BCE Inc. (BCE)

BCE Inc. (BCE) Q3 2024 Earnings Call Transcript

BCE Inc. (NYSE:BCE ) Q3 2024 Earnings Conference Call November 7, 2024 8:00 AM ET Company Participants Thane Fotopoulos - Investor Relations Mirko Bibic - President and CEO Curtis Millen - Chief Financial Officer Conference Call Participants Sebastiano Petti - JPMorgan Vince Valentini - TD Securities Drew McReynolds - RBC Capital Markets Maher Yaghi - Scotia Bank Simon Flannery - Morgan Stanley Aravinda Galappatthige - Canaccord Genuity Jerome Dubreuil - Desjardins Securities Batya Levi - UBS Lauren Bonham - Barclays Operator Good morning, ladies and gentlemen. Welcome to the BCE Q3 2024 Results Conference Call.

BCE (BCE) Reports Q3 Earnings: What Key Metrics Have to Say

While the top- and bottom-line numbers for BCE (BCE) give a sense of how the business performed in the quarter ended September 2024, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

BCE (BCE) Q3 Earnings and Revenues Miss Estimates

BCE (BCE) came out with quarterly earnings of $0.55 per share, missing the Zacks Consensus Estimate of $0.57 per share. This compares to earnings of $0.60 per share a year ago.

BCE Inc.: The Ziply Deal Puts This 9%+ Dividend In Serious Doubt

BCE offers an attractive dividend yield nearing 10%, but its sustainability is questionable due to high debt. BCE's balance sheet is heavily leveraged due to 5G network investments and funding its dividend, raising concerns about future financial stability. Its recently announced deal to buy Ziply could be a long-term positive, but at the expense of near-term free cash flow.

BCE Expands Into the U.S. Fiber Market With Ziply Fiber Acquisition

BCE's unit Bell Canada enters the U.S. fiber market by acquiring Ziply Fiber for roughly C$7 billion, with the closing expected in the second half of 2025.

BCE's Bell Canada expands into US with C$7B acquisition of Ziply Fiber

Bell Canada parent BCE Inc (TSX:BCE) has expansded south of the border with the acquisition of US Pacific Northwest-focused Ziply Fiber for C$7 billion. The purchase, where Bell will pay C$5 billion in cash and take on C$2 billion of outstanding net debt, will add roughly 1.3 million fibre locations to take Bell to around 9 million fibre locations, reinforcing its position as the third-largest fibre internet provider in North America.

Earnings Preview: BCE (BCE) Q3 Earnings Expected to Decline

BCE (BCE) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

BCE: $3.5 Billion MLSE Sale And Lower Rates Are Catalysts For Rebound

BCE has underperformed, down 14% this past year and nearly 35% in the last three, despite high dividend yields of 8.84%. Regulatory pressures and increased debt levels have raised concerns about dividend cuts, but payments have remained stable. Recent macroeconomic changes and strategic pivots suggest BCE is undervalued and can sustain dividends into 2025.

Want Over $5,000 in Annual Dividends? Invest $23,000 in Each of These 3 Stocks

These stocks have yields between 5.9% and 8.5%.

BCE Is Dead To Me - August Dividend Income Report

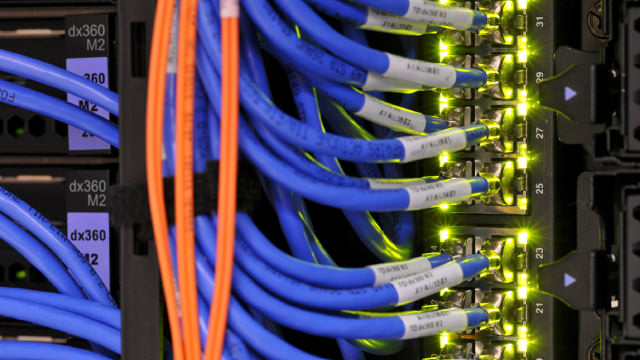

Telcos are capital-intensive. It means they must spend considerable amounts of money to maintain and improve their networks. Since 2017, BCE has been on a streak of securing more and more debt. ATD reported a mixed quarter as revenue jumped by 17%, but EPS declined by 4%.

BCE & MacLean Advance Sustainable Mining Practices: Stock to Benefit?

BCE's subsidiary BELL and MacLean forge a partnership to revolutionize mining with advanced technology and foster sustainability.

Buy These Smart 7-8% Yields As Rates Drop

BCE and EPR Properties offer high yields and strong prospects for income-focused investors in a lower interest rate environment. BCE benefits from 5G expansion, cost efficiencies, and media growth, supporting an 8.2% dividend yield despite regulatory uncertainties. EPR Properties has a diversified experiential asset portfolio, providing a stable 7.0% yield backed by a solid balance sheet and improving AFFO growth.