Nike Inc. (NKE)

“Buy, Buy, Buy” Jim Cramer Is Scooping up These 2 Tariff-Hit Stocks

Most investors treat tariff headlines like weather reports, something to grumble about and then ignore.

NIKE vs. adidas: Which Stock Leads the Global Sportswear Race?

NKE and ADDYY's face off in a global race is shaped by digital shifts, bold branding and evolving consumer trends.

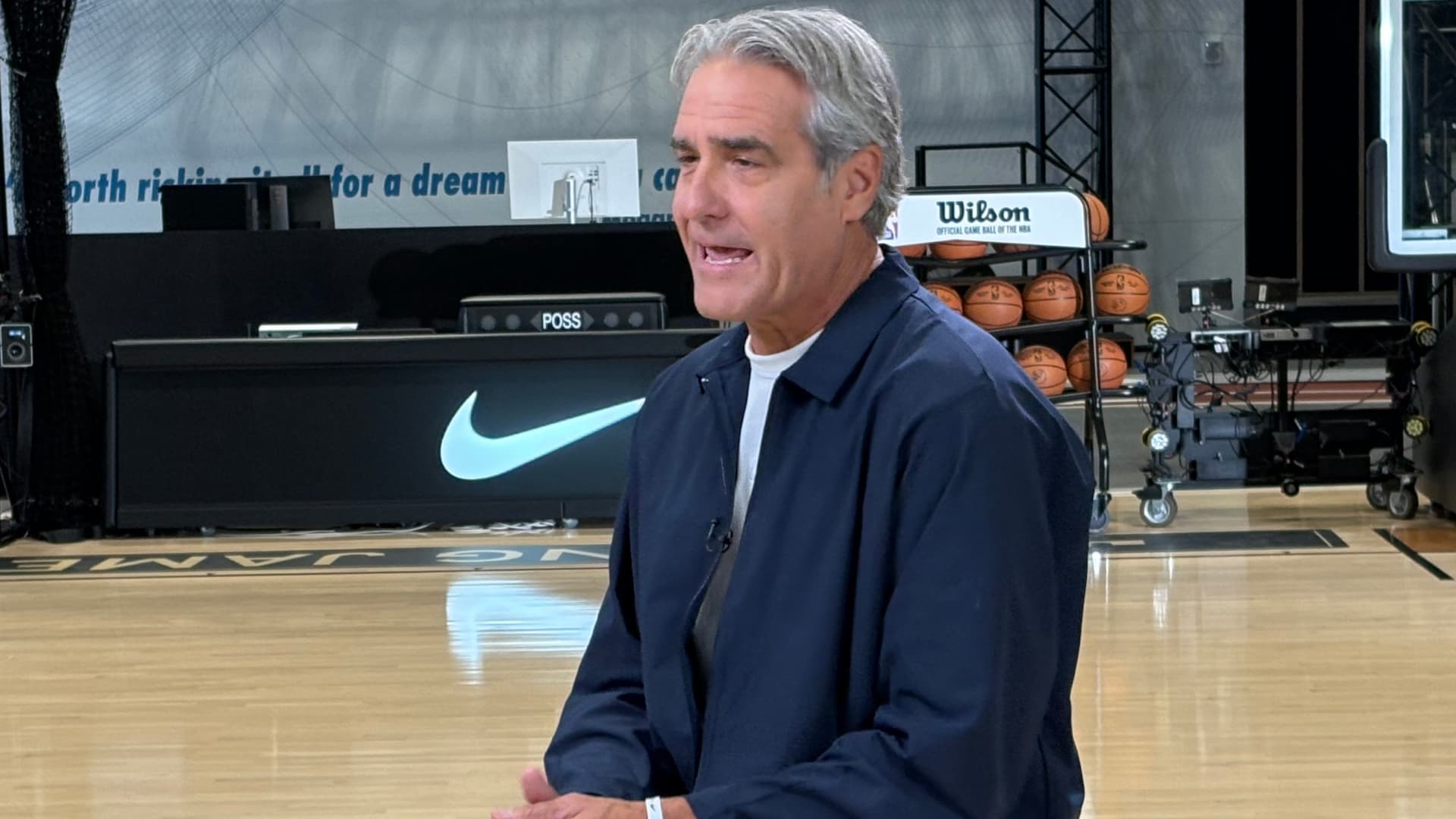

Nike CEO says the company needs to earn back shelf space in the face of stiff competition

In an exclusive interview Nike CEO Elliott Hill says he's betting on a “return to sport” to revive the brand.

Can Nike Get Its Groove Back? Inside Its CEO's High-Stakes Comeback Plan

Nike is the world's largest sportswear brand, but after several quarters of disappointing results, its comeback plan is just beginning. Longtime executive Elliott Hill, who came out of retirement to become CEO, says he's betting on a “return to sport” to revive the brand.

Nike and 3 More Companies Raising the Alarm About Tariff Costs

Plenty of companies will likely boost prices to protect their margins.

Nike's Comeback: Strong Turnaround Signals Overpower Near-Term Tariff Risks

Nike is rated a Buy, as current valuation and negative sentiment create a long-term investment opportunity, despite near-term headwinds. NKE's "Sport Offense" realignment, wholesale channel recovery, and strong brand equity are driving early signs of top line growth and future earnings rebound. Major risks include $1.5B annualized tariff headwind, ongoing weakness in Greater China, and prolonged digital/Converse resets impacting short-term profitability.

Is NIKE's 20% Running Growth the Blueprint for Its Comeback?

NKE's 20% y/y rise in running signals its comeback as innovation and athlete-driven storytelling reignite consumer demand.

Nike CEO Elliott Hill's first year: Wall Street grades his comeback plan a B.

Nike CEO Elliott Hill hit one year at the helm of the sportswear giant. Hill took the reins as sales declined and demand weakened in key markets.

Is NIKE Stock's Move Below 200-Day SMA a Warning or Opportunity?

NKE's slide below its 200-day SMA underscores waning momentum as its strategic reset and premium valuation test investor confidence.

Nike Stock To $40?

Nike (NYSE: NKE) has declined approximately 11% over the last year, falling behind the S&P 500's 17% increase. Its most recent quarter showed a slight revenue surprise, yet history teaches us that potential risks to the downside cannot be overlooked.

Nike Post Earnings: EPS Estimates Didn't Increase Much, Probably Thanks To Higher Tariffs

While Nike stock rose $4.50 the next day following the quarter's results, the headwinds cited during the conference call might mean the turnaround will be slower than originally suspected. The big surprise for me personally was that Nike raised their expected tariffs to $1.5 billion, from the expected $1 billion originally forecast in June '25. While clients remain long the stock, the turn for Nike will not happen overnight unless something dramatic happens with tariffs and the China relationship.

Nike's Transformation Strategy Is Finally Delivering Results

NIKE is showing early signs of a turnaround, driven by its Win Now and Sport Offense strategies, with Q1'26 results beating expectations. NKE posted revenue growth in North America and EMEA, and the Running segment surged 20% YoY, signaling momentum from its new organizational model. Valuation metrics suggest NKE is undervalued, as forward P/E ratios do not reflect anticipated revenue growth and the company's turnaround progress.