NVIDIA Corporation (NVDA)

NVDA Pushes Markets to Rally, September Jobs Emphasize Fed's Labor Focus

"Welcome to the melt up," says Kevin Hincks, as markets soared ahead of Thursday's opening bell. It's no secret that Nvidia's (NVDA) earnings served as the catalyst, with leadership appearing to quell fears of an A.I.

Nvidia Q3: The Flipside Of 'Everything Is Sold Out' Is Concerning

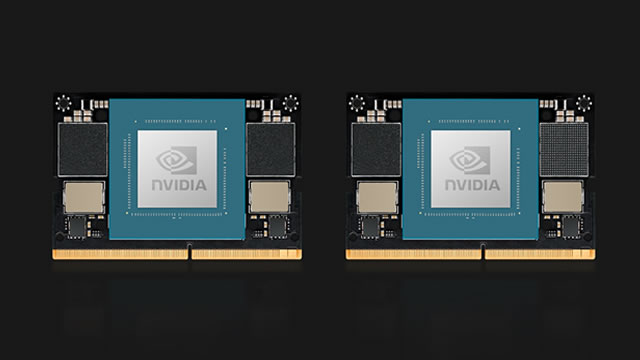

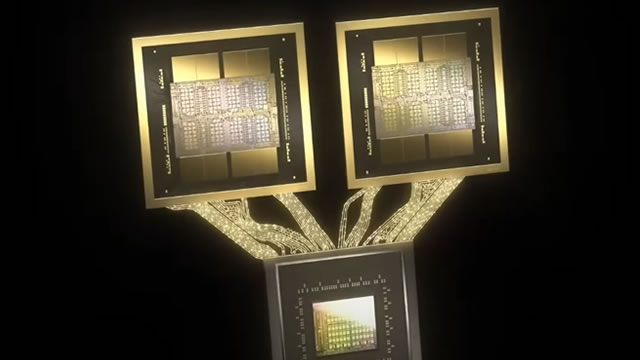

Nvidia Corporation's Q3 results and Q4 outlook point to an improving growth and margin profile, but they do not address the broader concern of potential AI overspending in the market. Total AI capex among hyperscalers to reach $600 billion, nearly triple from $200 billion at the beginning of this year. NVDA is still on track to achieve $500 billion in revenue from Blackwell and Rubin across 2025 and 2026, which could be challenging.

Nvidia trades higher in Thursday dealing, analyst says the chipmaker could be worth $6 trillion in a year

There's a lot more air to blow into the AI bubble, that's what snap analysis says following last night's update from Nvidia Corp (NASDAQ:NVDA, XETRA:NVD). Put in more nuanced parlance by Dan Ives, the closely followed analyst at West Coast US stockbroker Wedbush, the latest blockbuster numbers from Nvidia show it is 'a 1996 moment, rather 1999'.

Nvidia earnings takeaways: Bubble talk, 'half a trillion' forecast and China orders

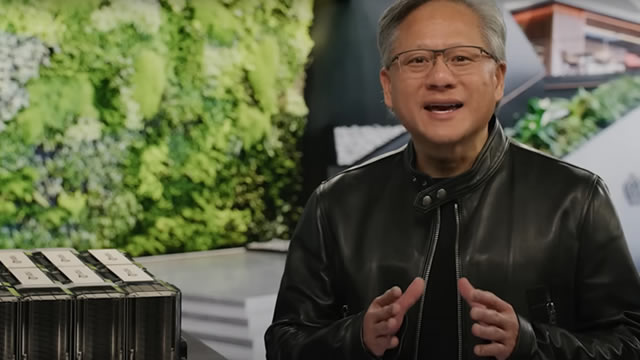

Nvidia on Wednesday reported fiscal third-quarter earnings that beat expectations for sales and earnings, and provided a strong forecast for the current quarter. CEO Jensen Huang sounded confident in the company's outlook during a call with analysts.

NVIDIA Stock Soars 6% as Q3 Earnings and Revenues Crush Estimates

NVDA jumps 6% as Q3 earnings and revenues surge on broad market strength and soaring demand for Blackwell-driven data center systems.

Is Nvidia Stock Worth Buying After Its Q3 Earnings?

Just when many investors thought that the AI trade as we knew it would go up in a poof of smoke, Jensen Huang's GPU empire, Nvidia (NASDAQ:NVDA), posted a quarterly earnings result that was a lot better than expected.

NVIDIA-Led Relief Rally in Tech Sector? Undervalued ETFs in Focus

While NVIDIA's strong earnings ease AI valuation jitters, undervalued tech ETFs like KNCT, RSPT, XSW, FITE and IGPT look appealing amid lingering ecosystem and overvaluation risks.

5 Things to Know Before the Stock Market Opens

Stock futures are surging this morning after Nvidia's highly anticipated quarterly results and outlook handily topped Wall Street expectations; Walmart released results that beat analysts' estimates on the top and bottom lines; the jobs report for September is finally set to arrive after its release was delayed by the government shutdown; and shares of Palo Alto Networks are losing ground after the cybersecurity firm released earnings and announced an acquisition. Here's what investors need to know today.

Nvidia's Q3 Proves AI Bubble Is Only In Doubters' Minds

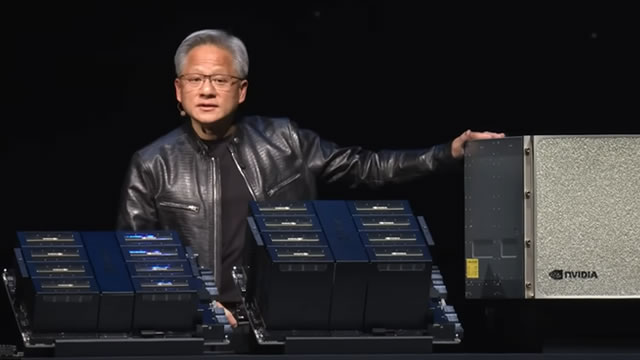

Nvidia delivered another strong Q3, beating consensus estimates and showcasing robust demand, particularly in data center and AI infrastructure segments. NVDA's guidance points to continued growth, with management highlighting a $0.5 trillion revenue opportunity through 2026 and expanding AI factory partnerships. The company is widening its competitive moat by selling full-stack "AI factories," making it increasingly difficult for customers to switch to competitors.

Nvidia Reignited the Stock Market's AI Rally. Why the Fed Could Extinguish It.

Fed leans toward December pause, sports streaming competition heats up, Target's incoming CEO faces challenges, and more news to start your day.

Nvidia Leads Rise In Stock Futures As Chipmaker's Blockbuster Earnings Ease AI Bubble Fears

Nvidia reported $57 billion in revenue in its third-quarter earnings report on Wednesday evening, comfortably beating out analyst estimates of $54.9 billion, according to FactSet data. A lion's share of the company's revenue, $51.2 billion, came from data center sales as companies push to scale up their AI infrastructure using Nvidia's advanced AI chips.

Nvidia Q3: There's A Red Flag In The Report, But I'm Still Buying

Nvidia's earnings report was very positive, with a beat on the top and bottom lines. There was one consideration for investors: gross margins, which were stagnant quarter-to-quarter and year-over-year. Margins may be impacted by the Blackwell rollout, and so this could be justified. Time will tell.