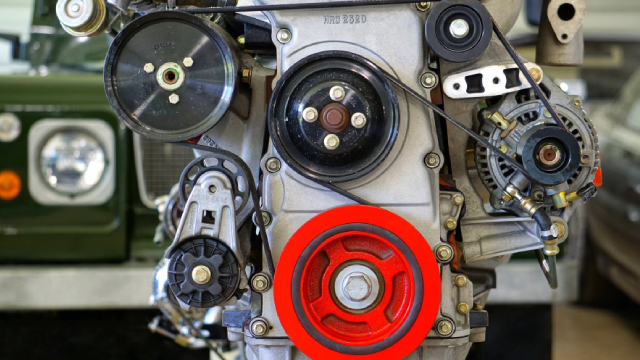

4 Stocks to Buy as Manufacturing Activity Makes Roaring Rebound

Stocks like AIT, GHM, AZZ and ENSare likely to benefit from the jump in manufacturing activity.

Is Applied Industrial Technologies (AIT) Stock Outpacing Its Industrial Products Peers This Year?

Here is how Applied Industrial Technologies (AIT) and Core & Main (CNM) have performed compared to their sector so far this year.

Here's Why Applied Industrial Technologies (AIT) is a Strong Growth Stock

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Applied Industrial Technologies (AIT) Reports Q2 Earnings: What Key Metrics Have to Say

Although the revenue and EPS for Applied Industrial Technologies (AIT) give a sense of how its business performed in the quarter ended December 2024, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

Applied Industrial Technologies, Inc. (AIT) Q2 2025 Earnings Call Transcript

Applied Industrial Technologies, Inc. (NYSE:AIT ) Q2 2025 Earnings Conference Call January 29, 2025 10:00 AM ET Company Participants Ryan Cieslak - Director, IR & Treasury Neil Schrimsher - President & CEO Dave Wells - CFO Conference Call Participants David Manthey - Baird Ken Newman - KeyBanc Capital Markets Chris Dankert - Loop Capital Markets Sabrina Abrams - Bank of America Brett Linzey - Mizuho Patrick Schuchard - Oppenheimer Operator Welcome to the Fiscal 2025 Second Quarter Earnings Call for Applied Industrial Technologies. My name is Liz, and I will be your operator for today's call.

Applied Industrial Q2 Earnings Beat Estimates, Revenues Miss

AIT's second-quarter fiscal 2025 revenues inch down 0.4% year over year due to the lackluster performance of its Service Center-Based Distribution segment.

Applied Industrial Technologies (AIT) Q2 Earnings Top Estimates

Applied Industrial Technologies (AIT) came out with quarterly earnings of $2.39 per share, beating the Zacks Consensus Estimate of $2.22 per share. This compares to earnings of $2.24 per share a year ago.

Analysts Estimate Applied Industrial Technologies (AIT) to Report a Decline in Earnings: What to Look Out for

Applied Industrial Technologies (AIT) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Applied Industrial Technologies (AIT) Is Up 5.14% in One Week: What You Should Know

Does Applied Industrial Technologies (AIT) have what it takes to be a top stock pick for momentum investors? Let's find out.