AES Corporation (AES)

Summary

AES Chart

AES Boosts Growth Outlook With Renewables & Data Center Deals

AES accelerates growth with expanding renewables, major data-center PPAs and continued progress on its clean-energy transition.

Here's 12 Ideal 'Safer' December Dividend Dogs Of The S&P500

S&P 500 high-yield 'safer' dividend stocks offer attractive upside, with twelve currently meeting the dogcatcher ideal of dividends exceeding share prices. Analyst targets forecast 21.14% to 44.05% net gains for top-ten S&P 500 dividend dogs by December 2026, with an average 28.35% gain and lower-than-market volatility. Stocks with negative free cash flow margins—fifteen of the top fifty—are flagged as unsafe for dividend sustainability despite high yields.

Why Is AES (AES) Down 3.6% Since Last Earnings Report?

AES (AES) reported earnings 30 days ago. What's next for the stock?

AES Corporation (AES) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

What is the earnings per share?

When is the next earnings date?

Has AES Corporation ever had a stock split?

AES Corporation Profile

| Electrical Equipment Industry | Industrials Sector | Andres Ricardo Gluski Weilert CEO | XMUN Exchange | US00130H1059 ISIN |

| US Country | 9,100 Employees | 30 Jan 2026 Last Dividend | 4 Mar 1994 Last Split | - IPO Date |

Overview

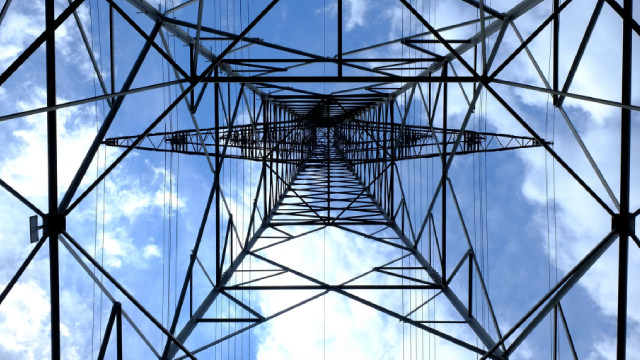

The AES Corporation, a significant player in the global power sector, operates as a diversified power generation and utility company with a presence in both the United States and international markets. Initially founded as Applied Energy Services, Inc., the company underwent a name change to The AES Corporation in April 2000. Since its inception in 1981, AES has grown to develop, own, and operate a wide variety of energy projects. Its operations span the generation and sale of electrical power to a broad spectrum of customers including utilities, industrial entities, and intermediaries, as well as the generation, transmission, distribution, and sale of electricity directly to end-user customers in various sectors. With a focus on efficiency and sustainability, AES utilizes an extensive range of fuel sources and technologies including coal, gas, hydroelectricity, wind, solar, biomass, and other renewable energy sources such as energy storage and landfill gas. Headquartered in Arlington, Virginia, AES has expanded its operational footprint to achieve a total generation capacity of approximately 34,596 megawatts, serving over 2.6 million customers worldwide.

Products and Services

The AES Corporation offers a diverse range of energy-related products and services, catering to various market needs. These include:

- Power Generation: AES owns and operates power plants that generate electricity using a variety of fuels and technologies. This diversification across coal, gas, hydro, wind, solar, and biomass, along with renewables such as energy storage and landfill gas, allows the company to maintain stable and efficient energy production.

- Utility Operations: The company's utility operations involve generating or purchasing electricity and then distributing, transmitting, and selling it to end-user customers in residential, commercial, industrial, and governmental sectors. This vertical integration ensures AES can control every step of the electricity supply chain, delivering reliable power to millions of customers.

- Wholesale Electricity Sales: Apart from serving end-users directly, AES also generates and sells electricity on the wholesale market. This facet of their operation caters to utilities, industrial users, and other intermediaries, highlighting AES’s role as a key player in the national and international energy markets.

- Renewable Energy and Energy Storage: Recognizing the importance of sustainable energy, AES has significantly invested in renewables and energy storage solutions. These efforts underline the company's commitment to reducing carbon footprint and promoting green energy initiatives across its operational territories.