Lam Research Corporation (LRCX)

Can AI-Driven Foundry Demand Drive LRCX's Systems Revenue Growth?

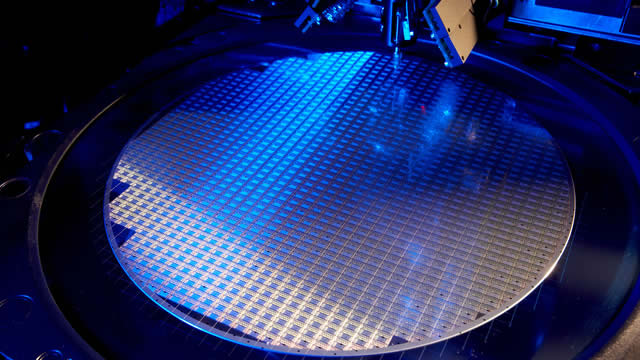

AI-driven foundry demand lifts Lam Research's systems revenues 48.3% YoY to $3.55B, with foundries comprising 60% of sales in the first quarter of fiscal 2026.

Why Lam Research (LRCX) is a Top Stock for the Long-Term

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Focus List.

Why Lam Research (LRCX) Dipped More Than Broader Market Today

Lam Research (LRCX) closed at $160.52 in the latest trading session, marking a -4.85% move from the prior day.

Lam Research Corporation (LRCX) Soars to 52-Week High, Time to Cash Out?

Lam Research (LRCX) is at a 52-week high, but can investors hope for more gains in the future? We take a look at the company's fundamentals for clues.

Here's Why Lam Research (LRCX) is a Great Momentum Stock to Buy

Does Lam Research (LRCX) have what it takes to be a top stock pick for momentum investors? Let's find out.

Why Lam Research (LRCX) is a Top Momentum Stock for the Long-Term

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Lam Research (LRCX) is a Top-Ranked Growth Stock: Should You Buy?

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Micron vs. Lam Research: Which Stock Has Better Upside Potential?

MU's faster growth estimates, stronger AI momentum and lower valuation than LRCX point to clearer upside.

Lam Research (LRCX) is an Incredible Growth Stock: 3 Reasons Why

Lam Research (LRCX) is well positioned to outperform the market, as it exhibits above-average growth in financials.

Wall Street Bulls Look Optimistic About Lam Research (LRCX): Should You Buy?

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?

Earnings Growth & Price Strength Make Lam Research (LRCX) a Stock to Watch

The Zacks Focus List offers investors a way to easily find top-rated stocks and build a winning investment portfolio. Here's why you should take advantage.

Lam Research: AI Foundry Growth Keeps The Upside Case Alive

Lam Research is rated a Buy with a revised price target of $178, reflecting a 14% upside and market outperformance. LRCX delivered strong FQ1 2026 results: 28% revenue growth, 47% EPS growth, and record gross/operating margins, driven by AI-powered demand. The company benefits from robust AI-related tailwinds, global diversification, heavy R&D investment, and a low-leverage capital structure supporting future growth.