ASML Holding N.V. New York Registry Shares (ASML)

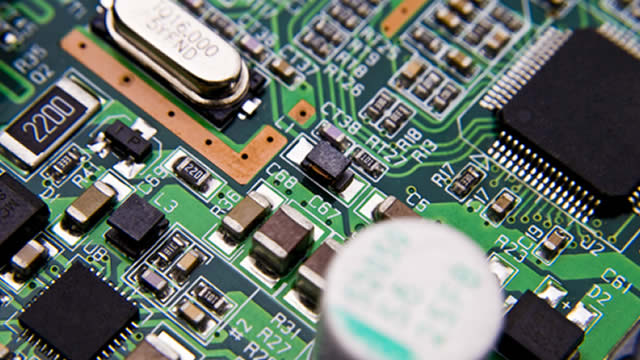

Exclusive look at the making of High NA, ASML's new $400 million chipmaking colossus

ASML's new $400 million chip colossus transforms how semiconductors are made. CNBC got the first-ever on-camera look at the new machine, called High NA.

ASML Holding Stock Soars 17% in a Month: Should You Bet on It Now?

ASML's technological leadership and robust financials offer strong long-term growth potential, making the stock worth buying.

ASML Holding N.V. (ASML) is Attracting Investor Attention: Here is What You Should Know

Zacks.com users have recently been watching ASML (ASML) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

ASML (ASML) Just Overtook the 200-Day Moving Average

ASML (ASML) reached a significant support level, and could be a good pick for investors from a technical perspective. Recently, ASML broke through the 200-day moving average, which suggests a long-term bullish trend.

Scoop Up These 4 GARP Stocks to Receive Handsome Returns

The GARP strategy helps investors gain exposure to stocks that have solid prospects and are trading at a discount. KLAC, ASML, GE and HWM are some such stocks.

Is ASML Holding (ASML) Stock Outpacing Its Computer and Technology Peers This Year?

Here is how ASML (ASML) and Cognizant (CTSH) have performed compared to their sector so far this year.

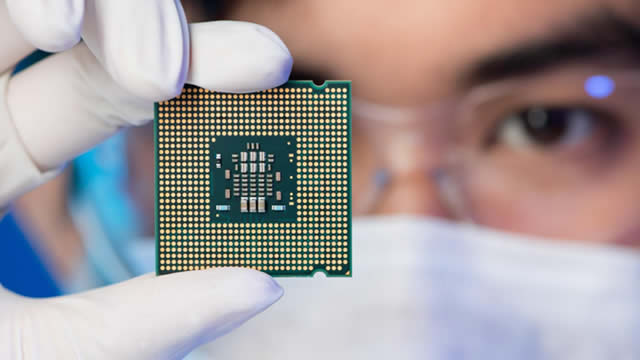

ASML vs. TSM: Which Semiconductor Stock is the Smarter Buy?

ASML Holding and Taiwan Semiconductor Manufacturing power the chip industry, but ASML's EUV monopoly and strong outlook give it the investment edge.

ASML Holding N.V. (ASML) Is a Trending Stock: Facts to Know Before Betting on It

ASML (ASML) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

ASML: Outsized AI Growth Opportunity

ASML has a significant MOAT due to its irreplaceable technology, making it a key player in the AI industry. With Trump planning to onshore chip manufacturing, ASML has significant tariff bargaining power not priced into the stock. At a seriously depressed valuation, ASML is facing a significant growth opportunity.

Is It Worth Investing in ASML (ASML) Based on Wall Street's Bullish Views?

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?

ASML (ASML) Crossed Above the 50-Day Moving Average: What That Means for Investors

ASML (ASML) is looking like an interesting pick from a technical perspective, as the company reached a key level of support. Recently, ASML broke out above the 50-day moving average, suggesting a short-term bullish trend.

Top Wide-Moat Stocks to Invest in for Long-Term Growth

Investing in wide-moat stocks like PFE, ASML, LRCX and KO can be a strategy for long-term wealth creation due to their ability to deliver consistent returns.