Airbnb, Inc. (ABNB)

2 Brilliant Growth Stocks to Buy Now

The stock market has had a bumpy start to the year, with the S&P 500 down about 6% year to date at the time of writing. While it can be unnerving to watch your investments lose value, market volatility is the price investors have to pay to experience large gains down the road.

AirBnb: An Outstanding Business Now At A Reasonable Price

AirBnb's business model is exceptional, generating significant cash flow with minimal capital expenditures, making it a strong long-term investment despite its stock volatility. The company's ability to earn interest on customer prepayments and its strong cash position highlight its financial strength and operational efficiency. Expansion into new markets and adjacent businesses, while risky, offers substantial growth potential, similar to Amazon's early strategy.

Airbnb: We're Obsessed With This Profitable, Growing Travel Juggernaut

Airbnb's asset-light, high-margin business model and strong financials - including $10B in cash and 24% net margins - make it a compelling long-term investment. Despite a recent growth slowdown, Airbnb's strategic focus on core services, global expansion, and new offerings positions it for continued revenue growth and market share gains. At 7x sales and 18x free cash flow, Airbnb shares are attractively priced, offering potential for significant compounded returns as the company scales.

Disney, Airbnb Stocks Are Falling. Airlines' Guidance Cuts Unnerve Investors.

Wall Street has started to worry about a slump in consumer spending—and that would be bad news for the tourism sector.

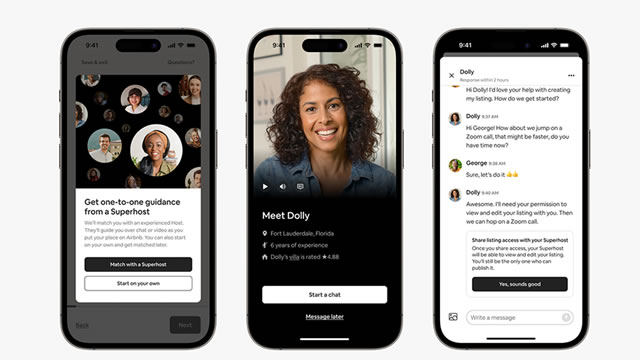

Airbnb CBO: AI Will Enable a ‘Concierge in Your Pocket'

Airbnb is planning to embed artificial intelligence (AI) throughout its operations to transform guest and homeowner experiences, enabling a “concierge in your pocket,” according to its chief business officer. AI is an “incredibly high priority,” said Airbnb's Dave Stephenson, at the Human[x] conference in Las Vegas on Monday (March 10).

From Big Tech to private equity, early Airbnb investor Rick Heitzmann sees more market ‘chop' ahead

Rick Heitzmann, FirstMark Capital founder & partner, joins 'Fast Money' to talk Big Tech's market struggle this week and why more pain may be on the horizon.

Is Most-Watched Stock Airbnb, Inc. (ABNB) Worth Betting on Now?

Airbnb (ABNB) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

5 Top Stocks to Buy in March

2025 has gotten off to a choppy start as some of the most valuable U.S.-based companies are dragging down the major stock market indexes. But getting caught up in short-term market movements is a mistake.

3 Must-Know Reasons to Buy Airbnb Stock, and 1 Reason to Steer Clear for Now

Airbnb (ABNB 1.75%) handily beat Wall Street expectations when it reported its fourth-quarter 2024 financial results on Feb. 13. Revenue of $2.5 billion and earnings per share of $0.73 for the three-month period were both well ahead of consensus analyst estimates.

1 Growth Stock That's a Winner from DeepSeek AI, According to the CEO

DeepSeek, the Chinese AI start-up, sent shockwaves through the industry just a month ago when it launched its latest model, R1.

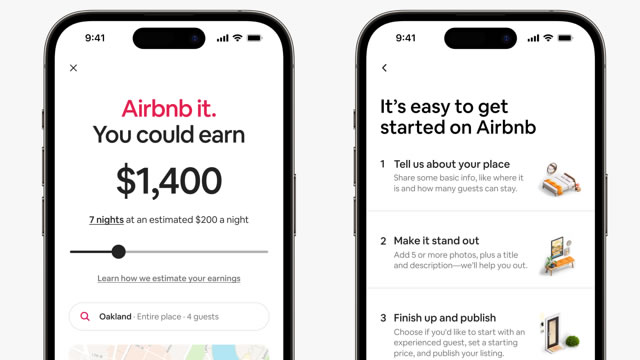

Airbnb surges after upbeat quarter, plan to become 'Amazon' of travel and living

To get the latest market news check out finance.yahoo.com Airbnb (ABNB) stock surged as much as 15% on Friday following better-than-expected quarterly results. The company also laid out plans to expand its vacation platform into an app for everything related to travel and living.

Airbnb Shares Jump 12% in a Week: Buy, Sell or Hold the Stock?

ABNB is riding on strong Nights & Experiences Booked and growing usage of its app amid challenging macroeconomic conditions and stiff competition.