Advanced Micro Devices, Inc. (AMD)

Loss-making Chinese AI chipmaker founded by ex-AMD employees surges eightfold in debut

At 50 times price to sales, MetaX looks expensive but investor demand focused on China's determination to build national champions in the tech sector

Advanced Micro Devices, Inc. (AMD) Is a Trending Stock: Facts to Know Before Betting on It

Advanced Micro (AMD) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Buy AMD On This Weakness

Advanced Micro Devices remains a 'Buy' with an updated 12–18 month price target above $370, reflecting robust earnings momentum and AI-driven growth. AMD's Q3 2025 results showed 35.6% YoY revenue growth and a 54% gross margin, with Q4 guidance pointing to further margin expansion and strong data center performance. AMD's platform transition, multiyear OpenAI GPU agreement, and expanding CPU/GPU ecosystem underpin a multi-vector growth thesis through 2026.

How Low Can AMD Stock Go?

Advanced Micro Devices (AMD) shares have decreased by 18.6% over the course of 21 trading days. This recent downturn stems from revived worries concerning intense competition in AI and Oracle's capital expenditure troubles, yet steep declines such as this often prompt a more challenging inquiry: is the current weakness short-lived, or indicative of more profound issues?

Can These 3 Semiconductor Stocks Lead the Next Tech Rally in 2026?

NVDA, AMD and MTSI are poised to ride the AI wave, chip demand surge and policy tailwinds into the next tech rally.

Expert warns this stock is signaling start of AI bubble burst

Amid lingering concerns about a possible artificial intelligence (AI) sector bubble, a trading expert has warned that Advanced Micro Devices (NASDAQ: AMD) may be flashing early warning signs.

AMD: High Growth At A Reasonable Price As AI Adoption Accelerates

AMD: High Growth At A Reasonable Price As AI Adoption Accelerates

Meet My Top 5 Artificial Intelligence (AI) Stocks for 2026

AMD is battling to gain some ground on Nvidia in the GPU space. Alphabet's TPUs, which it designed in partnership with Broadcom, could become the market's next hot computing units.

Here's Why Advanced Micro Devices (AMD) Fell More Than Broader Market

Advanced Micro Devices (AMD) closed at $210.78 in the latest trading session, marking a -4.81% move from the prior day.

AMD Enters A New Phase

Advanced Micro Devices, Inc. frames AI as a multi-decade investment cycle, with growth constrained by power, packaging, memory, and data center deployment, not demand. AMD management targets 55–58% long-term gross margins by monetizing GPUs, CPUs, and networking while avoiding low-margin rack or systems resale. The OpenAI 6-gigawatt partnership accelerates ecosystem adoption, shortening sales cycles and validating AMD infrastructure across hyperscalers and neoclouds.

News Events Push Around AMD Stock

If you hold Advanced Micro Devices (AMD), this week has been unsettling. The stock hasn't plummeted like Oracle, but the pressure could be building.

AMD: The OpenAI Partnership, Data Center Dominance - And A Breakout To $300?

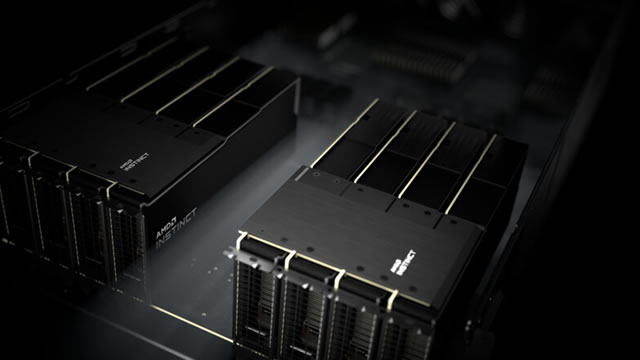

Advanced Micro Devices, Inc.'s Q3 2025 results delivered record revenue of $9.25 billion, up 36% year-over-year, with EPS of $1.20 beating consensus by 2.56%. The landmark 6-gigawatt OpenAI partnership positions AMD as a core AI infrastructure provider, with potential revenue exceeding $90 billion over the deal's lifetime. AMD's Data Center segment revenue hit a record $4.3 billion, up 22% YoY, driven by EPYC server CPU market share gains to around 40% and accelerating Instinct MI350 GPU adoption.