ARK Genomic Revolution ETF (ARKG)

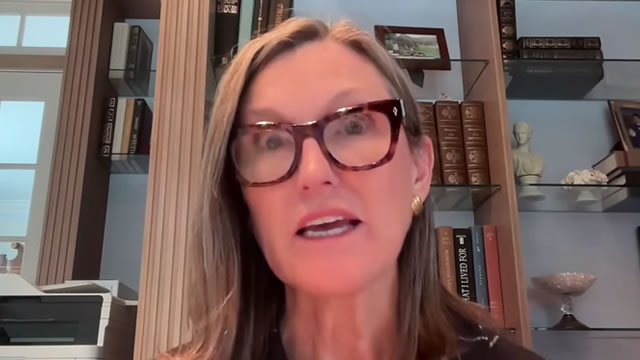

Cathie Wood Comeback: These 2 Ark ETFs are Sailing Higher Again

It's probably time to give Cathie Wood the benefit of the doubt as the tides turn back in disruptive innovation's favor.

2 Actively Managed ETFs That Got Smoked by the S&P 500 Last Year

Low-cost passive index investing (in the S&P 500 or Nasdaq 100) has been key to impressive results in recent years.

Can Health Care ETFs Aid Your Portfolio?

The Health Care Select Sector SPDR ETF (XLV) was up approximately 6% year-to-date as of January 29. While it is still early days, this performance is already twice as robust as the sector ETF's performance for all of 2024.

Cathie Wood's Top Biotech Plays for February

Don't look now, but Cathie Wood of Ark Invest is fresh off an impressive comeback year, with her broader basket of disruptive technology funds posting high double-digit percentage returns.

Under-the-Radar Opportunities in ETFs

Over recent years, investors have sought safety within mega-cap tech stocks while searching for alpha within disruptive technology trends like artificial intelligence. Most investors can agree the AI theme has long-term growth potential, and the current market sell-off is a short-term hiccup.

ETF Prime: Islam Shares 2025's Top Trends and ETFs

On this week's episode of ETF Prime, Roxanna Islam, CFA, CAIA, head of sector & industry research at VettaFi, joined host Nate Geraci. The two discussed top ETF performers and trends this year as well as long-established asset managers finally joining the ETF industry.

ARKG: Eyeing Favorable Macro 2025 Turns, Encouraging Momentum Trends

I maintain a buy rating on ARK Genomic Revolution ETF (ARKG) due to improving momentum, potential lower interest rates, and a favorable M&A environment in 2025. Despite a 20% decline in 2024, ARKG's technical chart shows bullish potential with key support at $21-$22 and resistance at $28. ARKG is a small, actively managed ETF focused on genomics, with high exposure to small-cap stocks and a diversified mix of value, blend, and growth.

Best-Performing ETF Areas of Last Week

Wall Street was upbeat last week with the Dow Jones and the S&P 500 hitting all-time highs last week.

Interest Rate Regimes And ARKG: Underperformance Explained

ARKG's top holdings were replaced due to poor performance, highlighting the fund's vulnerability to interest rate changes and high concentration in cash-burning companies. ARKG underperformed significantly compared to peers and the Nasdaq, especially during tighter monetary conditions, due to its concentrated portfolio and high valuation multiples. Virtus, with a more diversified and less concentrated portfolio, outperformed ARKG, suggesting that ARKG needs restructuring to better handle interest rate changes.

Almost Every Ark Fund Is Now Underperforming The Overall Market. Here's Why.

Ark Funds pull exclusively from different slivers of the technology sector that also tend to be the most volatile. Economic conditions can make a bigger performance difference over the long term than most investors might expect.

5 Technology ETFs at the Forefront of the August Rebound

Wall Street roared back after a sell-off early in the month as fears of recession eased. The technology sector, which bore the biggest brunt, rebounded strongly and once again led the market over the past week.

5 Sector ETFs That Outperformed With Double-Digit Gains in July

July witnessed the "Great Rotation" in the U.S. stock market as investors shunned the hot technology stocks in favor of smaller companies and other sectors, which are the bigger beneficiaries of the Fed rate cuts.