Super Micro Computer, Inc. (SMCI)

Super Micro Computer: A Buy For Risk-Tolerant Investors Eyeing AI Growth

Supermicro is a buy for investors willing to speculate, as it overcomes past accounting issues and capitalizes on robust AI infrastructure demand from hyperscalers and enterprises. Despite a Q3 revenue miss due to delayed AI platform adoption, AI GPU solutions still drive over 70% of revenues, signaling strong market appeal. Upcoming quarters should benefit from Nvidia ramping up shipments of new Blackwell GPUs, supporting future topline growth.

Banking giant predicts almost 30% drop for this AI darling

BofA Securities has resumed coverage on Super Micro Computer (NASDAQ: SMCI) with an ‘Underperform' rating and set a $35 price target, representing roughly 28.5% downside from current levels.

Super Micro Computer Stock's Rally May Well Continue In The Future

Super Micro Computer's stock surged nearly 70% since April, fueled by AI enthusiasm and easing trade tensions, despite recent earnings misses and margin compression. Recent quarters showed strong year-over-year revenue growth but declining profit margins and EPS, mainly due to inventory issues and delayed customer orders. Upside potential remains due to AI demand, new product launches, and insider ownership, though insider selling and inventory risks warrant caution.

Super Micro plans to ramp up manufacturing in Europe to capitalize on AI demand

Super Micro CEO Charles Liang told CNBC the company has plans to increase investment in Europe. Liang said that "demand [in] Europe is growing very fast.

Super Micro Computer (SMCI) Sees a More Significant Dip Than Broader Market: Some Facts to Know

The latest trading day saw Super Micro Computer (SMCI) settling at $47.11, representing a -2.99% change from its previous close.

Super Micro Computer: Path To $100

The amazing fact is that SMCI's current extremely modest price/sales ratio of around 1.3 is by far behind P/S ratios of pure value plays like Pfizer and Home Depot. My DCF analysis suggests intrinsic value near $100, indicating significant upside potential. SMCI's aggressive revenue growth, strong AI tailwinds, and deep partnerships with Nvidia, AMD, and Intel reinforce its competitive edge.

Super Micro Stock To $100?

Super Micro Computer stock (NASDAQ: SMCI) has experienced a remarkable performance, increasing by nearly 10x over the last three years from approximately $5 per share in June 2022 to about $47 currently, fueled by a surge in demand for server systems driven by the generative artificial intelligence movement. While the stock faced a significant selloff in 2024 – enduring a drawdown of up to 80% at one stage – due to regulatory worries and allegations from short-seller Hindenburg Research regarding accounting discrepancies, there are indications that the markets are lifting the governance-related discounts on the stock.

Is Trending Stock Super Micro Computer, Inc. (SMCI) a Buy Now?

Recently, Zacks.com users have been paying close attention to Super Micro (SMCI). This makes it worthwhile to examine what the stock has in store.

Why The 50% Rise In SMCI?

Super Micro Computer stock (NASDAQ:SMCI) surged nearly 10% in last week's trading and is up approximately 58% year-to-date. What is behind the recent gains?

SMCI's Margins Contracting: Is it Still Built for Profitable Scale?

Super Micro Computer's revenues are climbing fast, but shrinking margins raise questions about its ability to scale profitably in server and liquid cooling.

Super Micro Computer (SMCI) Stock Declines While Market Improves: Some Information for Investors

Super Micro Computer (SMCI) reached $47.58 at the closing of the latest trading day, reflecting a -3.43% change compared to its last close.

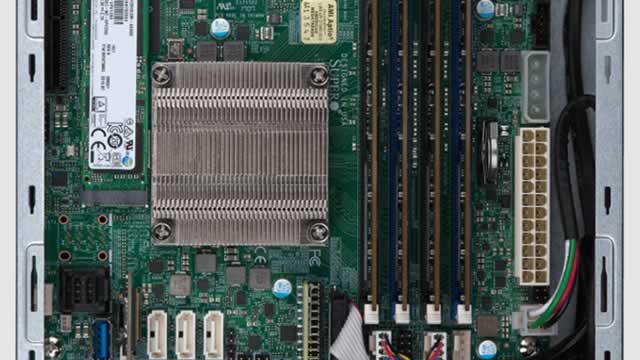

Super Micro: The Unsung Engine Powering America's AI Factories

Super Micro's agile, modular server design and U.S. manufacturing position it as a key beneficiary in the AI data-center build-out. Rapid iteration, liquid-cooling expertise, and alignment with U.S. policy incentives drive share gains and create a sticky customer base. Despite recent margin compression and guidance reset, robust cash flow and balance sheet support continued expansion and resilience.