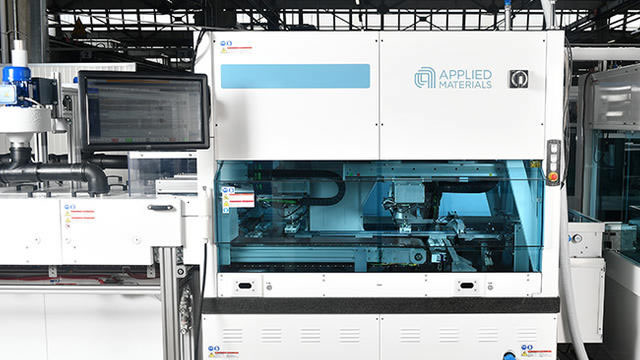

Applied Materials Inc. (AMAT)

Wall Street Analysts Think Applied Materials (AMAT) Is a Good Investment: Is It?

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

Applied Materials, Inc. (AMAT) Is a Trending Stock: Facts to Know Before Betting on It

Applied Materials (AMAT) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Charts We Liked (And Didn't Like) Last Week

Subscribers to Chart of the Week received this commentary on Sunday, August 17.

Don't Overlook Applied Materials (AMAT) International Revenue Trends While Assessing the Stock

Explore how Applied Materials' (AMAT) revenue from international markets is changing and the resulting impact on Wall Street's predictions and the stock's prospects.

What Moved Markets This Week

Listen on the go! A daily podcast of Wall Street Breakfast will be available by 8:00 a.m.

Applied Materials Stock Declines After Weak Q4 Forecast

The shares of Applied Materials (NASDAQ:AMAT) are on the downswing this morning, despite the tech manufacturing giant reporting fiscal third-quarter results that surpassed analyst estimates.

Applied Materials shares slide on weak Q4 guidance

Applied Materials Inc (NASDAQ:AMAT, ETR:AP2) shares fell 13.2% on Friday after the semiconductor equipment maker issued weaker-than-expected guidance for the fourth quarter. The company expects revenue around $6.7 billion and EPS near $2.11, both below analysts' forecasts of $7.32 billion and $2.38.

Applied Materials' Knee-Jerk Sell-Off Is Your Signal to Buy

Applied Materials NASDAQ: AMAT gave its market a reason to sell with its Q3 results. However, the 15% pre-market decline is a knee-jerk reaction to news that opens up a solid buying opportunity.

Applied Materials sinks 13% on weak guidance due to China demand

Applied Materials topped Wall Street's third-quarter earnings estimates but issued light guidance due to macroeconomic pressures. CEO Gary Dickerson said the current macroeconomic backdrop and trade issues have fueled "increasing uncertainty and lower visibility," primarily within its China business

Applied Materials Q3 Earnings Beat Estimates, Revenues Rise Y/Y

AMAT's third-quarter fiscal 2025 earnings reflect higher sales, led by Semiconductor Systems and global revenue gains.

Why Applied Materials' latest earnings have investors so spooked

Analysts wonder if China's recent “overspending” on chip equipment is coming to a halt — and if the company is losing market share to rivals.

This semiconductor stock just collapsed; Here's why

Applied Materials (NASDAQ: AMAT) shares plunged on Friday, trading at $164.31 as of market open, a 12.71% drop from Thursday's close of $188.24.