Airbnb, Inc. (ABNB)

I Just Bought More of These 3 High-Conviction Stocks. Here's Why

Many successful investors regularly invest new money. It's an under-appreciated, winning approach to the stock market.

1 Artificial Intelligence (AI) Stock Investors Are Overlooking That Could Be Worth Buying

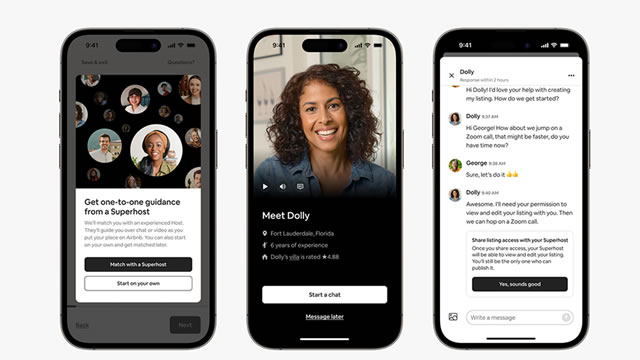

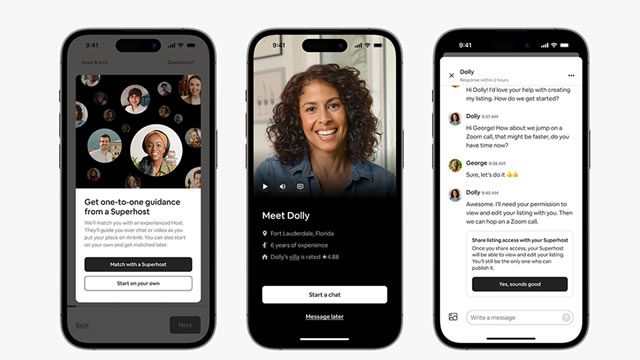

One of the more surprising stock stories during the first half of the 2020s may be Airbnb (ABNB 1.17%). The site leveraged artificial intelligence (AI), bringing landlords and tenants together to market vacation properties that may have otherwise never made it to the market.

Airbnb, Inc. (ABNB) is Attracting Investor Attention: Here is What You Should Know

Airbnb (ABNB) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

I Just Bought Airbnb Stock for the First Time Since 2021. Here's Why.

I didn't realize it at the time, but I was an early adopter of Airbnb (ABNB -4.62%), having used the short-term rental platform often, both domestically and internationally, for more than a decade. My large family makes hotel stays complicated -- many have a limit of five people per room, not to mention that kids are hard to keep quiet out of courtesy for the other hotel guests.

Airbnb: A Real GARP Play

Airbnb has shown impressive growth post-pandemic, with revenue rising from $5.99 billion in 2021 to $9.92 billion in 2023, driven by increased bookings and higher gross bookings value. Despite its high valuation, Airbnb is considered a GARP (growth-at-a-reasonable-price) stock due to its strong cash flow margins and substantial net cash position of $9.26 billion. The company's global reach, with significant revenue from North America and EMEA, and potential growth in the Asia Pacific region, supports a soft 'buy' rating.

Airbnb, Inc. (ABNB) Stock Falls Amid Market Uptick: What Investors Need to Know

In the closing of the recent trading day, Airbnb, Inc. (ABNB) stood at $133.07, denoting a -1.52% change from the preceding trading day.

Airbnb Falls 5% in a Year: Should You Buy, Sell or Hold the Stock?

Airbnb faces rising competition, margin compression and regulatory challenges, which raise short-term concerns that could keep investors cautious.

Airbnb: Excited For An Expanding Market In 2025

Airbnb is well-positioned to capitalize on the travel industry's projected high single-digit growth in 2025, leveraging AI for personalized experiences and operational efficiency. Airbnb's robust free cash flow and share repurchase strategy highlight its strong financial health and shareholder value. AirDNA data suggests Airbnb's Q4 2024 revenue will exceed consensus estimates, indicating strong booking trends.

Airbnb, Inc. (ABNB) Is a Trending Stock: Facts to Know Before Betting on It

Recently, Zacks.com users have been paying close attention to Airbnb (ABNB). This makes it worthwhile to examine what the stock has in store.

Bargain hunting? This value manager has scooped up Airbnb, an AI-healthcare play and a GE spinoff

Five overlooked stocks that the Oakmark Fund unearthed last year.

Airbnb: A Compelling Investment In 2025

I value Airbnb's solid balance sheet, with $9 billion in net cash, which provides a significant margin of safety. I believe Airbnb's forward free cash flow valuation of 17x is pricing in too much negativity, presenting a compelling buy. I am optimistic about a potential 15% revenue growth in 2025, driven by easier comparables and expanding markets.

Airbnb in 2025: Growth Potential vs. Risks

Explore the exciting world of Airbnb (ABNB -0.97%) with our expert analysts in this Motley Fool Scoreboard episode. Check out the video below to gain valuable insights into market trends and potential investment opportunities!