Advanced Micro Devices, Inc. (AMD)

Advanced Micro Devices, Inc. (AMD) Is a Trending Stock: Facts to Know Before Betting on It

Recently, Zacks.com users have been paying close attention to Advanced Micro (AMD). This makes it worthwhile to examine what the stock has in store.

AMD Is Thriving While Its Stock Price Is Crashing, Something Has To Give

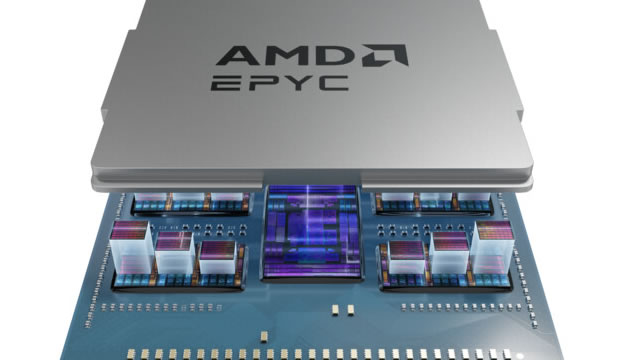

A rising tide lifts all boats, and that applies to AMD with respect to the strong growth in the AI data center market. While its top-end chips are comparable to those of Nvidia, it is still hampered by networking and software, although these matter somewhat less in the inference market. But they don't have to beat Nvidia, AMD is benefiting from the high cost and scarcity of high-end Nvidia chips.

Prediction AMD Will Soar Over the Next 5 Years. Here's 1 Reason Why.

In the current environment, it seems antithetical to say anything positive about Advanced Micro Devices (AMD -0.88%). The semiconductor stock has lost more than 60% of its value over the last 13 months as industry struggles and tariff-related worries have weighed on the company.

2 No-Brainer AI Stocks to Buy Right Now

Stocks across industries have suffered in recent times, amid concerns that President Trump's tariffs on imports would crush earnings and economic growth. But investors have been particularly worried about technology companies as many rely on producing their goods abroad.

AMD: This Dip Is A Gift

I reiterate my "Strong Buy" rating for AMD, citing massive undervaluation and strong growth prospects in AI and data center markets despite recent stock underperformance. AMD's Q4 revenue of ~$7.6 billion and EPS of $1.09 beat expectations, driven by significant growth in the data center segment. The potential $800 million tariff-related charge is manageable, with AMD's diversification and strong AI and server market positioning mitigating long-term risks.

AMD: China AI Hiccup

Advanced Micro Devices, Inc. faces a potential $800 million charge due to new U.S. export controls on AI GPUs to China, impacting up to $1.6 billion in revenue. Despite this setback, AI GPU demand remains robust, with AMD securing major orders, including a $2+ billion contract with Oracle. AMD stock is undervalued trading at just 15x '26 consensus EPS estimates, with potential for far higher earnings on faster sales growth from AI GPUs.

History Is About To Repeat Itself: Another AMD 2022 Rally May Be Incoming

Advanced Micro Devices, Inc. is the value pick of the current market sell-off and the new U.S. restrictions just made it that much more attractive. AMD stock is about to repeat its 2022 rally, in my opinion, and all the worst news is already priced into the stock. AMD's stock is trading at its lowest valuation since 2022, with a forward PE of 19x and below all its EMAs at $88.2 per share, signaling a potential rebound.

Advanced Micro Devices Inc. (NASDAQ: AMD) Price Prediction and Forecast 2025-2030 (April 2025)

Shares of Advanced Micro Devices ( NASDAQ:AMD ) have been battered over the past month, losing -16.34% and compounding their year-to-date and one-year losses to -27.47% and 43.20%, respectively.

A Cautious Opportunity Emerges For AMD Investors

AMD stock fell over 7% due to Nvidia's export restrictions to China, impacting AMD's AI chip sales and contributing to a ~26% YTD decline. The Company's forward P/E of ~19x for 2025 EPS offers a margin of safety, prompting an upgrade in the stock rating. Advanced Micro Devices' diversified revenue mitigates the impact of potential Chinese market losses.

Great News for AMD Stock Investors

In this video, I go over recent updates regarding Advanced Micro Devices (AMD -7.42%). Watch the short video to learn more, consider subscribing, and click the special offer link below.

AMD says US rule on chips to China could cost it $800 mn

Chip developer Advanced Micro Devices (AMD) on Wednesday said it expects new US licensing requirements for semiconductors exported to China to cost it as much as $800 million.

Why AMD Stock Plummeted Today

Advanced Micro Devices (AMD -7.42%) stock saw a big valuation pullback Wednesday. The semiconductor company's share price ended the day's trading down 7.4% amid a 2.3% decline for the S&P 500 and a 3.1% decline for the Nasdaq Composite.