General Electric Company (GE)

GE Aerospace Had a Solid Quarter. Here's Why I Wouldn't Buy the Stock.

GE Aerospace recently emerged as a stand-alone company after spinning off other units. GE Aerospace's first two quarters of 2024 show strong growth.

3 Up-and-Coming Stocks That Could Make Your Summer Unforgettable

We're entering the dog days of summer, and the stock market continues to be a rollercoaster ride for investors. After a strong rally in the year's first half, the waters got choppy in July as investors rotated capital out of technology stocks in favor of small-caps and value stocks.

Assess Industrial ETFs Post Q2 Earnings

Look at Industrial ETFs as companies report mixed Q2 2024 earnings.

GE Aerospace Silences the Doubters -- Here's Why the Stock Is a Buy

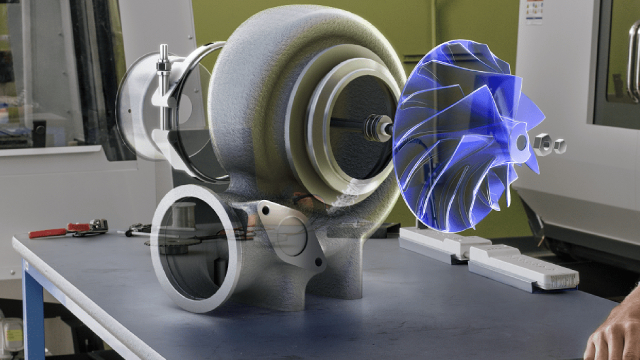

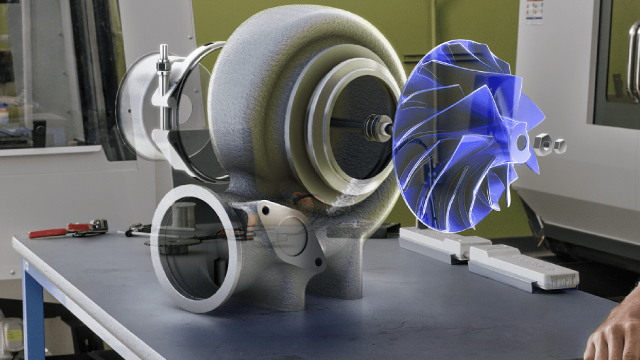

GE Aerospace continues to outperform analysts' expectations in services. The pushout in LEAP engine deliveries means airlines will use CFM56 engines more.

Does GE Aerospace Stock Have More Upside Potential After A 70% Rise This Year?

GE Aerospace (NYSE: GE) recently reported its Q2 results, with revenues missing but earnings well above the street estimates. The company reported adjusted revenue of $8.2 billion and adjusted earnings of $1.20 per share, compared to the consensus estimates of $8.4 billion and $0.98, respectively.

GE Stock Soars 67% In 2024 On Strong Jet Engine Demand. Is GE Aerospace A Buy?

GE stock has leapt 67% in 2024 after converting to a pure-play aerospace company. Jet demand is high.

3 Iconic Companies to Buy Stock in After Earnings

Glancing at the Zacks Rank #1 (Strong Buy) list, the stocks of three iconic companies are standing out after they were able to exceed Q2 earnings expectations.

GE Vernova says manufacturing issue led to Vineyard turbine blade failure

Power services firm GE Vernova said on Wednesday a manufacturing issue led to a turbine blade failure at its Vineyard Wind offshore project off the coast of Massachusetts earlier this month.

GE Aerospace Flies High On Hopeful Guidance

GE Aerospace shares spiked 5.7% after reporting Q2 results, with revenue slightly below expectations but adjusted earnings per share higher than anticipated. Orders for Commercial Engines & Services segment increased significantly, while the Defense & Propulsion Technologies segment saw a decline. Despite strong financial performance, GE Aerospace shares are still expensive, leading to a 'hold' rating.

Why GE Stock Has Finally Recovered from the Great Recession

Shares of GE Aerospace (GE) on Tuesday hit their highest level since early 2008 as second-quarter results showed the company's years-long turnaround plan was bearing fruit.

GE Aerospace (GE) Q2 Earnings Beat Estimates, Rise Y/Y

GE Aerospace's (GE) second-quarter 2024 results reflect a 4% increase in revenues, driven by the solid performance of its segments.

Why GE Aerospace Stock Is Flying Higher Today

GE Aerospace beat earnings estimates thanks to strong demand for spare parts and engine replacements. The company raised its full-year guidance.