Micron Technology Inc. (MU)

Micron Technology, Inc. (MU) is Attracting Investor Attention: Here is What You Should Know

Recently, Zacks.com users have been paying close attention to Micron (MU). This makes it worthwhile to examine what the stock has in store.

Selling Micron? You May Regret It (Technical Analysis, Rating Upgrade)

Despite a 35% decline since mid-January, I believe selling Micron Technology now is a mistake due to its strong fundamentals and attractive valuation. Technical analysis shows bearish momentum, but recent earnings indicate robust financial health and resilience, making Micron a top AI beneficiary. Micron's Q2 results were strong, with impressive revenue and EPS growth, and while Q3 guidance shows deceleration, growth remains solid.

Micron Tumbles on Tariff Threat: Risk/Reward Outlook Improves

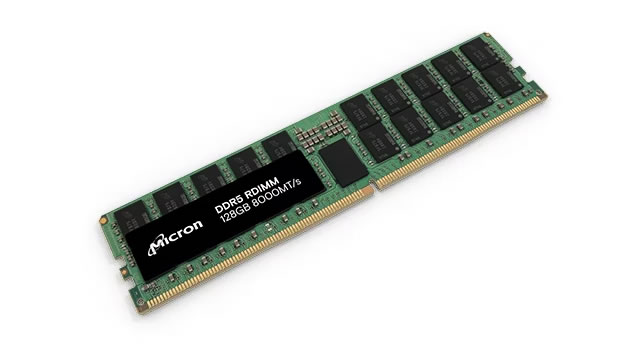

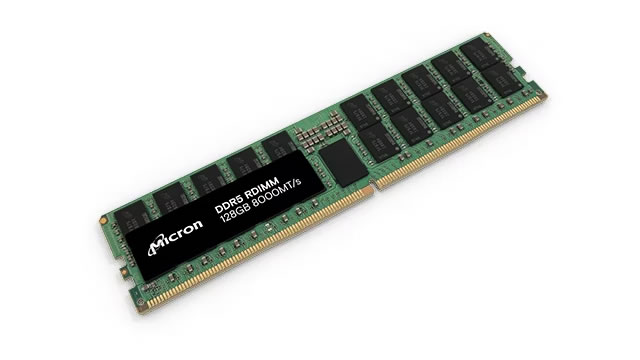

Micron NASDAQ: MU is among the most tariff-exposed semiconductor stocks on the market. While its microchips are exempt from Trump's tariffs, its business includes memory modules and SSD equipment that are not.

Why Micron Stock Is Plummeting Today

Micron Technology (MU -10.12%) stock is getting hit with big sell-offs Thursday. The memory-chip and storage company's share price was down 12.3% by midday.

Micron Technology: I'm Doubling Down

Trump's tariffs announcement caused significant market uncertainty, but semiconductors, including MU, are currently excluded from these tariffs, which is crucial for MU's stability. MU's role in the AI revolution is pivotal, with its innovative memory and storage solutions complementing NVIDIA's GPUs, essential for data centers and AI development. Despite market struggles, MU's valuation is opportunistic with a forward EV to EBITDA multiple of 4.8x, making it an attractive investment given its leadership position in the niche.

Micron to impose surcharge on some products amid tariff pressure

Micron Technology Inc (NASDAQ:MU) will impose a tariff-related surcharge on select products starting Wednesday, in response to new US trade levies, Reuters reported. Shares of the memory chipmaker rose 5.3% in premarket trading.

It's Time To Start Layering Into Micron Stock Again

Investing in deeply cyclical businesses like Micron can be difficult for individual investors. Understanding historical earnings cyclicality and why earnings are not a good way to value Micron is essential to avoid paying too much for the stock. This article shares my philosophy and purchasing strategy for Micron, which has worked well for me in the past.

Micron Technology, Inc. (MU) Is a Trending Stock: Facts to Know Before Betting on It

Micron (MU) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Patience Pays: Waiting Until After Trump's Liberation Day To Buy Micron Stock

Micron Technology, Inc.'s stock is volatile, currently at $87, and I think it will drop further to its 52-week-low at $83.54 after Trump's Liberation Day due to tariffs on semiconductor imports. I think that's when MU stock will be most attractive, and, hence, I'm initiating it with a buy. Anticipated tariffs may temporarily hurt Micron, but federal investments and AI market growth position it for a significant rebound.

Micron's Bullish Support And Promising H2 Commentary Trigger Strong Buy Rating

MU's double beat FQ2'25 performance, robust FQ3'25 guidance, and promising H2'25 commentary imply that the worst of the memory chip correction is well behind us. Despite the elevated inventory levels and higher net debt position, its improving gross margins signal financial recovery, with data center demand expected to strengthen in H2'25. MU's stock appears undervalued at our estimated FWD PEG ratio of 0.63x compared to its historical trends and semiconductor peers, with it offering rich double digit capital appreciation prospects.

Micron Is A Broken Stock, Not A Broken Company (Rating Upgrade)

Despite a 45% drawdown, Micron's robust demand for HBM products amid AI infrastructure buildout supports a "Buy" rating. Micron's recent price hikes and strong Q2-FY2025 earnings counter margin contraction fears. Assuming a 20x P/FCF exit multiple, Micron could trade at ~$192 per share in five years, implying a 5-year CAGR return of +17.26%.

Micron Stock: Buy Before The Supercycle

Micron Technology reported earnings on March 20th. MU stock fell in response to gross margin pressure as NAND pricing faces pressure. DRAM and NAND will likely both see favorable conditions in FY2026, leading to record operating results.