Ameren Corporation (AEE)

Here's Why You Must Add Ameren Stock to Your Portfolio Right Now

AEE is a solid pick in the utility space, given its growth prospects, strong ROE, systematic investment plan and ability to raise shareholder value via regular dividends.

Are Utilities Stocks Lagging Ameren (AEE) This Year?

Here is how Ameren (AEE) and Atmos Energy (ATO) have performed compared to their sector so far this year.

54 Upcoming Dividend Increases, Including A King

This week features the largest list of dividend increases ever, with 50 companies, including Coca-Cola extending its 63-year streak with a 5.2% increase. My strategy focuses on companies with consistent dividend growth and outperforming benchmarks, using data from the "U.S. Dividend Champions" spreadsheet and NASDAQ. I recommend the Schwab U.S. Dividend Equity ETF for broad U.S. equity exposure and the Cohen & Steers REIT & Preferred Income Fund for REITs.

What Makes Ameren (AEE) a Strong Momentum Stock: Buy Now?

Does Ameren (AEE) have what it takes to be a top stock pick for momentum investors? Let's find out.

Is Ameren (AEE) Stock Outpacing Its Utilities Peers This Year?

Here is how Ameren (AEE) and CenterPoint Energy (CNP) have performed compared to their sector so far this year.

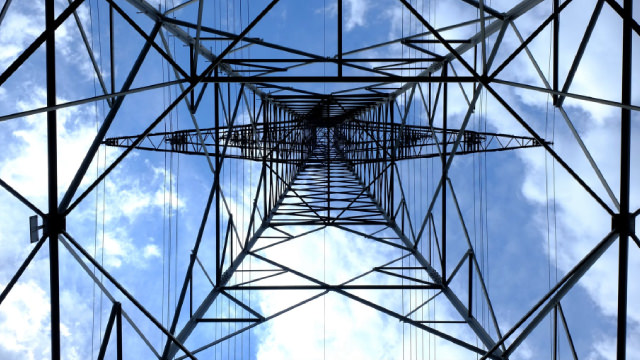

4 Electric Power Stocks to Consider Amid Industry Weaknesses

Despite near-term weakness in the electric power industry, utilities like VST, EXC, ETR and AEE are set to benefit from their systematic investments, which allow them to serve their customers efficiently.

Ameren Corporation (AEE) Q4 2024 Earnings Call Transcript

Ameren Corporation (NYSE:AEE ) Q4 2024 Earnings Conference Call February 14, 2025 10:00 AM ET Company Participants Andrew Kirk - Senior Director, Investor Relations and Corporate Modeling Martin Lyons - Chairman, President and Chief Executive Officer Michael Moehn - Senior Executive Vice President and Chief Financial Officer Conference Call Participants Shahriar Pourreza - Guggenheim Securities Durgesh Chopra - Evercore ISI Nicholas Campanella - Barclays Carly Davenport - Goldman Sachs Julien Dumoulin-Smith - Jefferies Anthony Crowdell - Mizuho Securities William Appicelli - UBS Jeremy Tonet - JPMorgan David Paz - Wolfe Research Operator Greetings and welcome to Ameren Corporation Fourth Quarter 2024 Earnings Conference Call. At this time, all participants are in a listen-only mode.

Ameren Q4 Earnings Miss Estimates, Revenues Increase Y/Y

AEE's Q4 total operating revenues of $1.94 billion rise 20% year over year and beat the Zacks Consensus Estimate by 10.3%.

Ameren Missouri updates generation strategy to boost investment and jobs

U.S. energy firm Ameren's Missouri unit said on Friday that it had made significant changes to its strategy to accelerate investment in generation, bolster reliability and create jobs.

Compared to Estimates, Ameren (AEE) Q4 Earnings: A Look at Key Metrics

The headline numbers for Ameren (AEE) give insight into how the company performed in the quarter ended December 2024, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

Ameren (AEE) Lags Q4 Earnings Estimates

Ameren (AEE) came out with quarterly earnings of $0.77 per share, missing the Zacks Consensus Estimate of $0.79 per share. This compares to earnings of $0.60 per share a year ago.

Ameren Corporation Boosts Shareholder Value With 6% Dividend Hike

AEE continues to increase shareholder value as its board of directors raises dividends by nearly 6%.