Advanced Micro Devices, Inc. (AMD)

Advanced Micro Devices (AMD) Beats Q1 Earnings and Revenue Estimates

Advanced Micro Devices (AMD) came out with quarterly earnings of $0.96 per share, beating the Zacks Consensus Estimate of $0.93 per share. This compares to earnings of $0.62 per share a year ago.

AMD earnings reaction, top wellness stocks: Asking for a Trend

Asking for a Trend Host Josh Lipton, joined by Charles Schwab head trading and derivatives strategist Joe Mazzola, examines some of the top themes of the trading day after the closing bell. Synovus Trust senior portfolio manager Daniel Morgan joins to discuss AMD's latest earnings print, and Bank of America Securities leisure analyst Alex Perry examines shifting trends in the fitness space and their impact on wellness stocks.

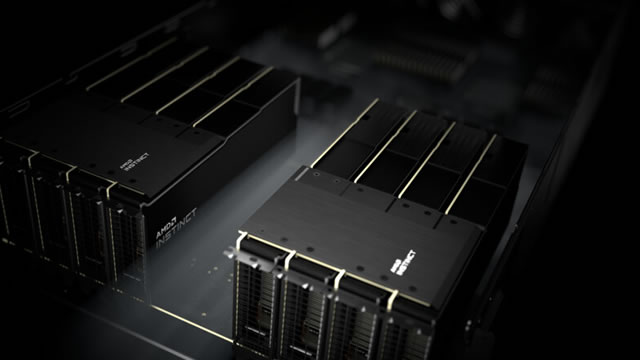

AMD Stock Surges on Strong Earnings and Outlook, Driven by 'AI Momentum'

Advanced Micro Devices (AMD) delivered first-quarter earnings that topped analysts' estimates as sales from its data center segment surged, sending shares higher in extended trading Tuesday.

Advanced Micro Devices Guides for Higher Quarterly Revenue

The chip maker logged higher profit and sales in the fiscal first quarter. Shares rose in after-hours trading.

AMD's stock rises as earnings show momentum in its data-center business

The chip maker expects “strong growth” this year despite the uncertain macroeconomic and regulatory environment.

EARNINGS ALERT: AMD

Shares of AMD Inc. (AMD) rise after a top and bottom-line beat in its 1Q earnings report. George Tsilis joins Caroline Woods with immediate reaction to the release.

AMD earnings beat as overall sales surge by 36%

AMD reported first fiscal quarter earnings on Tuesday that topped expectations, and provided a strong guide for current quarter revenue. In this article AMD

The Day Ahead: Markets Steady Today as Fed Meeting and AMD Earnings Take Focus

Markets today open with focus on the Fed meeting kickoff, AMD earnings, and ongoing tariff uncertainty.

Got $1,000? 2 Top Growth Stocks to Buy That Could Double Your Money

The concerns around tariffs and the impact on the economy triggered a sharp sell-off for stocks recently. But this uncertainty hasn't seemed to slow the momentum for the artificial intelligence (AI) market.

Why Investors Need to Take Advantage of These 2 Computer and Technology Stocks Now

Investors looking for ways to find stocks that are set to beat quarterly earnings estimates should check out the Zacks Earnings ESP.

Will This Be the Catalyst AMD Stock Investors Are Waiting For?

In today's video, I discuss Advanced Micro Devices (AMD 2.33%) and what investors should know before the company reports earnings. To learn more, check out the short video, consider subscribing, and click the special offer link below.

AMD: Too Cheap To Ignore Before Earnings (Rating Upgrade)

AMD is massively undervalued and presents a compelling opportunity ahead of Q1 earnings, despite competitive pressure from Nvidia. AMD's earnings record is strong, with only one EPS miss in the last 12 quarters, and AI tailwinds are robust. Valuation analysis shows a fair share price around $150, indicating a 52% upside potential, even with conservative growth assumptions.