AMC Entertainment Holdings Inc. (AMC)

AMC Entertainment (AMC) Stock Declines While Market Improves: Some Information for Investors

In the closing of the recent trading day, AMC Entertainment (AMC) stood at $3.35, denoting a -1.47% change from the preceding trading day.

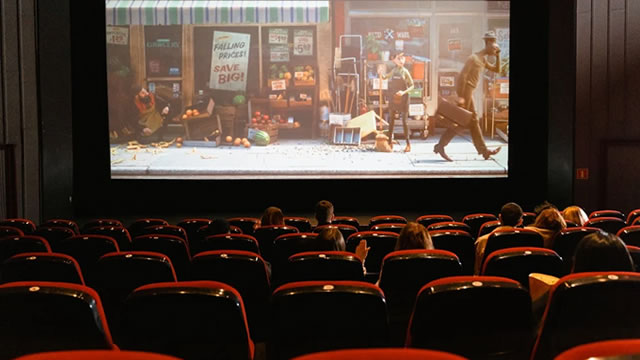

AMC Theatres: New Plan Of Ads Before Movies Won't Detract Moviegoers

AMC Theaters is confident its new business model of running ads before movies won't discourage filmgoers from coming to movies at the theater chain.

AMC Entertainment Holdings, Inc. (AMC) Is a Trending Stock: Facts to Know Before Betting on It

AMC Entertainment (AMC) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

U.S. Theater Stocks Gain on Memorial Day Records and Industry Revival

Shares of AMC, CNK and MCS jump as Memorial Day records fuel theater industry revival and highlight surging demand for premium moviegoing experiences.

AMC Entertainment shares soar as blockbuster weekend breaks revenue records

AMC Entertainment Holdings (NYSE:AMC) shares soared after the cinema chain reported record weekend revenue over Memorial Day, driven by strong openings from Disney's Lilo & Stitch and Paramount's Mission: Impossible – The Final Reckoning. It set all-time weekend records for admissions revenue, food and beverage revenue and overall revenue at its US locations.

AMC stock skyrockets 25%; Time to buy?

Shares of AMC Entertainment (NYSE: AMC) have jumped over 20% as investors react positively to the movie theater chain's strong performance over the Memorial Day holiday weekend.

Here is What to Know Beyond Why AMC Entertainment Holdings, Inc. (AMC) is a Trending Stock

AMC Entertainment (AMC) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

AMC Entertainment: Heavy Cash Burn In Q1 2025, But Q2 Looks Much Better

AMC reported negative $417 million in free cash flow in Q1 2025, although $195 million of that was due to seasonal working capital changes. Q1 2025's box office was down considerably from Q1 2024, while Q2 2025 looks to be much stronger. I believe that AMC will deliver positive free cash flow in Q2 2025 and reach around breakeven free cash flow for the full year.

Why Investors Should Be Careful About AMC's Bitcoin Dreams

The management team at AMC Entertainment Holdings Inc. NYSE: AMC has made several attempts to revive some of the events that took place during 2021. In a period of financial history that will now be referred to as the “meme stock mania,” shares of AMC and other previously disregarded companies soared by enough percentage points to make a select few bold traders significantly wealthier overnight.

Compared to Estimates, AMC Entertainment (AMC) Q1 Earnings: A Look at Key Metrics

While the top- and bottom-line numbers for AMC Entertainment (AMC) give a sense of how the business performed in the quarter ended March 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

AMC Entertainment (AMC) Reports Q1 Loss, Tops Revenue Estimates

AMC Entertainment (AMC) came out with a quarterly loss of $0.58 per share versus the Zacks Consensus Estimate of a loss of $0.61. This compares to loss of $0.78 per share a year ago.

AMC Entertainment Holdings, Inc. (AMC) Q1 2025 Earnings Call Transcript

AMC Entertainment Holdings, Inc. (NYSE:AMC ) Q1 2025 Earnings Conference Call May 7, 2025 5:00 PM ET Company Participants John Merriwether - VP, Capital Markets and IR Adam Aron - Chairman and CEO Sean Goodman - CFO Conference Call Participants Operator Greetings, and welcome to the AMC Entertainment Holdings Incorporated First Quarter 2025 Earnings Webcast. At this time, all participants are in a listen-only mode.