Advanced Micro Devices, Inc. (AMD)

What To Expect in the Markets This Week

Wednesday's expected decision on interest rates from the Federal Reserve, along with earnings from several large tech and entertainment companies, could highlight a busy week ahead for investors.

What Analysts Think of AMD Stock Ahead of Earnings

Advanced Micro Devices (AMD) is slated to report quarterly results after the closing bell Tuesday, and several analysts have lowered their price targets in recent weeks in the wake of tighter restrictions on U.S. chip exports to China.

Should You Buy, Hold, or Sell AMD Stock Ahead of Q1 Earnings?

Advanced Micro Devices' Q1 results are likely to reflect weakness in the Embedded and Gaming segments, offset by strong Data Center and Client growth.

Will Advanced Micro (AMD) Beat Estimates Again in Its Next Earnings Report?

Advanced Micro (AMD) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

AMD: You May Not Get It This Cheap Again

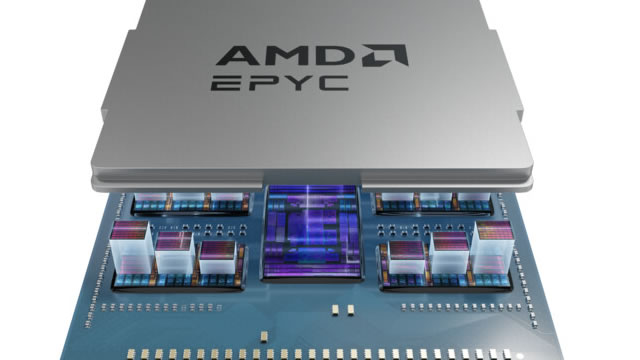

AMD stock has shown resilience, recovering over 30% from April lows despite trade war uncertainties and semiconductor tariffs. The data center business is crucial for AMD, contributing nearly 49% of total revenue, and is expected to maintain momentum despite potential CapEx reductions. AMD's valuation is attractive, with a forward EBITDA multiple of 21.2x, suggesting the market has priced in significant risks against its cyclicality.

Advanced Micro Devices, Inc. (AMD) is Attracting Investor Attention: Here is What You Should Know

Zacks.com users have recently been watching Advanced Micro (AMD) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

AMD: It Could Get Worse Before The Turnaround Occurs

Advanced Micro Devices continues to lag behind Nvidia as the AI revolution moves onto the “agentic phase”, while a possible slowdown in hyperscalers' CapEx plans ahead would particularly hurt AMD. 67% of CIOs seek to purchase “AI agents” from external software companies, benefitting rival Nvidia as it is the key technology provider to key players like Salesforce, ServiceNow, and others. AMD still doesn't offer hardware systems that are optimized for “agentic AI”, missing the opportunity to serve the 27% of enterprises that are open to building their own “AI agents”.

Should You Buy AMD Stock Before May 6?

AMD (AMD -0.84%) is scheduled to report quarterly financial results likely to have huge implications for stock market investors.

Gear Up for Advanced Micro (AMD) Q1 Earnings: Wall Street Estimates for Key Metrics

Besides Wall Street's top -and-bottom-line estimates for Advanced Micro (AMD), review projections for some of its key metrics to gain a deeper understanding of how the company might have fared during the quarter ended March 2025.

AMD Stock Signals Strong Buy Ahead of Earnings

The analysts are bullish on AMD and forecast a substantial 45% upside at the consensus. However, sentiment dampened in Q1 and Q2, weighing on the stock price.

Prediction: This Magnificent Artificial Intelligence (AI) Semiconductor Stock Will Soar After May 6

Advanced Micro Devices (AMD 1.46%) investors are having a forgettable year so far as shares of the chipmaker have pulled back by more than 20% in 2025 as of this writing. However, there is a good chance that the company's fortunes could turn around for the better once it releases its first-quarter 2025 results after the market closes on May 6.

Advanced Micro Devices (AMD) Reports Next Week: Wall Street Expects Earnings Growth

Advanced Micro (AMD) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.