Badger Meter Inc. (BMI)

The Gabelli Small Cap Growth Fund Q3 2025 Contributors And Detractors

During Q3 2025, Gabelli Small Cap Growth Fund underperformed the Russell 2000 Total Return Index, S&P SmallCap 600 Total Return Index, and Lipper Small-Cap Core Funds Average. The better performing stocks in (y)our portfolio included Mueller Industries, Inc., Gorman-Rupp Co., and GATX Corp. Detractors from (y)our fund's performance included Ryman Hospitality Properties, Inc., Badger Meter, Inc., and Herc Holdings, Inc.

Badger Meter (BMI) Declines More Than Market: Some Information for Investors

Badger Meter (BMI) closed at $177.38 in the latest trading session, marking a -1.53% move from the prior day.

Badger Meter (BMI) Upgraded to Buy: Here's What You Should Know

Badger Meter (BMI) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #2 (Buy).

Why Is Badger Meter (BMI) Down 7.4% Since Last Earnings Report?

Badger Meter (BMI) reported earnings 30 days ago. What's next for the stock?

Wall Street Bulls Look Optimistic About Badger Meter (BMI): Should You Buy?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock's price.

3 Reasons Why Growth Investors Shouldn't Overlook Badger Meter (BMI)

Badger Meter (BMI) is well positioned to outperform the market, as it exhibits above-average growth in financials.

Is the Options Market Predicting a Spike in Badger Meter Stock?

Investors need to pay close attention to BMI stock based on the movements in the options market lately.

Here's Why Badger Meter (BMI) is a Strong Momentum Stock

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Wall Street Analysts Think Badger Meter (BMI) Is a Good Investment: Is It?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock's price.

Badger Meter (BMI) is a Top-Ranked Growth Stock: Should You Buy?

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

3 Reasons Why Growth Investors Shouldn't Overlook Badger Meter (BMI)

Badger Meter (BMI) could produce exceptional returns because of its solid growth attributes.

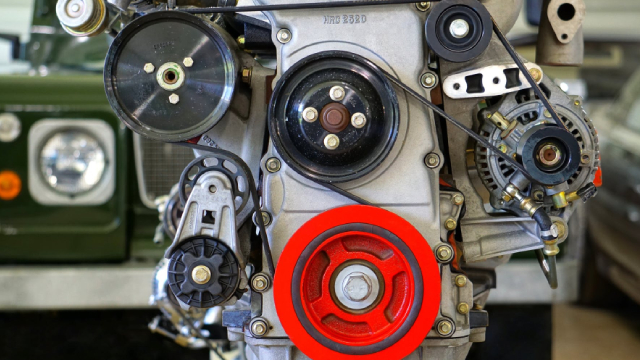

Badger Meter: Strong Visibility To Further Margin Expansion

Badger Meter is rated a buy, evolving into a recurring revenue model with strong growth prospects and margin expansion potential. BMI's modular BlueEdge platform and leading cellular AMI network drive customer stickiness, higher margins, and predictable subscription-based revenue. The SmartCover acquisition expands BMI's addressable market into wastewater monitoring, enhancing its integrated water lifecycle solutions for utilities.