Peloton Interactive Inc. (PTON)

Peloton raises its full-year profit guidance, but expects the holiday quarter to be softer than expected

Peloton's fiscal first-quarter revenue beat Wall Street's expectations. The connected fitness company raised its full-year adjusted EBITDA guidance but posted a weaker-than-expected holiday forecast.

This is why David Einhorn thinks Peloton could be worth five times what it is now

David Einhorn's Greenlight Capital has a $6.8 million stake in Peloton, and he thinks the company could be worth five times it current value, if it cuts more costs. If Peloton can generate $450 million in EBITDA, about double its current projections, it could reach a share price of between $7.50 and $31.50 a share, Einhorn said at the Robinhood Investors Conference.

Einhorn Says There Is a Lot to Like About Peloton

David Einhorn, Greenlight Capital President, says there's a lot to like about Peloton stock. He says the company has a large customer base that is very engaged and the stock is undervalued.

Einhorn Says There Is a Lot to Like About Peloton

David Einhorn, Greenlight Capital President, says there's a lot to like about Peloton stock. He says the company has a large customer base that is very engaged and the stock is undervalued.

Peloton stock skyrockets 16% after billionaire calls it ‘undervalued'

Shares of Peloton Interactive (NASDAQ: PTON) have surged by 16% after David Einhorn, billionaire, and hedge fund manager, called the stock undervalued at Robinhood's (NASDAQ: HOOD) investor conference on October 23.

Peloton's Shocking Partnership with Costco Explained

Peloton bikes will be available at Costco this holiday season. But why?

Shares of Peloton surge 11% after David Einhorn says stock is significantly undervalued

CNBC's Andrew Ross Sorkin reports on the latest news.

Peloton shares receive Einhorn vote of confidence

There was an after-hours boost for Peloton Interactive Inc (NASDAQ:PTON) shares, which jumped over 11% after David Einhorn of Greenlight Capital highlighted the company's potential at the Robin Hood Investors Conference. Einhorn, who revealed a $6.8 million stake in the exercise bike giant as of June 30, believes the stock is undervalued, though he didn't specify a target price.

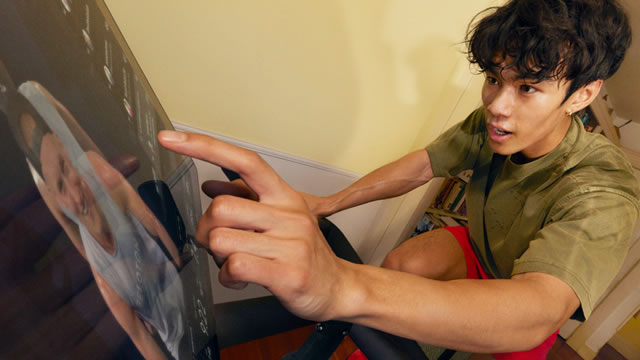

Shares of Peloton surge 11% after David Einhorn says stock is significantly undervalued

Greenlight Capital's David Einhorn told investors that Peloton's stock is significantly undervalued. The hedge fund boss made the pitch while riding a Peloton, a source familiar with the comments told CNBC.

Peloton Interactive Stock: Sell Before Q1 Earnings (Rating Downgrade)

I'm downgrading Peloton Interactive, Inc. stock to a sell rating ahead of its expected Q1 earnings release (due on October 31). Key ongoing concerns include declining subscriber numbers, near-zero hardware margins, and the potential negative impact of a new $95 initiation fee on secondary market sales. The company recently struck a deal to sell discounted Bike+ products through Costco, but this may hurt margins further and fail to bring in incremental buyers.

Peloton stock mixed after Costco deal, here's what the market is overlooking

Peloton stock has received a mixed reaction from investors after announced a deal with Costco.

Peloton (PTON) Surges 10.8%: Is This an Indication of Further Gains?

Peloton (PTON) witnessed a jump in share price last session on above-average trading volume. The latest trend in earnings estimate revisions for the stock doesn't suggest further strength down the road.