Advanced Micro Devices, Inc. (AMD)

Cathie Wood Just Placed a Huge Bet on This AI Chip Stock (Hint: It's Not Nvidia)

Cathie Wood's recent buying spree in AMD should not go ignored. AMD's next-generation chip may be the catalyst that helps close the valuation gap with Nvidia.

Citi raises AMD and Nvidia price targets

Citi are feeling more bullish about semiconductors, lifting their price targets for Nvidia (NASDAQ: NVDA) and AMD as the AI race intensifies.

AMD vs. Micron Technology: Which Semiconductor Stock Has More Upside?

MU's surging HBM demand, stronger earnings growth, and better valuation metrics may give it an edge over Advanced Micro Devices.

Nvidia: OpenAI-AMD Partnership Implications

Nvidia Corporation remains a Strong Buy as surging data center GPU demand and AI ecosystem growth drive robust profit potential and new highs in 2025. The OpenAI-AMD partnership intensifies GPU competition, but the market's rapid expansion ensures both Nvidia and AMD are major beneficiaries. Nvidia's dominant 92% GPU market share, superior profits, and upcoming Blackwell GPUs position it to capitalize on pent-up, high-inference chip demand.

AMD: OpenAI Endorsement Is A Game Changer

OpenAI's partnership with Advanced Micro Devices to co-develop LLM-optimized chips is a game changer, accelerating AMD's growth and challenging Nvidia's dominance. The Company's data center sales are surging, with new MI400/MI450 GPUs and Helios rack-scale solutions poised to drive further sales and margin expansion. Despite rapid growth and strategic partnerships, Advanced Micro Devices trades at a low 24.9x 2026e profit multiple, making it an undervalued AI play vs. peers.

AMD: The Inflection Moment May Have Arrived

Nvidia has won the generative AI market, but there's more than enough room for AMD as well. Management expects new GPU products to drive data center growth in the second half, providing a near-term catalyst for the stock. AMD trades at a conservative valuation, offering attractive risk-reward even without multiple expansion.

Advanced Micro Devices (AMD) Stock Declines While Market Improves: Some Information for Investors

Advanced Micro Devices (AMD) closed at $141.9 in the latest trading session, marking a -1.33% move from the prior day.

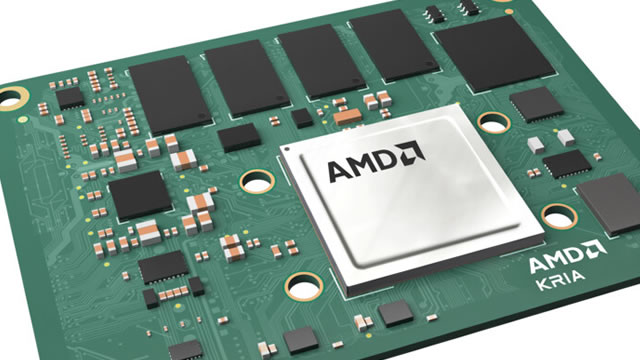

AMD is Pursuing Product Line Expansion: Will Margins Sustain?

Advanced Micro Devices margin gains continue as high-end Ryzen and data center demand drive strong pricing and favorable mix.

Top 5 Stocks for July: Momentum-Driven Picks to Watch Now

With June drawing to a close, it's time to look at the hot buys for July. The hot buys for July have numerous factors in common, including momentum-driven stock price movements and an outlook for substantial upside.

Best Stocks for the Rest of 2025

There's always going to be a better-performing stock out there. No one can hit only home runs.

Can Advanced Micro Devices Aid Its Data Center Revenues With GPUs?

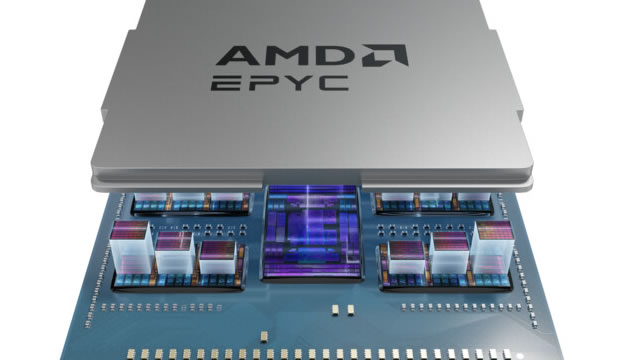

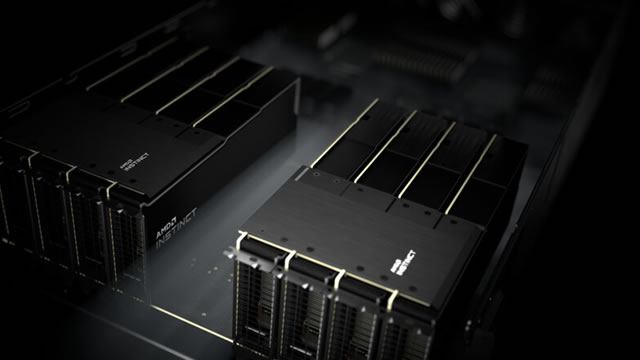

AMD's Data Center revenues jump 57% as Instinct GPUs and EPYC CPUs power AI-driven demand and expand its market footprint.

AMD's Rally Has Just Begun

AMD has surged over 40% since my prior coverage, with analysts now raising targets to $165 and $175. Micron's Q3 results confirmed AI memory demand, with HBM revenue up 50% sequentially, directly benefiting AMD's Instinct GPUs. AMD projects 60%+ annual AI revenue growth, driven by MI300 adoption and expanding cloud deployments of EPYC Turin processors.