Brookfield Renewable Partners L.P. (BEP)

2 Durable Dividends At Bargain Prices

In the process of the market losing its optimism, there have been several cases, where the baby has been thrown out with the bathwater. Namely, we have now more interesting high-quality opportunities to consider, where the discounts have gone too far. In this article, I elaborate on two high-yielding and strong quality picks, which, in my view, trade at bargain-basement prices.

Brookfield Renewable (BEP): Strong Industry, Solid Earnings Estimate Revisions

Brookfield Renewable (BEP) has seen solid earnings estimate revision activity over the past month, and belongs to a strong industry as well.

The Market Is Crashing, But We Are Rejoicing

Why I'm celebrating this market crash—and loading up on these high-yield assets. Tariffs, recession fears, and falling interest rates: here's where smart money is going now. These overlooked stocks could soar—even if some tariffs remain in place.

These Ultra-High-Yielding Dividend Stocks Are No Joke

It's good to have a healthy dose of skepticism, especially today on April Fools' Day. If something seems to be too good to be true, it might be a trap trying to get you to fall for a joke.

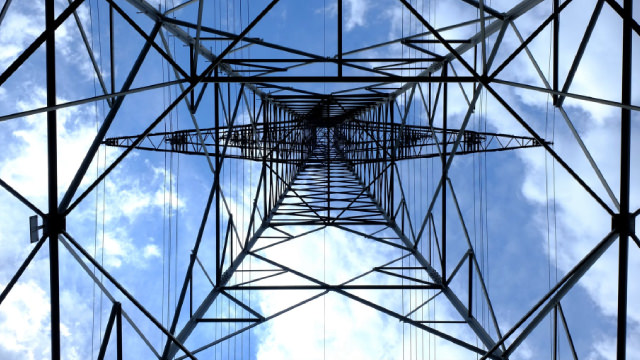

AI Needs Power: Invest in High-Yield Utility Stocks to Ride the Electricity Demand Wave

During Brookfield Renewable's (BEP -0.04%) (BEPC -0.44%) fourth-quarter 2024 earnings call, the company's CEO stated very clearly that, "Following several decades of modest electricity demand growth, we are experiencing a dramatic shift in demand driven by the AI revolution." That's basically the same sentiment that's being expressed by electricity providers across the board and it highlights an opportunity for investors broadly and income investors specifically.

3 Brilliant High-Yield Energy Stocks to Buy Now and Hold for the Long Term

There's a new administration in Washington, D.C., and it has a short-term plan for the energy sector whose key goal is to quickly lower energy prices for consumers.

5 Dividend Stocks Yielding Over 5% to Buy Right Now

Stocks have cooled off quite a bit this year, with most broader market indexes declining about 10% from their peaks. The silver lining amid this sell-off is that dividend yields move in the opposite direction as stock prices.

2 Clean Energy Dividend Stocks to Buy With $10,000 and Hold Forever

Clean energy is still a relatively modest contributor to the global energy pie. But it is the fastest-growing segment of that pie, as the world seems to be taking an all-of-the-above approach to deal with rising electricity demand.

The More They Drop, The More I Buy (Up To 11% Yields)

These 4 dividend stocks have dropped sharply. Here's why they are worth doubling down on. Buy the dip in these high-yield stocks before the market catches on—valuation resets could drive big upside.

3 Dividend Stocks With Yields Over 5% to Buy Now and Boost Your Passive Income Stream

The benefits of investing in dividend stocks can feel modest when the major market indexes are notching all-time highs. But the passive income they provide can be an excellent supplement to your finances no matter what equity prices are doing.

This 5%-Yielding Dividend Stock Continues to Add to Its Powerful Growth Profile

Brookfield Renewable (BEPC -3.45%) (BEP -2.99%) isn't your average high-yielding dividend stock. The leading global renewable energy producer also has powerful growth potential.

The Market Is About To Flip: 3 AI-Driven Dividend Stocks Set To Soar

The market is likely about to flip - here are three under-the-radar stocks positioned to benefit. These up to 7%-dividend stocks are quietly positioning themselves to profit from surging AI demand. As the market shifts, these overlooked stocks could be the biggest beneficiaries—lock in these golden buying opportunities now.