Micron Technology Inc. (MU)

EARNINGS ALERT: MU

Micron (MU) sunk after hours due to its sales miss in 1Q and lower-than-expected guidance for 2Q. Oliver Renick, Caroline Woods and Kevin Green talk about the downside move and what it means for the A.I.

Micron's weak outlook sparks a big skid for the AI stock

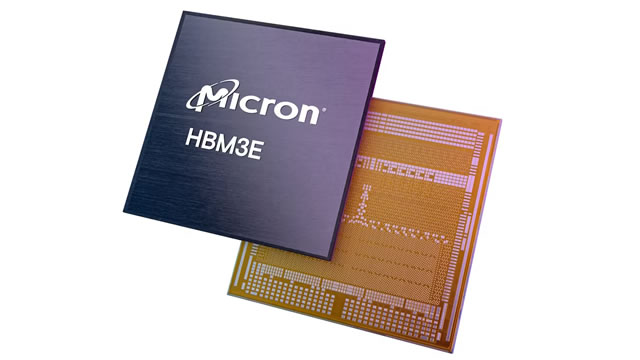

The memory-chip company cited weakness in consumer-facing markets but momentum in higher-margin areas and those levered to AI.

Micron Stock Dives As Chipmaker Whiffs On Guidance

Memory-chip leader Micron roughly matched analyst estimates for its fiscal first quarter but badly missed with its outlook. The post Micron Stock Dives As Chipmaker Whiffs On Guidance appeared first on Investor's Business Daily.

Micron Technology expects second-quarter revenue below estimates

Micron Technology forecast second-quarter results below Wall Street estimates on Wednesday, as weakened prices of memory chips used in handsets and personal computers weigh on earnings.

Micron Earnings: Will AI Growth Outweigh 'Choppy' Memory Market?

Micron Technology Inc MU heads into its first-quarter earnings announcement with a mix of optimism and caution.

Wall Street Analysts Look Bullish on Micron (MU): Should You Buy?

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

What Micron Stock Investors Should Know About the AI Memory Market Before It Reports Earnings Today

In today's video, I discuss recent updates impacting Micron Technologies (MU 0.31%). To learn more, check out the short video, consider subscribing, and click the special offer link below.

How To Earn $500 A Month From Micron Stock Ahead Of Q1 Earnings

Micron Technology, Inc. MU will release earnings for its first quarter, after the closing bell on Wednesday, Dec. 18.

Micron eyeing potential beat before tougher conditions hit - analysts

Micron Technology Inc (NASDAQ:MU) could well be on course to top estimates in Wednesday's first-quarter earnings, Wedbush analysts have said. First-quarter guidance was likely achievable, “if not beatable”, Wedbush said in a note ahead of the results.

Is Micron Stock a Buy Before Dec. 18?

In this video, I will cover the recent updates regarding Micron Technology (MU 5.62%). Watch the short video to learn more, consider subscribing, and click the special offer link below.

Prediction: This Artificial Intelligence (AI) Semiconductor Stock Is Set to Soar After Dec. 18

Surprisingly, Micron Technology (MU 5.62%) stock turned in a disappointing performance on the stock market in 2024. It clocked gains of just 20%, despite delivering solid results in recent quarters that point toward outstanding growth in the company's revenue and earnings.

Micron Q1 Preview: AI Has Hit A Wall, This Is Good For Micron

Micron Technology, Inc.'s shares have risen modestly due to evolving market expectations on AI demand, especially in post-training inference arena, which requires more memory, benefiting Micron's DRAM business. The shift from pre-training compute to post-training inference in AI models increases memory demand, positioning Micron favorably as a major DRAM supplier. Despite market skepticism, Micron's forward revenue and EPS growth rates exceed sector medians, suggesting shares are undervalued with potential for significant upside.