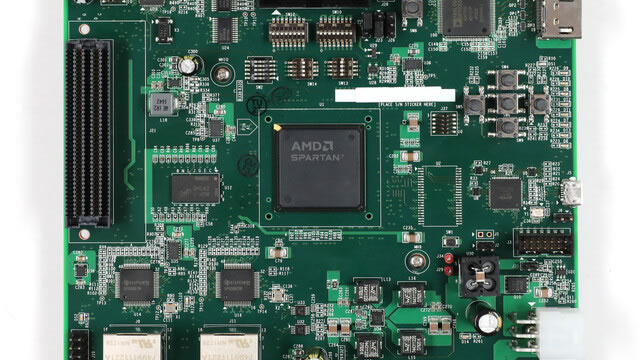

Advanced Micro Devices, Inc. (AMD)

Is AMD set to crash below $100?

For lack of a better description, Advanced Micro Devices (NASDAQ: AMD) stock fell off a cliff following the company's latest earnings report and found itself 10.07% in the red on the daily chart once the February 5 morning bell rang.

AMD shares drop 10% on disappointing data center revenue

Advanced Micro Devices shares fell on Wednesday after the chipmaker under-delivered on Wall Street's estimates for its important data center business. The chipmaker reported better-than-expected results on the top and bottom lines but fell short of Wall Street expectations for its data center sales.

AMD Q4: The Next Nvidia Or The Next Intel?

Advanced Micro Devices, Inc. delivered record Q4 revenues and EPS, but the AMD stock dropped due to disappointing Data Center revenue and cautious Q1 guidance. Was this selloff justified? Is AMD doomed like Intel? On the contrary, AMD is now better positioned than ever to compete with Nvidia.

GOOGL Disappoints in Cloud, AMD Dips to 52-Week Low

Alphabet (GOOGL) falls off of its all-time high after its revenue and Google Cloud revenue slipped under Wall Street's expectations. AMD Inc. (AMD) also reported earnings that disappointed investors, notably in its data center revenue.

AMD Earnings: Data Center and PC Shine

Here's our initial take on Advanced Micro Devices' (AMD 4.58%) fourth-quarter financial report.

AMD: I See Risks That Keep Me On The Sidelines

Advanced Micro Devices, Inc.'s Q4 results were mostly in-line with expectations, driven by strong performance in the client computing segment as a result of market share growth fueled by Ryzen processor uptake. The data segment has an uninspiring with a flat H1 FY25 vs. H2 FY24. The key growth catalyst is in H2 FY25 with the launch of the MI350 GPU. I expect EBIT margins to be contained with some potential downside pressure in FY25 driven by mix-shift impacts and production ramps.

Advanced Micro Devices Bottoms Out: Nowhere To Go But Up In 2025

Advanced Micro Devices' NASDAQ: AMD share price plunged more than 10% following what can only be described as a great report. While the Q1 guidance may be tepid, analysts set the bar high, and growth is expected to continue under the influence of AI for many years.

Mark Zuckerberg Just Delivered Incredible News for Nvidia, AMD, and Micron Stock Investors

Last week, semiconductor stocks like Nvidia (NVDA 1.71%), Advanced Micro Devices (AMD 4.58%), and Micron Technology (MU 0.82%) plunged on news that a Chinese start-up called DeepSeek had figured out how to train artificial intelligence (AI) models for a fraction of the cost of its American peers.

AMD's $4.9 bln ZT Systems deal faces EU antitrust decision by March 12

European Union antitrust regulators will decide by March 12 whether to clear U.S. chipmaker AMD's $4.9 billion bid for server maker ZT Systems, a European Commission filing showed on Wednesday.

AMD, Alphabet, Chipotle And Other Big Stocks Moving Lower In Wednesday's Pre-Market Session

U.S. stock futures were lower this morning, with the Nasdaq futures falling over 150 points on Wednesday.

Nvidia Stock Rises. Why AMD, Alphabet Earnings Are Boosting the AI Chip Maker.

Nvidia was gaining after Google's parent updated on its AI spending plans.

AMD: The Market Likely Got It Wrong

AMD's Q4 results show strong growth, with a 69% YoY increase in data center revenue and stable client segment performance, justifying my "Strong Buy" rating. Despite a 9% after-hours dip, I believe trading algorithms caused the sell-off, not AMD's fundamentals, which remain strong with promising AI and data center growth. Management's guidance for 2025 includes a 30% YoY sales increase and strong AI processor demand. The growth should be massive, in my view.