Hudbay Minerals Inc. (HBM)

HudBay Minerals (HBM) Stock Drops Despite Market Gains: Important Facts to Note

HudBay Minerals (HBM) concluded the recent trading session at $7.45, signifying a -1.46% move from its prior day's close.

Cadence Unveils HBM4 IP Memory System Solution for AI & HPC Systems

CDNS launches the fastest HBM4 IP at 12.8Gbps, targeting next-gen AI and HPC SoCs with unmatched memory bandwidth for cutting-edge performance.

HudBay Minerals (HBM) Surges 14.1%: Is This an Indication of Further Gains?

HudBay Minerals (HBM) was a big mover last session on higher-than-average trading volume. The latest trend in earnings estimate revisions might not help the stock continue moving higher in the near term.

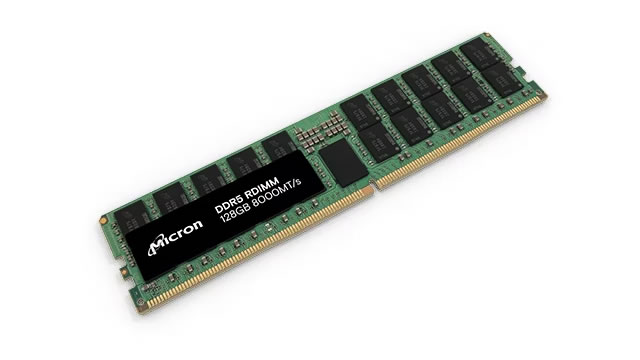

Micron Technology: Nothing Is Over

Despite the recent market correction, I maintain a "Buy" rating on Micron Technology, Inc. due to strong fundamentals, rising memory prices, and increasing AI demand. Micron's Q4 revenue hit $8.1 billion, with record data center DRAM sales and significant HBM growth, beating Wall Street expectations. Micron's $14 billion CapEx plan for FY2025 is ambitious but feasible, aiming to meet rising demand and achieve market share parity in HBM.

Micron: High Margin Of Safety

Micron Technology's HBM up-scaling is driving significant profit growth, with profits expected to surge 433% in 2025 and 60% in 2026. Despite disappointing 2Q25 sales guidance, Micron's robust demand for HBM from data centers positions it for long-term growth and margin expansion. Micron's stock is undervalued at 8.6x leading profits, offering a favorable risk/reward ratio with an implied intrinsic value of $165.

Micron Shortens Its Product Cadence To Align With Grace Blackwell (Rating Upgrade)

Micron is turning production to HBM3E 12-high chips for Nvidia's GB300 GPU in 2h25 and anticipating significant revenue growth on a per-chip basis. Q2'25 saw substantial growth in HBM and DRAM modules while NAND lagged due to customer inventory digestion. Management is taking steps to work down inventory by curtailing NAND utilization in Q3'25. This may create an uplift in free cash flow in the coming quarters.

Why Investors Need to Take Advantage of These 2 Basic Materials Stocks Now

Investors looking for ways to find stocks that are set to beat quarterly earnings estimates should check out the Zacks Earnings ESP.

HudBay Minerals (HBM) Advances But Underperforms Market: Key Facts

HudBay Minerals (HBM) closed the most recent trading day at $8.29, moving +1.72% from the previous trading session.

Micron Technology: HBM Ramp-Up May Pressure Margins, But Stock Remains A Buy

Micron Technology, Inc. reported a 38.3% YoY revenue increase, driven by DRAM and NAND sales growth, despite some pricing pressures and inventory adjustments. The company delivered on its guidance, but the stock price declined due to margin pressures and competitive pricing, particularly from China. Micron's Q3 guidance indicates higher sales but continued margin pressure, necessitating careful management of capacity and investments in HBM chips.

Micron Q2: Inflection Point In Sight, Upside Case Strengthens

Q2 revenue rose 38% YoY, driven by 47% DRAM growth and record HBM sales exceeding $1B; Micron is now a key AI memory supplier. Q3 guidance at record $8.8B shows momentum; HBM3E ramp and full 2025 sell-out confirm structural demand strength. Margins to expand in H2 as DRAM pricing recovers and NAND stabilizes; stock offers 25–50% upside on cyclical and secular growth.

Micron: A Dirt-Cheap AI Growth Play

Micron's Q2'25 earnings exceeded expectations due to strong demand for memory products, particularly HBM3E, and showed solid revenue growth in DRAM and NAND segments. The memory and storage company provided a positive outlook for Q3 with projected revenues of $8.8B, reflecting strong demand for memory, driven by Data Centers. HBM-related revenue crossed the $1.0B threshold in Q2'25 and the long term outlook for the memory market benefits Micron significantly.

Micron Q2: Anticipating More HBM Shipment In H2

I reiterate a 'Strong Buy' rating on Micron with a fair value of $140 per share, driven by robust HBM growth and strategic capacity expansion. Micron reported 38.3% revenue growth and 24.9% adjusted operating income, with HBM revenue growing 50% sequentially, reaching a record high. The company is guiding for $8.8 billion in Q3 FY25 revenue, with significant investments in HBM manufacturing, forecasting 38.2% year-over-year growth for FY25.