Airbnb, Inc. (ABNB)

Airbnb Shares Rise 11.9% in a Month: What Should Investors Do Now?

ABNB benefits from a strong core business, expanding host community and growing international footprint amid volatility in the travel market.

Airbnb: The Best Place In Travel

Airbnb is a wonderful business that has run into some short-term struggles, which has impacted the price. Airbnb connects guests with hosts for short-term rentals, with over 8 million listings. Despite the recent stock drop, international growth and expansion into new segments offer long-term potential.

Why Airbnb Stock Is Insanely Cheap Right Now

It's not often that disruptive companies are this cheap for investors.

Why Airbnb, Inc. (ABNB) Outpaced the Stock Market Today

In the most recent trading session, Airbnb, Inc. (ABNB) closed at $126.18, indicating a +0.57% shift from the previous trading day.

Airbnb: One Year Later, I'm Still Bullish

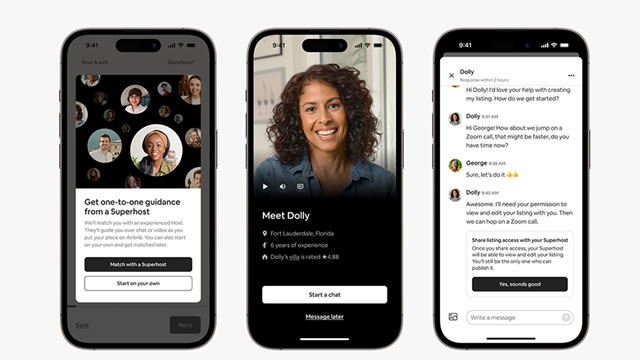

Q2 2024 financials show a 12% YoY increase in gross booking value and $2.75 billion in revenue despite rising costs and shorter booking lead times. Key growth drivers for Airbnb include product innovation like co-hosting, high-quality listings, relaunching Experiences, and international expansion in under-penetrated markets. Regulatory risks and competition from VRBO and hotels persist, but Airbnb's unique offerings and strong cash flow position it well for future growth.

Airbnb Stock Is Down 25% -- Is It a Bargain or Should Investors Stay Away?

The travel disruptor hasn't been a strong performer lately, but has the market overreacted?

Airbnb: Wait Before Checking Into This Attractive Yet Turbulent Opportunity

Airbnb's asset-light model allows for rapid scaling without owning physical properties supported by strong network effects. Stagnant booking growth, regulatory challenges in major cities, and vulnerability to economic downturns could limit Airbnb's future revenue and profitability. Despite a $215 target price, Airbnb's growth concerns and market risks make it too risky for investment at this time.

Amazon Stock Was a Once-in-a-Generation Investment Opportunity Thanks to 1 Underappreciated Trait. Here's an $80 Billion Company That Surprisingly Hopes to Follow in Its Footsteps.

Many people believe Amazon was successful because it was early to the e-commerce scene, but founder Jeff Bezos has a different perspective on its success. The co-founder of one $80 billion business is starting to talk like Bezos and he has billions of dollars at his disposal to make his dreams a reality.

Airbnb, Inc. (ABNB) Stock Drops Despite Market Gains: Important Facts to Note

In the closing of the recent trading day, Airbnb, Inc. (ABNB) stood at $129.25, denoting a -1.12% change from the preceding trading day.

Airbnb: Profitable Growth At A Reasonable Price

Airbnb is undervalued relative to its earnings, growth trajectory, and market position, making it a compelling investment opportunity. Despite slower growth and macroeconomic headwinds, Airbnb retains a decisive leadership position within the homestay booking industry. The company's future looks as bright as ever. Airbnb's strong balance sheet and powerful network effects ensure its continued success and market leadership.

3 Tech Stocks That Could Go Parabolic

Airbnb has a massive opportunity, and it's growing into its valuation. Global-e continues to onboard A-list clients and generate double-digit revenue growth.

The Airbnb Opportunity for Real Estate Investors

BiggerPockets CEO Scott Trench joins Motley Fool analyst Alicia Alfiere and host Mary Long to chat about Airbnb.